FTX’s $5B Repayment Tomorrow: Why This 2% Stablecoin Supply Payout Could Fuel a Bull Run?

Highlights

- FTX is set to distribute $5B in stablecoin as creditors’ repayment on May 30.

- The repayments equal 2% of stablecoins' total supply, marking one of the biggest liquidity events in the market.

- Analysts remain divided on its impact, but some anticipate a bull run due to better macro conditions.

The second phase of the FTX repayments to creditors begins tomorrow, May 30, 2025. After 27 months of its collapse in November 2022, the once glorious crypto exchange will reimburse the creditors, with a $5 billion payout in stablecoin tomorrow, equivalent to 2% of the total stablecoin supply. Such a high amount is creating concerns about its potential impact on the broader crypto market, where experts await a bull run formation under its influence. Let’s discuss.

FTX Repayment Details: Distribution Plans, Partners & More

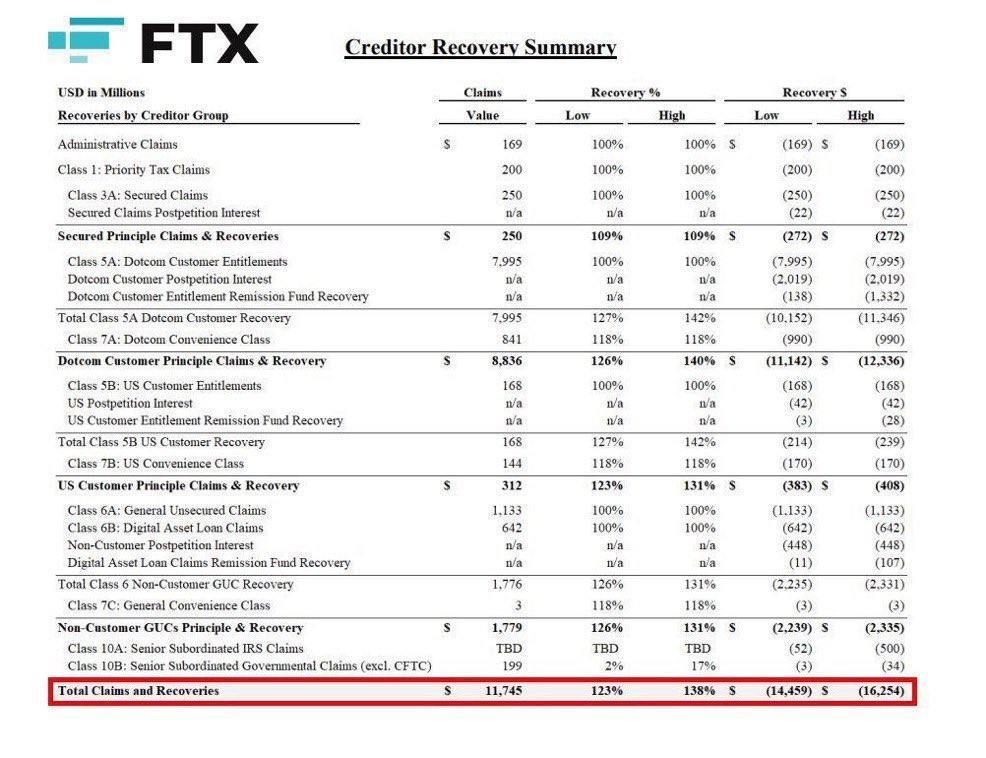

After a previous repayment round in February, the second FTX repayment will take place on May 30 under FTX’s Chapter 11 Plan of Reorganization. Under this, the different class creditors with claims above $50,000 would receive different payouts.

According to official FTX payout announcement, Class 5A (Dotcom customer) would receive 72% of the distribution, Class 5B would receive 54%, Class 6A & 6B (unsecured & loan claims) would receive 61% each, Class 7 (Convenience claims) would receive 120%.

Although the official payout day is tomorrow, the completion could take a few business days. Moreover, the distribution would take place through popular crypto platforms like BitGo and Kraken. Hence, there are no direct payments from the FTX exchange.

The crypto community seems pumped over the payout, but some creditors feel misled, as the FTX announcement revealed that they would receive 118% of their investment. Since November 11, 2022, Bitcoin, Solana, and XRP prices have been up multiple times, but the receiving amount would be based on their holding prior to these gains.

In addition to this uneven recovery rate, there are additional concerns around KYC verification, phishing verification & more. More importantly, its influence on the crypto market is more concerning.

FTX Repayment to Influence the Crypto Market

The $5 billion in stablecoins is a suitable decision as it would not directly impact the price of particular digital currencies in which creditors have invested. Experts believe that nearly 2% of the stablecoin supply would enter the market, not leave the market.

As a result, the crypto market would be affected positively or negatively depending on the investors’ sentiments, with this large-scale repayment. Neeti Mittal and a few other experts foresee the money heading to the top cryptos like Bitcoin and Ethereum.

FTX Repayment Incoming: $5B in stablecoins.

🚨 Distribution starts May 30.

💸 That’s ~2% of all stablecoins entering the market.

⏳ Payouts expected to land in 1–3 days.This is one of the largest liquidity injections in crypto history.

Where’s the money headed?

→ BTC

→ ETH…— Neeti Mittal (@NeetiBTC) May 29, 2025

A Bitcoin price rally would fuel the rest of the market, as it nears its ATH mark.

Will This 2% Stablecoin FTX Payout Fuel Bull Run?

The smaller convenience class creditors have already received their FTX repayments. However, the crypto market remained almost unaffected, let alone a bull run, despite the $800 million drop. According to experts, the prime reason behind this is that the market trends were weak, but things will go differently this time.

Crypto analyst Master of Crypto believes that the market trends are different this time, as Bitcoin trades above $108k. Additionally, the Ethereum price is pumping, potentially targeting $3K, and even the macro is solid. Other analysts add to this outlook, claiming that money will flow into cryptos this time, especially altcoins.

As a result, the crypto market could witness a rally. However, the odds of a bull run are still limited, as the influence of the Trump tariff and other macroeconomic events persists.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. When will creditors receive their repayments?

2. How much will be repaid in this FTX payout?

3. Why are creditors dissatisfied with the repayment plan?

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs