XRP ETF Hype vs On-Chain Reality: XXRP Inflows Crashed 98% in 3 Weeks

Highlights

- Teucrium’s futures-based XRP ETF (XXRP) inflows have plummeted 98% in 3 weeks.

- While social media buzz favors XRP ETFs, their performance contradicts.

- Investors’ concerns over performance while they wait for the SEC’s decision.

The crypto community has been awaiting the SEC to approve more altcoin exchange-traded funds, especially the spot XRP ETF. Being the fifth biggest cryptocurrency, with worldwide recognition and a focus on global transactions, Ripple’s token ETF is the most in demand, as presented on social media platforms. Still, the reality seems far from different as the inflows of XXRP, a futures XRP exchange-traded fund, keep crashing.

XRP ETF Update: XXRP Inflows Crashed to Just $600k

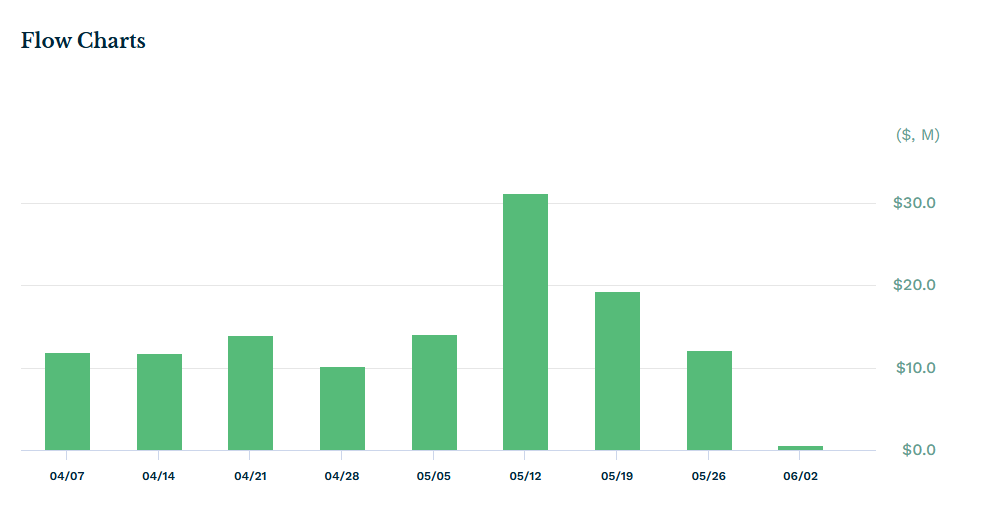

Despite the high optimism around Teuncrium’s futures XRP ETF launch, the performance is poor. The XXRP ETF was launched in April and quickly grew to $100M plus in assets; however, the weekly charts present a constant decline in performance, resulting in a 98% crash in just three weeks.

The ETF reports reveal that it received $31M in inflows in the second week of May, $19.3M in the third week, and $12.1M in the last week. However, the number has crashed to $600k this week, showcasing a 14% drop in 5 days and 98% in three weeks.

Meanwhile, the Ethereum ETF inflows create new highs, showcasing the limited demand for Teuncrium one.

Although the drop came amid the broader crypto market crash, affecting the XRP price, it hints that the hype differs from reality.

How Would the Spot XRP ETF Perform if Approved?

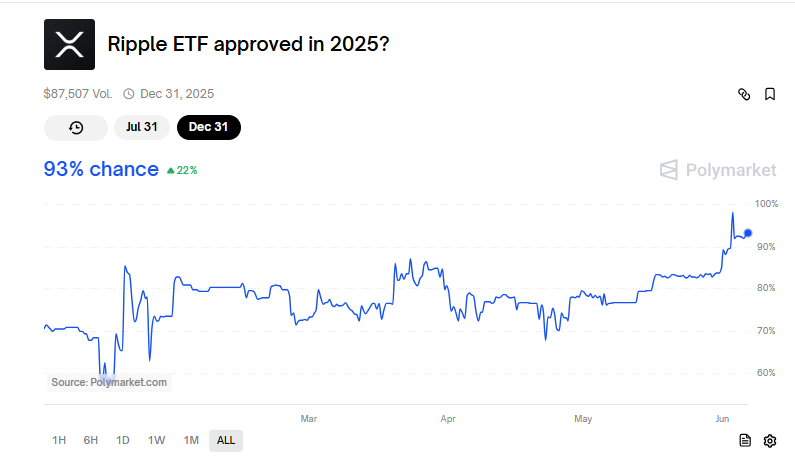

Due to the bullish performance of the Bitcoin and Ethereum exchange-traded funds, the demand is higher for the spot Ripple ETF. The Polymarket data reveals that investors are betting in favor of the SEC approving the Ripple ETF, with 93% odds.

However, the XXRP ETF inflows performance reveals that there’s a significant difference between hype and actual performance.

Additionally, the XRP price could crash below $2, as despite the hype, bear dominance is high, so there are also concerns around the exchange-traded fund’s performance post-launch.

Previously, experts anticipated the Ripple ETF (spot and leverage) to witness $2 billion in inflows, but now it is uncertain.

Moreover, the SEC has yet to approve the XRP ETF, so it’s difficult to conclude. Investors must await the SEC’s decision, which is due in June, before jumping to conclusions.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What is the status of XXRP ETF inflows this week?

2. Why are XRP ETF inflows declining?

3. When will the SEC approve the spot XRP ETF?

- Bitcoin Falls as U.S. Jobless Claims Signal Labor Market Rebound

- Bitcoin News: CitiBank to Launch BTC Services in 2026

- Deutsche Bank-Backed AllUnity Launches First MiCA-Compliant Swiss Franc Stablecoin

- Crypto Market on Edge as US-Iran Hold Talks Ahead of Trump’s War Deadline

- XRP Prepares for Phase 4 Lift-Off, $21.5 Level in Focus

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

Buy $GGs

Buy $GGs