Top 5 Reasons Ethereum Price Is Down Today

Highlights

- Ethereum price down today amid broader crypto market selloffs and Bitcoin weakness.

- ETH struggles to hold $2,000 amid weak technical chart.

- Whales and institutions continued to sell ETH.

- On-chain data signals deeper Ethereum price fall.

- Ethereum price drop today after FOMC minutes release.

Ethereum price is down today amid significant selling pressure, widening its YTD downfall to more than 45%. While some on-chain data hints at potential exhaustion of sellers, triggering buy-the-dip sentiment, but recovery will depend on broader market stability and upside momentum above $2,000.

Ethereum Price Down amid Broader Crypto Market Selloffs and Bitcoin Weakness Today

The crypto market is under bearish pressure, with Bitcoin failing to hold advances above key levels amid headwinds including esclating in US-Iran tensions and risk-off sentiment. As ETH often follows BTC’s lead, Ethereum price is down today.

Iran is rushing military and domestic preparations for possible US strikes if nuclear talks fail, amid severe threats from US President Donald Trump. Trump officials say there’s a 90% chance of strikes on Iran.

CNN and CBS reported Wednesday that the US military will be ready to launch strikes against Iran as early as this weekend, though Trump has reportedly not made a final decision yet.

Ethereum Price Struggles to Hold $2,000 amid Weak Technical Chart

Ethereum price breaking down below the 200-week moving average at $2,450 in early February and failing to reclaim the key level has turned ETH bearish. This triggered massive long liquidations to drag ETH below $2,000.

Also, it has failed to sustain above $2,000 multiple times in recent weeks. This technical barrier, combined with bearish chart structure, led to choppy trading and deleveraging.

ETH price is down more than 2% in the past 24 hours, currently trading at $1,976. The 24-hour low and high are $1,923.81 and $2,037.16, respectively.

No support from ETH options and futures traders has kept Ethereum price under $2,000. At present, options traders target prices below the level until March.

Analyst Ted Pillows claimed the Ethereum price drop amid the escalating US-Iran situation could be severe. He suggested watching the $1,850-$1,900 level closely.

Ongoing Selling Pressure from Whales and Institutions

Whales and big investors such as Arthur Hayes and Peter Thiel dumping ETH triggered massive profit booking. Billionaire Peter Thiel fully exits Ethereum treasury firm ETHZilla, sells entire stake.

The October 10 insider whale Garrett Jin deposited 261K ETH worth almost $542.57 million to Binance. He has sold millions in BTC and ETH in the last few days.

Outflows from spot Ethereum ETFs show bearish sentiment among institutions amid bear market predictions. On Wednesday, spot Ethereum ETFs posted total net outflows of $41.83 million. BlackRock Ethereum ETF (ETHA) saw the largest single-day net outflow at $29.93 million.

On-Chain Data Signals Deeper Ethereum Price Fall

Santiment data showing waning retail interest and loss saturation as the crypto market struggled to maintain momentum. ETH Positive/Negative Sentiment Ratio data sentiment has declined into more bearish territory.

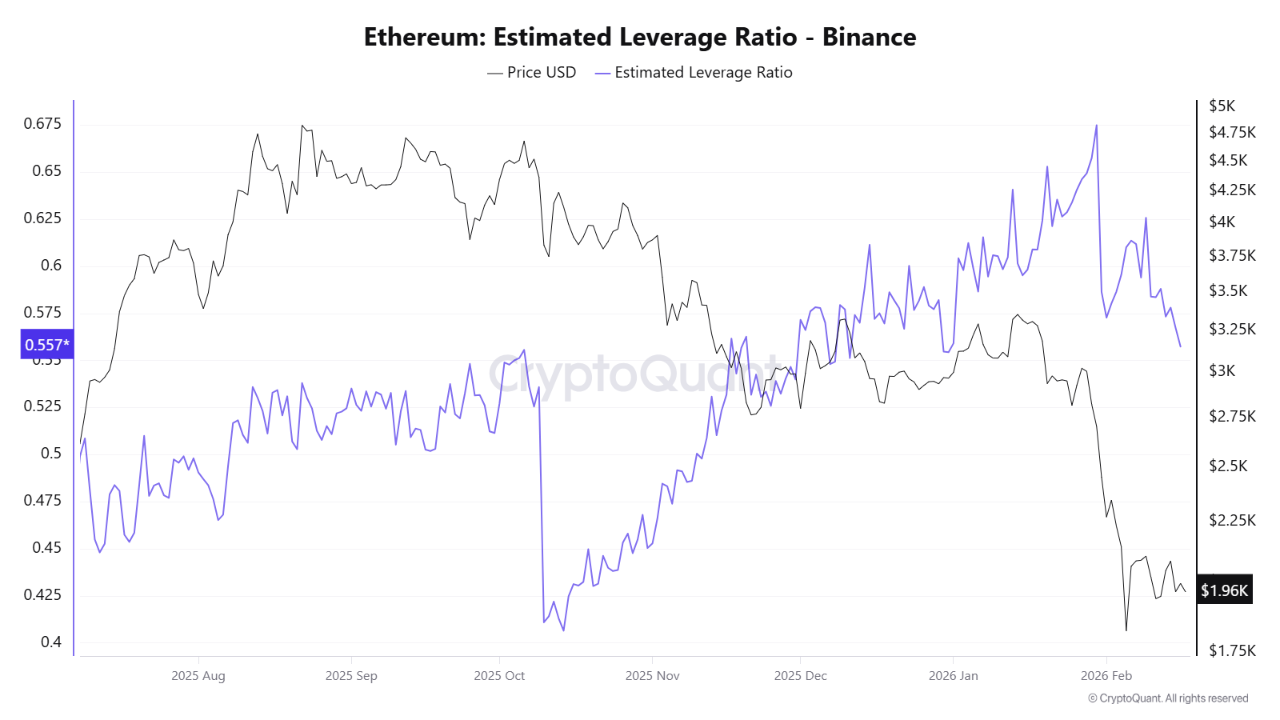

Ethereum price is down today as ETH has fallen below the realized price of the accumulation addresses. CryptoQuant data points to a decline in Ethereum’s leverage ratio on Binance to its lowest level since last December.

Ethereum Price Drop Today After FOMC Minutes Release

Fed officials are divided on next rate decisions as they move to curb inflation and support the labor market, according to the January FOMC minutes. Some Fed officials favor further rate cuts, while others prefer to hold steady, and a few have raised the possibility of additional hikes.

The latest US CPI inflation data has reduced the Federal Reserve’s readiness to cut interest rates further as inflation moves closer to its 2% target. The CME FedWatch Tool shows two Fed rate cuts this year, with the first in June.

- Senator Warren Warns Fed Against Bitcoin Crash Rescue Amid Liquidity Pump Claims

- Crypto Market Slides as Hawkish FOMC Minutes Trigger BTC, ETH, XRP Sell-Off

- XRP News: French Banking Giant Taps XRPL for Euro Stablecoin With Ripple Support

- Kalshi Better at Predicting FOMC Rate Decisions, US CPI Than Fed Funds Futures: FED Research

- Congress to Revisit Crypto Market Structure Bill in Key Meeting Tomorrow

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum