Crypto Market Bleeds Ahead of FOMC Meeting Minutes Today- Another Crash Or Recovery?

Highlights

- Nearly $450M in crypto was liquidated today as the market suffers ahead of key events.

- Bitcoin plunged to $1113k, ETH to $4.2k today as the FOMC Minutes event brings volatility.

- Profit-taking, macroeconomic uncertainty, and crypto ETF outflows further exacerbated the downtrend.

The crypto market tosses bulls out of the picture this week, as fear and bears take over investors’ trading decisions. Despite surpassing a $4T market cap earlier in the month and BTC’s ATH rally, the trends have completely changed today. Under the impact of which, $450M worth of liquidation position has been wiped out.

Crypto Market Crash Fuels $450M Liquidation

The Bitcoin’s slippage below $113k and the Ethereum declining to $4.2k mark resulted in a major series of liquidations in the crypto space, staining the market in red. CoinGlass data reveals the liquidation of a $450M position in the market today, affecting 122,096 traders.

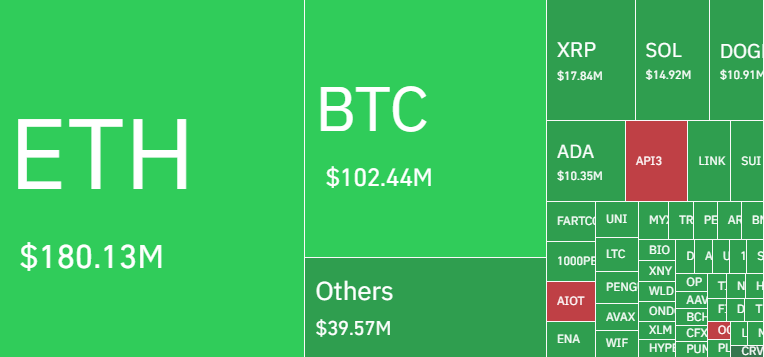

In this Ethereum position leads the liquidation, losing $180.13M, followed by Bitcoin with $102.44 in liquidation. Other top altcoins, such as XRP ($17.84M), SOL ($14.92M), and DOGE ($10.91M), are also in the liquidation race, impacting global traders.

- Source: CoinGlass, Crypto Market Liquidation Heatmap

Notably, Ethereum’s dominance in the liquidation has been consistent for the last few days, since its recent uptrend has heavily influenced investors’ trading decisions. One individual who has turned $125k into $29.6M on ETH has lost it all again with this downtrend, reports Lookonchain.

This legendary trader went long on $ETH again but was liquidated in the market crash, losing $6.22M.

Starting with just $125K, he grew his accounts to $6.99M(peaking $43M+).

Now only $771K remains—4 months of gains nearly wiped out in just 2 days.https://t.co/aHuSEEQVhx pic.twitter.com/byQrsQGnOs

— Lookonchain (@lookonchain) August 20, 2025

Will FED Hint Rate Cut Today As Institutional Investors Continue Sell-Off

The broader crypto market is facing a correction ahead of the FOMC Meeting Minutes release today and Jerome Powell’s speech at Jackson Hole on Friday. Notably, investors are greatly cautious of their trading decisions while awaiting the Fed’s hint at potential rate cuts in September.

FOMC Minutes drop today at 3PM (ET).

PREPARE FOR VOLATILITY! pic.twitter.com/hnFCPabfzv

— Mister Crypto (@misterrcrypto) August 20, 2025

CME FedWatch tool, Polymarket, and others showcase strong odds of rate cuts next month. However, the U.S. PPI, tech revenue report, weekly job data, and much more can impact the Fed’s decision, creating uncertainty in the market.

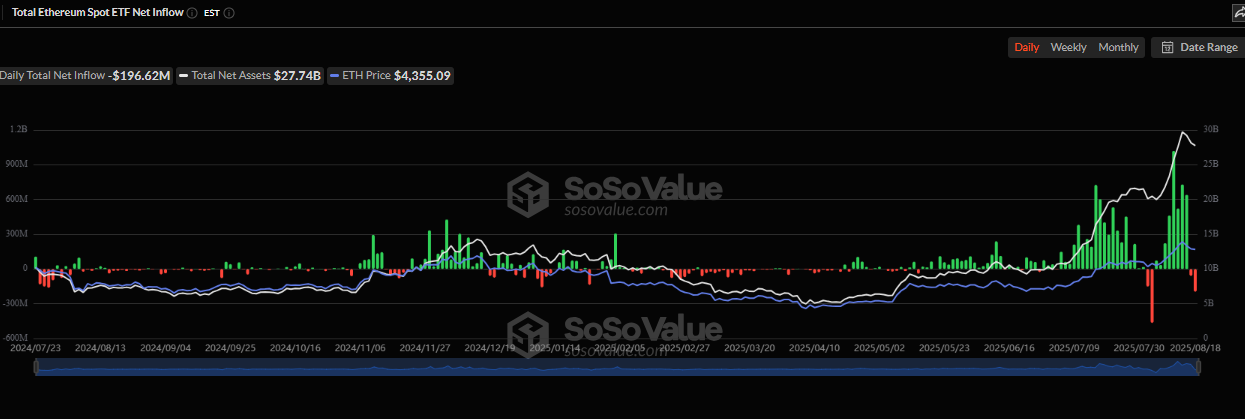

A shift in investors’ sentiments was also noticed as the SEC postponed the XRP ETF decision to October. Even the launched ETFs witnessed significant outflows, led by the Bitcoin spot ETF with -$121.81M net flow on August 19. Ethereum also has the same result, with $196.62M outflows.

- Source: SosoValue, Ethereum ETF Net Flow

Profit taking, whale sell-off also played a significant role. Further down, the downturn may persist if the macro events bring further bearish trends this week.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What crypto holders were affected the most?

2. Which event is affecting the crypto price today?

3. When will the crypto market recover?

- Crypto Market Bill Hits New Deadlock as Banks Reject White House Deal

- Why Experts Are Warning Bitcoin Rally Could Be A “Dead Cat Bounce”

- BTC and Gold Price Bounce as Trump Admin Brokers US-Venezuela 1000 Kg Gold Deal

- SEC Advances Major Crypto Securities Plan to White House for Approval

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

Buy $GGs

Buy $GGs