Traders Bet Against Fed Chair Jerome Powell’s Removal Despite Donald Trump’s Criticism

Highlights

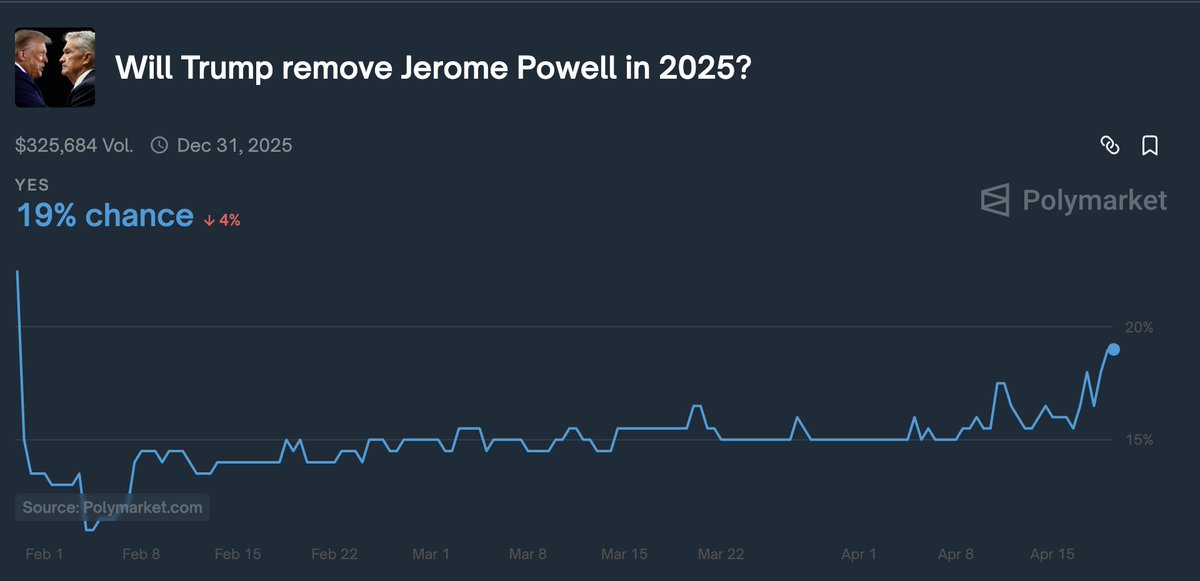

- Polymarket data shows that there is only a 19% chance Donald Trump fires Jerome Powell this year.

- This comes despite a WSJ report that Trump is considering replacing Powell with Kevin Warsh.

- Trump has urged Powell to cut interest rates several times.

Traders on Polymarket are betting against Fed Chair Jerome Powell’s removal this year despite criticisms from US President Donald Trump. Trump has consistently called on Powell to cut interest rates, which would be a positive for the crypto market. However, Powell has refused to listen so far, indicating it isn’t yet time to cut rates.

Traders Bet Against Donald Trump Removing Jerome Powell This Year

Polymarket data shows that traders are currently betting against Donald Trump removing Jerome Powell this year. Currently, there is only a 19% chance of that happening this year, based on data from the prediction platform.

The odds for this happening have dropped by 4% in the last 24 hours, despite a Wall Street Journal (WSJ) report that the US President has privately discussed firing Powell for months, including in meetings with his potential replacement, Kevin Warsh.

As CoinGape reported, Donald Trump had criticized Powell yesterday, stating that he is always “too late and wrong.” He also remarked that the Fed Chair’s termination “cannot come fast enough.”

The US President made this statement while noting that the European Union (EU) was about to cut interest rates for the seventh time. Yet, Powell and the Fed still hold tight on easing monetary policies.

Following his meeting with Italy’s Prime Minister, Giorgia Meloni, Trump made some comments about Powell again, sparking debates on whether the US president would remove him soon.

Trump stated that he wasn’t happy with Powell and that the Fed Chair would leave if he asked him to. The US president again expressed his displeasure with Powell, remarking that he does not believe Powell is doing his job.

Meanwhile, the White House also confirmed that Trump is studying whether he has the power to remove Powell. However, the Fed Chair once asserted that the US President has no legal power to remove him.

Significance Of This Development

Reports around Jerome Powell’s termination as Fed Chair are significant for the crypto market, as the Bitcoin price and other altcoins have shown a tendency to react more to monetary policies than to other macroeconomic fundamentals.

As such, Donald Trump firing Powell or the Fed Chair resigning could be a positive for the market, since Powell has shown that he has no intention of lowering rates just yet. In his recent speech, Powell made it clear that the Federal Reserve would likely keep interest rates steady for now while monitoring the impact of Donald Trump’s tariffs on inflation.

Meanwhile, market participants may be more inclined toward Kevin Warsh, who appears to be more crypto-friendly. However, Warsh once advocated for Central Bank Digital Currencies (CBDCs) and looked to be against private stablecoins.

This contradicts Trump’s policies, as the US president has already signed an executive order prohibiting the creation of a CBDC. On the other hand, Powell looks to be more welcoming to cryptocurrencies at the moment, as he noted the need for stablecoin regulations amid their rising demand.

For now, all eyes will be on what the Fed’s next move will be and if they will cut interest rates anytime soon. Despite Powell’s hesitance, Bank of America predicts that there will be four Fed rate cuts this year, with the first coming at the May FOMC meeting.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs