$200M Wiped Out in Crypto Crash Today, But Ethereum Holders Lost the Most, Here’s Why

Highlights

- Crypto market crash continues with $200M liquidation today, affecting 83,975 traders.

- Ethereum holders suffered the biggest loss with $57.5M in liquidations, with the token lacking bullish catalysts.

- Ethereum price remains flat, reflecting investors’ uncertainty amid current market conditions.

The crypto market conditions are still unfavorable today, dividing the tokens amid price recovery and crash. Although the majority of the market consolidated some struggles harder than others for recovery, wiping out nearly $200M, affecting thousands of investors. However, the Ethereum holders faced the biggest loss, wiping out $57M.

Crypto Crash Fuels $200M Liquidation Today

The CoinGlass data reveals that the $193.75M has been liquidated in the last 24 hours, affecting 83,975 traders. Although the liquidation was not as extreme as the earlier crypto market crash fueled by the Israel-Iran conflict, the loss reveals that uncertainty in the market is still persistent.

Notably, today’s liquidation event liquidated both the short and long traders, signaling recovery attempts of the digital assets. Out of these, the largest single liquidation on the OKX exchange in the ETH-USDT swap was valued at $1.25M.

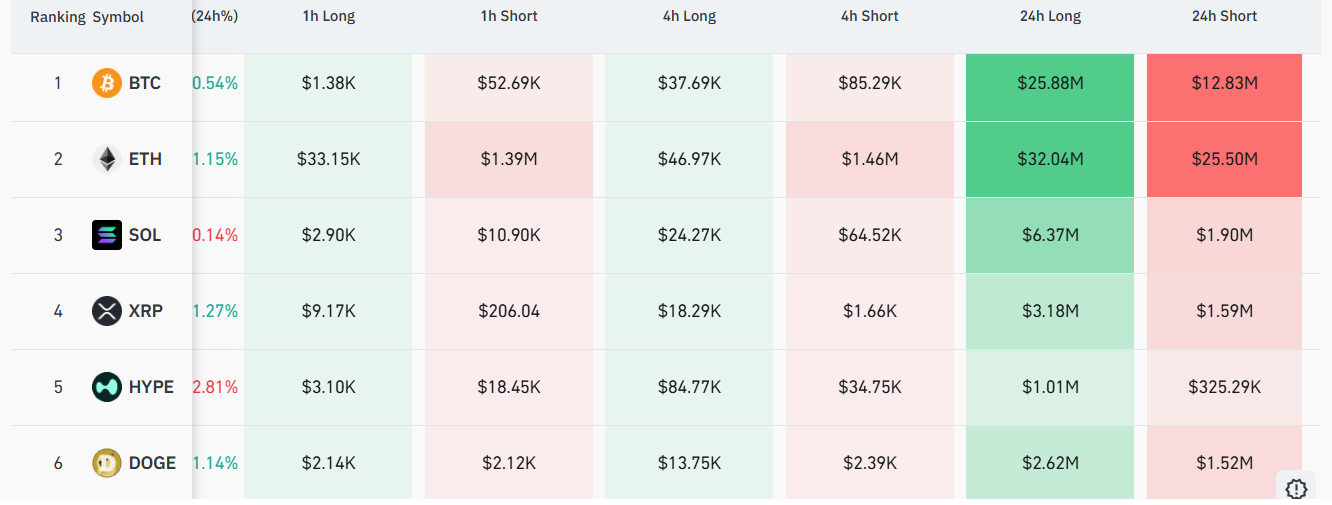

Top contributors for the wipeout are Bitcoin, Ethereum, Solana, XRP, Hype, and Dogecoin, affecting their holders significantly.

Exchange data also reveals the dominance of the longs leading the liquidation, signaling that investors anticipate a surge, but the crypto crash continues.

Ethereum Holders Liquidate Most Over Missing Price Surge Catalyst

Ethereum liquidation in the 24 hours reached $57.54M, dominated by long traders at $32M. However, the short liquidation also reached $25M, signaling major price fluctuations impacting all the traders.

Per the CoinMarketCap stats, the Ethereum price fluctuated between $2,471 and $2,545, currently trading at $2,532.08, concerning holders.

Some experts see it as a buying opportunity as the price is expected to rise. However, others question whether the ETH inflows have lost their impact on the price.

The Ethereum ETFs have been gaining consistent positive net flows for days, $19.1M on June 18 alone, but the price remained down.

Experts estimated that this is due to Ethereum holders’ profit-taking strategies amid the Israel-Iran conflict and other macroeconomic pressures. Besides, the token is missing any bullish catalyst, so the consolidation continues.

As a result, all the short and long traders struggle amid day-to-day fluctuations.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. How did the crypto crash result in $200M liquidation?

2. What are the top contributors to the liquidation?

3. How is Ethereum price reacting to ETF inflows?

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs