Why is Bitcoin Price Going Down Today?

Highlights

- Bitcoin price plunges below $110k today, marking the lowest point in the month.

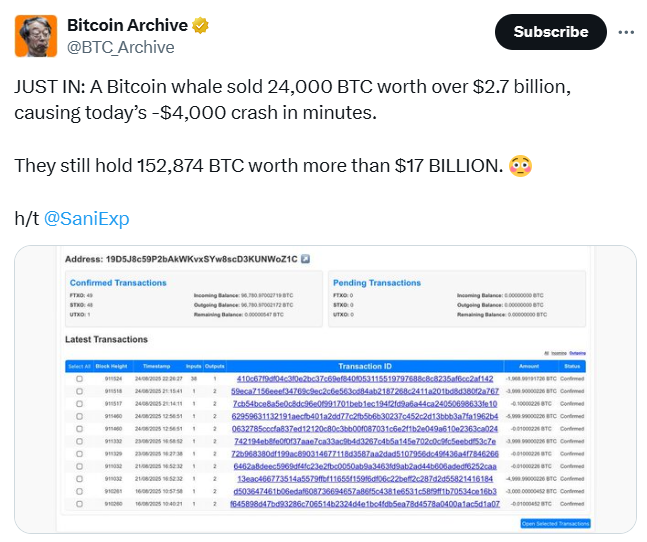

- A massive whale sell-off of 24,000 BTC fueled Bitcoin’s downtrend today.

- Spot Bitcoin ETFs also recorded $1.17B in outflows last week, signaling capital rotation in the market.

August is near its end, but the entire market is facing heavy turbulence, led by the Bitcoin price crash. Despite major milestones this month, even hitting an ATH of $124.4k, the token is struggling as experts allege capital rotation amid Bitcoin whale trades and Ethereum competition.

Bitcoin Price Dips Below $110K

Despite gaining a bullish stance on Powell’s Jackson Hole speech, the Bitcoin price came crashing down late Sunday, continuing till today. With a 4.5% drop over a 24-hour frame, BTC currently trades at $110.2k, but has dipped down to $109.4k earlier in the day with $2.17T in market capitalization.

- Source: CoinMarketCap, Bitcoin Price Chart

Even the major crypto market is following this correction, losing nearly 3% of its total market cap. ETH, SOL, and the rest of the altcoins are in a similar downtrend, suggesting investors’ cautious approach.

Top 2 Reasons Why Bitcoin Price Crash Today

A significant shift in the investors’ sentiments has been noted this month, where various factors impacted the trading decision of investors. Even the Fear and Greed index has once again shifted to neutral (43) from greed, showcasing investors’ cautious approach.

Notably, the previous week’s crypto headlines have not been entirely favorable for the market’s performance. Beginning with the FOMC Minutes and more, the token price crashed, but a few, like Jerome Powell’s Jackson Hole speech, temporarily saved the gains until it all came crashing down today.

1. Powell Speech Impact on Bitcoin

Today, Bitcoin dipped again, and investors associated it with the Powell speech theory, adding market dips after the Jackson Hole event based on historical data. This is because the investors show great dependence on the speech and its discussion, adding high volatility in the crypto market.

Just a day before this event, the market crashed before pumping on the outcome of the speech (hint at interest rate cut). However, the sentiments fell short and the Powell speech left a volatile impact on Bitcoin.

SO WHY DID BITCOIN DUMP?

We warned you 3 days ago.

The classic pump & dump after every Powell Jackson Hole speech struck again! pic.twitter.com/laOPI8FWfZ

— Crypto Rover (@rovercrc) August 25, 2025

2. Crypto Whale Sell-off

While this may be one of the reasons, the crypto whale sell-off fueled the actual downtrend, especially the Satoshi era ones. The prime whale is an individual who sold 24,000 BTC worth over $2.7B hours ago, crashing the Bitcoin price by $4k in just minutes. Moreover, $45B in market cap got lost due to this sell-off within minutes.

Notably, such a large sell order overwhelms investors and fuels the market sell-off. The same happened here as experts noted a drastic shift in investor sentiments.

- Source: Bitcoin Archive, Crypto Whale Activity

Another OG is on BTC swap, where in the last 5 days they have deposited nearly $2.7B tokens to Hyperliquid for sale and have bought $2.2B spot, per Lookonchain.

Willy Woo, a crypto analyst, notes that these OG holders are behind the price crash as they bought BTC at $10 or even lower. However, at present, someone would need $110k or more to absorb the sales they are making. As a result, an upward move is harder.

Why is BTC moving up so slowly this cycle?

BTC supply is concentrated around OG whales who peaked their holdings in 2011 (orange and dark orange).

They bought their BTC at $10 or lower. It takes $110k+ of new capital to absorb each BTC they sell. pic.twitter.com/7CbWXsvX2l

— Willy Woo (@woonomic) August 24, 2025

While the impact is already disastrous, experts fear that much more similar action might take place in the future as well. Interestingly, the token still has the largest dominance in the crypto space, and experts like Michael Saylor’s Bitcoin price prediction foresee a 30% surge YoY, but capital rotation is persistent at press time.

Due to this, even spot BTC ETFs witnessed $1.17B of outflows last week, the second-largest outflows since their inception.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. How much value has been lost from the market due to the whale sell-off?

2. What was the outcome of Jerome Powell’s Jackson Hole speech?

3. How did Spot Bitcoin ETFs perform last week?

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs