Tom Lee’s BitMine Adds $820M Worth of Ethereum as ETH Rebounds

Highlights

- BitMine expands Ethereum treasury to $13.4 billion amid $820 million new accumulation.

- Ethereum rebounds 211% in six months as staking demand surges globally.

- BitMine stock jumps 782%, coinciding with record $13.7 billion Ethereum inflows.

BitMine Immersion Technologies chaired by Fundstrat’s Thomas “Tom” Lee, has accumulated roughly $820 million in ETH purchases. The move coincides with a sharp rebound in ETH price.

BitMine Strengthens Lead as World’s Largest Ethereum Treasury

Based on an official statement, BitMine has now expanded its Ethereum treasury to more than 2.83 million ETH. It is now worth over $13.4 billion in combined crypto and cash reserves. BitMine’s crypto portfolio includes 2,830,151 ETH, 192 Bitcoin, $456 million in cash, and a $113 million equity stake in Eightco Holdings (NASDAQ: ORBS).

These positions place the firm as the world’s largest Ethereum treasury. It is also the second-largest overall crypto holder, trailing only Strategy Inc. (MSTR), which controls over 640,000 BTC valued at about $79 billion.

Ethereum Rebound Fuels BitMine’s 782% Stock Surge

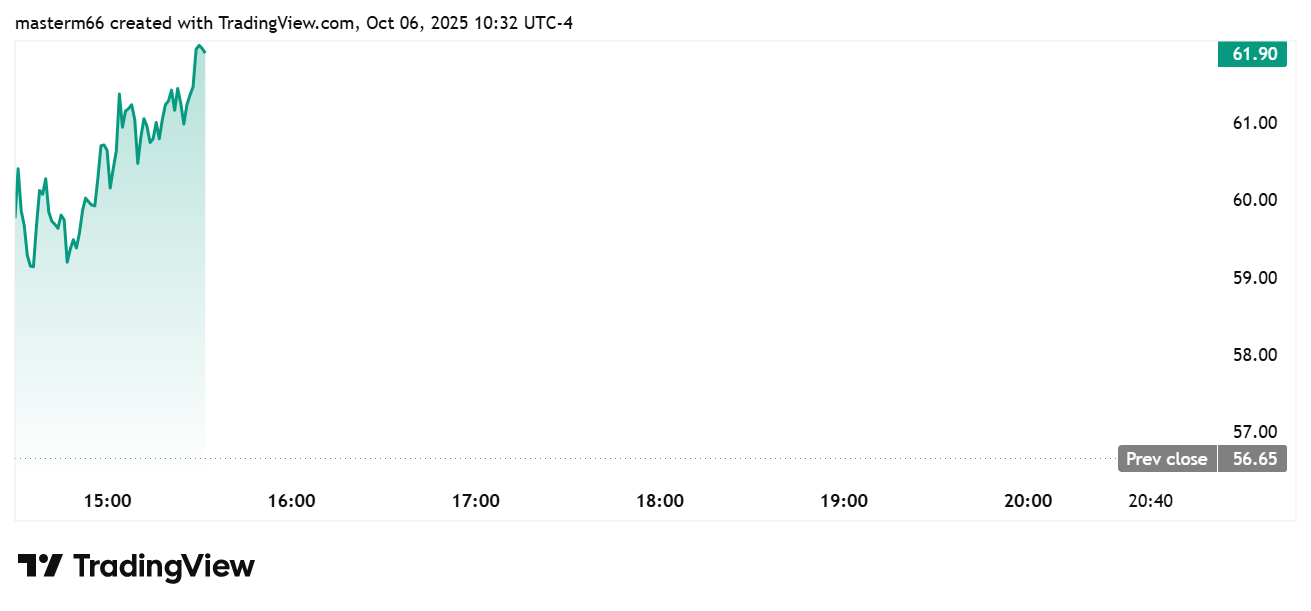

The announcement arrives as Ethereum (ETH) continues its strong rebound, climbing to $4,598, a 1.85% daily rise and over 211% growth in the past six months, according to TradingView data. The rally extends Ethereum’s year-to-date gains to nearly 38%.

The price with such growing institutional staking and anticipations of increased integration of blockchain in financial markets are seen to benefit. The recent launch of the first Ethereum staking ETF is also accelerating this demand. This has reinforced expectations of broader institutional participation in ETH.

BMNR recovered by 9% to trade at $61.90, as more investors showed increasing interest in it. The firm’s stock has also risen by 631% since the start of the year, and 782% in the last six months. The move underscores BitMine’s position among the fastest-rising blockchain equities on Wall Street.

Record $13.7B Ethereum Inflows as BitMine Trading Volume Soars

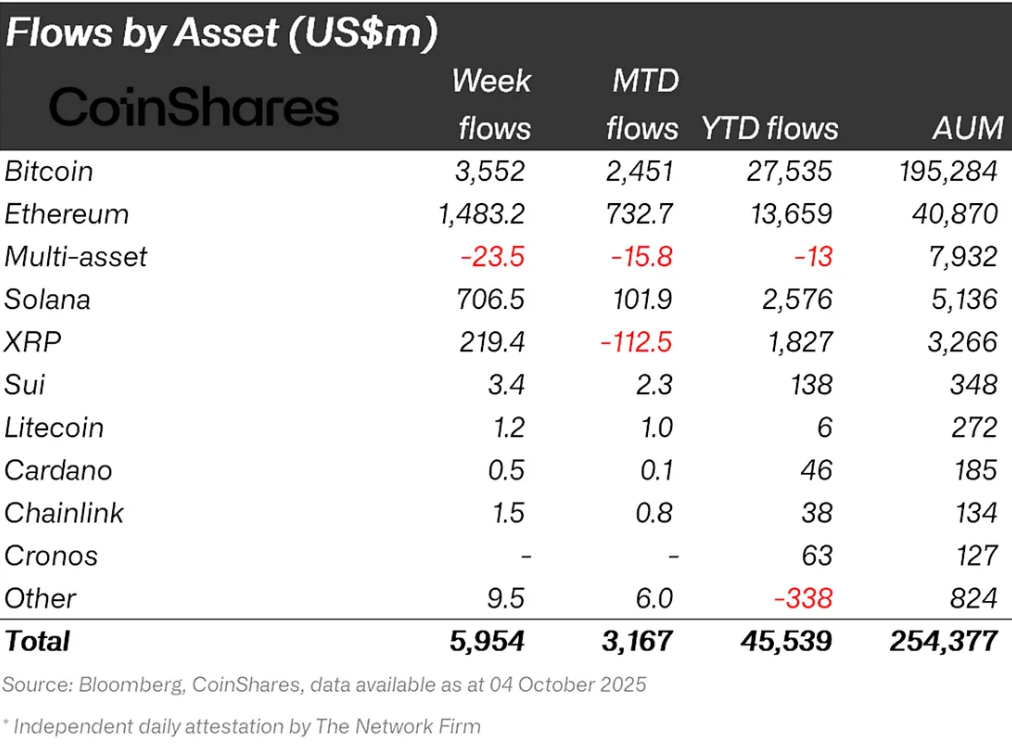

Fresh data from CoinShares highlights the growing institutional appetite for Ethereum. The firm reported $1.48 billion in Ethereum inflows last week. This pushed year-to-date inflows to a record $13.7 billion, almost three times higher than last year’s total.

On-chain data shows Ethereum exchange supply continues to decline. This indicates investors are moving assets off exchanges in anticipation of further price stability. Bitcoin led with $3.55 billion weekly inflows and $27.5 billion year-to-date.

With an average daily trading volume of $2.5 billion, BitMine is now the 28th most-traded stock in the U.S., sitting just behind JPMorgan and ahead of Nike in turnover. The rapid growth of the company denotes the great level of investor confidence in the company treasury policy.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs