Why Tether Mint 1 Billion USDT Today and What it Means for BTC & ETH Price?

Highlights

- Tether minted 1 billion USDT today on Ethereum, bringing its total supply to 157.05B.

- Bitcoin historically rallies after large USDT mints with FOMO driven investor sentiments.

- Although uncertainty exists, BTC and ETH price could rebound next.

Tether minted 1 billion USDT today, as the crypto market witnesses turmoil with the FOMC meeting and the ongoing geopolitical issues.. With a billion worth of liquidity entering the market, investors anticipate positive results on the cryptocurrency prices. Interestingly, experts also highlight that this event could influence BTC and ETH price. Why? Let’s discuss.

Why did Tether Mint 1 Billion USDT?

Whale Alerts X post revealed that the Tether minted 1 billion USDT on Ethereum on June 18. This is part of USDT’s issuer’s broader plan and has increased this stablecoin’s total supply to 157.05B.

Since November 6, 17 billion USDT have been minted on Ethereum and Tron, and aim to provide additional liquidity in the crypto market.

Further reports also reveal that out of these 1 billion, $225.36 million was sent to Bitfinex, a Tether-affiliated exchange.

BTC Price Historical Correlation to USDT Minting

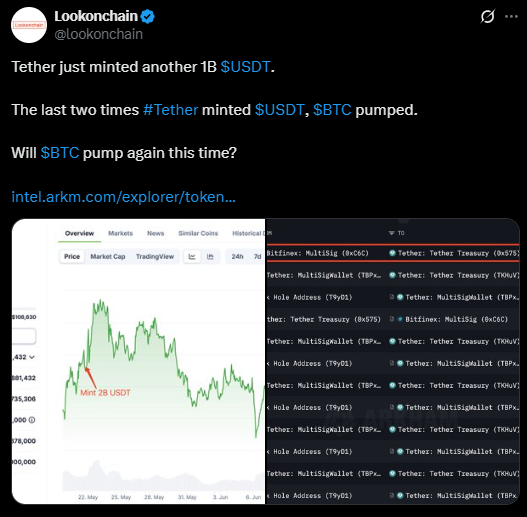

Lookonchain X post and historical data show that Bitcoin has reacted bullishly to the USDT minting news. On May 21, Tether minted $2B tokens, and just a day after that, Bitcoin price hit a new ATH past the $111k mark.

Blockchain Research Lab findings also reveal that Bitcoin tends to rise 0.4-0,8% right after minting. This surge is due to its impact on the investors’ sentiments and FOMO building due to liquidity changes.

Will BTC and ETH Price Rally Next?

Bitcoin and Ethereum tokens’ prices are struggling amid the broader crypto market correction. BTC is currently trading at $105k, whereas ETH is down to $2.5k, fueled by the FOMC meeting and geopolitical tension.

Although experts predict that the Fed would keep the interest rate unchanged, there’s a slight possibility that the BTC and ETH price could react positively.

Moreover, the clarity on the Israel-Iran conflict could help. Besides, the minted Tether token also influences the investors’ sentiments. If bullish momentum forms, the crypto market could see a significant uptrend.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. Why did Tether mint 1 billion USDT today?

2. Does Tether’s USDT minting affect Bitcoin price?

3. What are the other factors influencing the crypto market today?

- TRUMP Coin Jumps as Team Announces Conference With President Trump as Keynote Speaker

- Breaking: Trump Calls For Emergency Fed Rate Cut Before Next Week’s FOMC Meeting

- Breaking: U.S. Senate Passes Bipartisan Housing Bill That Includes CBDC Ban

- Crypto Market Rebounds as Trump Mulls Suspending Jones Act to Ease Oil Price Pressures

- Goldman Sachs Revises Fed Rate Cut Forecast to September as Iran War Threatens Inflation

- What Happens to XRP Price If US Wins War Against Iran?

- COIN Stock Prediction as Crypto Crash Odds Jump as Expert Sees Inflation Hitting 3.4%

- Cardano Price Turns Bullish as ADA Futures OI Hits $416M Ahead Of Key Upgrades

- Dogecoin Price Outlook If Elon Musk’s X Money Integrates Crypto- Is $0.2 Possible This Week?

- Will XRP Price Rally After Ripple’s Strategic Acquisition in Australia?

- Bitcoin Price At Risk of Losing $65k as Iran Warns of “Continuous Strikes” That May Push Oil to $200