Here is Why ETH, WLFI, PYTH, and BONK Price are Down Today

Highlights

- ETH price dips 2.3% today as the Ethereum Foundation plans to sell 10k tokens, adding to market pressure.

- Trump-backed WLFI token tumbles, PYTH, and BONK also face sell-offs.

- Crypto market shows a diversion in trend, affecting $242M crypto positions.

After facing significant volatility in August, investors have been expecting a different outcome this month, but the price performance of ETH, WLFI, and other altcoins tells a different story. Although the crash isn’t severe, it signals rising volatility in the space ahead of the FOMC Meeting and more.

ETH, WLFI, PYTH, and BONK Price Crash Today

Although the fear and greed index shows neutral investor sentiment, many cryptos are facing significant downward pressure today. Ethereum (ETH), the second biggest cryptocurrency, has again plummeted from its near-ATH mark, marking a 2.3% price dip today and 6.2% over the week.

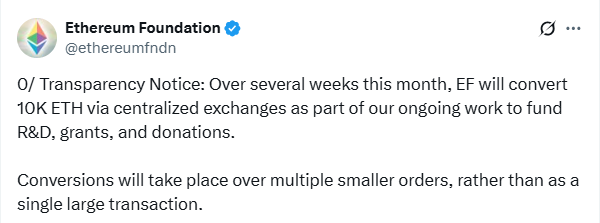

Currently, ETH trades at $4.3k with a $519B market cap. Notably, this dip formed as the Ethereum Foundation deposited 10k ETH ($42.7M) to Kraken to sell. Moreover, the whale sell-off, investors’ shifting sentiments, and more played a role.

- Source: X, Ethereum Foundation

The same is true for others, including the World Liberty Financial token. Notably, despite Trump family support, WLFI price crashed 50% from prime, and 8% today. With the token unlocked, investors sold off, and more, pushed the token down to $0.2238 with $5.54B in market capitalization.

PythNetwork, which rose nearly 100% in a day, is also crashing now. Today, PYTH price fell 3.84% due to profit-taking and mixed technical signals. Notably, on the week frame, it’s still 37% up.

Lastly, Bonk meme coin is also showing volatility today, losing nearly 1% of its value due to whale profiting. On-chain experts note that a wallet linked to Galaxy Digital transferred 510B BONK to the exchange, building selling pressure.

Interestingly, apart from these reasons, there’s a general volatility in the market due to the release of many U.S. economic data this week. There’s a JOLTS report today, followed by the U.S. Jobless Claims tomorrow and Nonfarm Payrolls & Unemployment on Friday.

MACRO STORM INCOMING.

🇺🇸 JOLTS report Today

🇺🇸 Jobless Claims Tomorrow

🇺🇸 Nonfarm Payrolls & Unemployment FridayPrepare for Volatility! pic.twitter.com/Ph7odVm6R8

— Crypto Rover (@rovercrc) September 3, 2025

These data could impact the Fed’s interest rate decision, hence the volatility and price crashes.

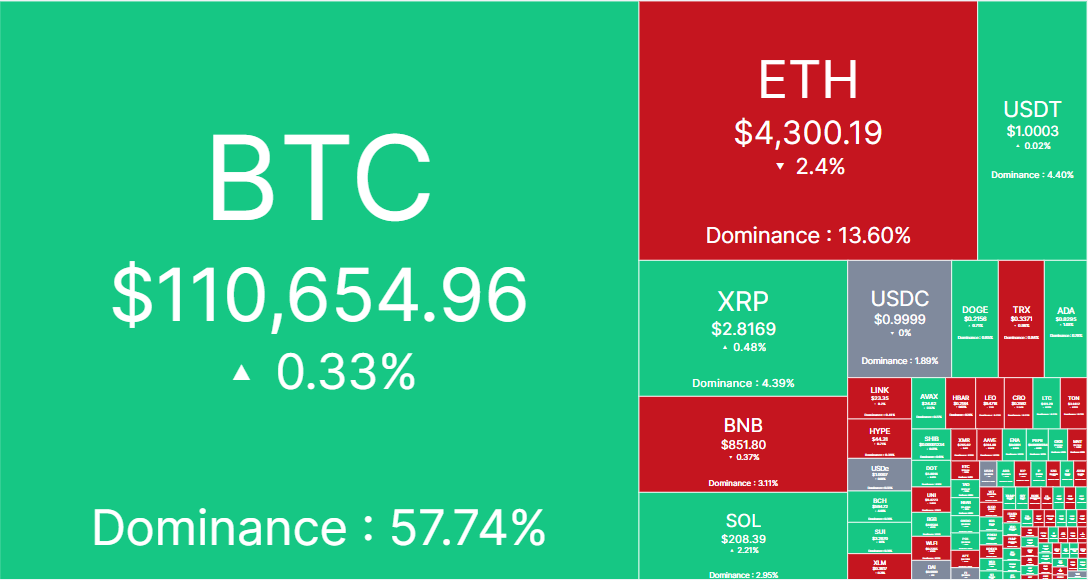

Crypto Market Witness Divided Trends, Liquidation Hits $242M

The crypto heatmap shows divergent trends in the market, where many like Bitcoin, XRP, and others are moving up, whereas the price of ETH, WLFI, PYTH, and others is crashing. The dispersion is due to investors’ varying sentiments around a particular asset.

The top and utility-based tokens are performing better than others as the investors move to safe assets.

- Source: CoinMarketCap, Crypto Market Heatmap

Amid this shift, nearly $242M worth of crypto positions have been liquidated, 107.7k traders, per CoinGlass data. Notably, Ethereum long positions were mostly liquidated (~$43M), followed by Bitcoin ($21.73M) and more.

Frequently Asked Questions (FAQs)

1. Why is the Ethereum Foundation selling 10k ETH?

2. Why is WLFI failing to recover despite investor demand?

3. How much of the crypto market has been lost in liquidation today?

- Bitcoin vs Gold Feb 2026: Which Asset Could Spike Next?

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible