Why is the Crypto Market Moving Down Today?

Highlights

- The dip in BTC, ETH, and the rest of the altcoins fueled a major crypto market crash, wiping out 3% of the market cap.

- The Trump vs. Fed feud, the upcoming FOMC meeting, and other factors are pushing the market down today.

- Despite the crash, tokens like PTH are up, signaling a lack of bullish catalysts for others.

Investors’ crypto positions are again at risk, as the market tumbles today. The uncertainty of the impact of the macroeconomic events and technical factors is affecting the digital assets’ performance, led by Bitcoin, Ethereum, and other top altcoins’ crash.

Crypto Market Cap Dips 3% Today, Liquidation Hits $414M

In just 24 hours, the broader market cap of the crypto market has declined 3%, currently at $3.8 trillion, despite crossing the $4 trillion mark earlier. This dip showcases a growing weakness in the investors’ confidence as volatility builds. Notably, the trading volume has surged to $178.4 billion, showcasing the sellers’ dominance in the market.

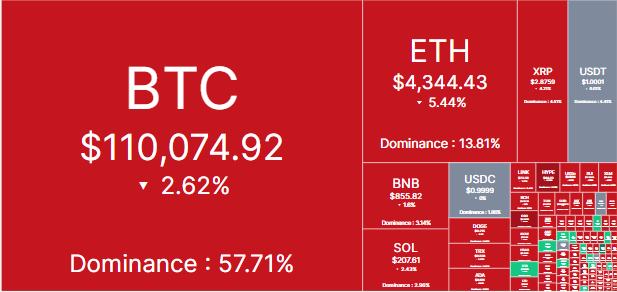

Not only this, the fear and greed index shows a significant decline to the neutral zone (47), and the Bitcoin dominance has dropped to 57.6, as the BTC price crashes to $110k today. Not only Bitcoin, but altcoins are also taking a toll, ETH down to $4.3k, XRP to $2.87, and more, collectively wiping out nearly half a billion from the market.

- Source: CoinMarketCap, Crypto Heatmap

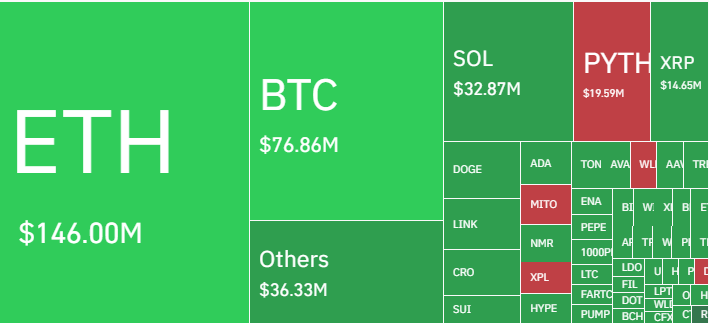

CoinGlass data confirms that nearly $414 million crypto positions have been liquidated, affecting 127.8k traders. In this, the Ethereum positions were most impacted, losing $136M long positions, whereas Bitcoin longs were liquidated only half of that; $73M.

- Source: CoinGlass, Crypto Liquidation Data

Why the Crypto Market Crash Today?

August crypto market crashes amid macro uncertainty and seasonal headwinds. Investors are cautious after this week’s Jobless claim data release and the September Fed meeting. Additionally, the Trump vs Fed feud, including the Fed Governor Lisa Cook’s dismissal on August 28, has affected the market, as investor sentiments fell from greed to neutral.

Notably, just last week Jerome Powell’s speech at Jackson Hole barely lifted the market, but the uncertainty of upcoming macro events is affecting investors negatively today. The $14.7B crypto options expiry today also played a role.

Bitcoin and Ethereum are dumping hard

This is due to $15B option expiry and we also have monthly close in 2 days.

Don’t get shaken out in this manipulation pic.twitter.com/SYM8c2WnxU

— Ash Crypto (@Ashcryptoreal) August 29, 2025

However, experts also suggest that it’s a temporary storm after excessive leverage and macro uncertainty. Interestingly, not all cryptos are bearish; some, like PYTH, are riding the bulls. Its price has surged 100% today as the Trump administration ushers in the GDP data to blockchain.

Moreover, the long-term outcome is bullish per experts, including Eric Trump, who recently forecasted the $1 million price milestone for BTC.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. How much value is lost from the crypto market today?

2. How many traders were liquidated today?

3. Which crypto is defying the crypto market crash today?

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

Buy $GGs

Buy $GGs