Trump Media Invests $40M in Bitcoin as Incoming CFTC Chair Signals Crypto Clarity Act Push in January

Highlights

- Trump Media adds $40M Bitcoin, raising holdings to 11,542 BTC worth over $1B.

- CFTC Chairman says Congress is poised to advance crypto market structure rules.

- Senate Banking Committee plans January markup of digital asset legislation.

CFTC Chairman Michael Selig said Congress is poised to advance crypto market structure legislation. His comments came as Trump Media & Technology Group disclosed a $40 million Bitcoin purchase. The company added the assets to its corporate balance sheet.

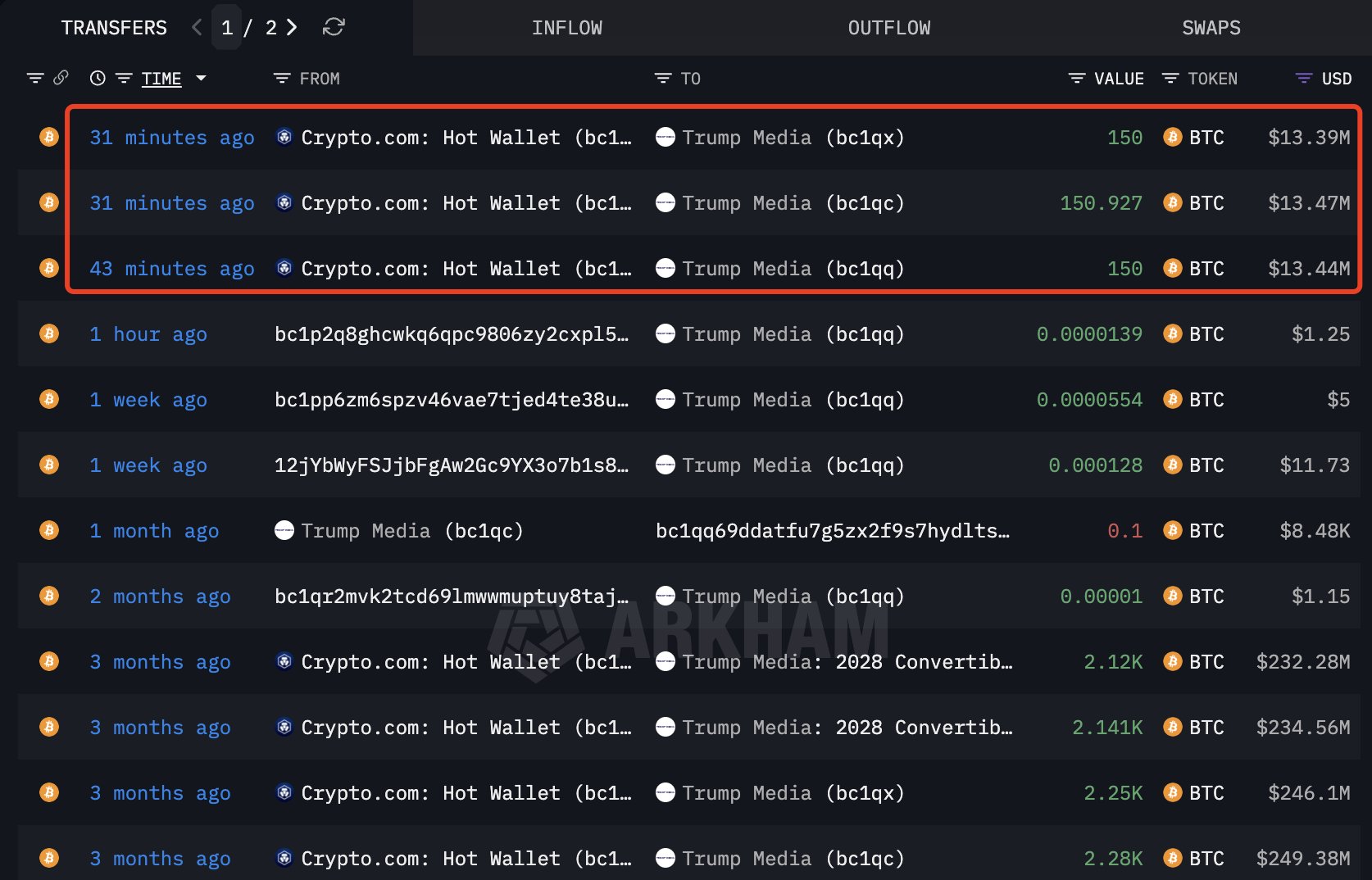

In an X post, analytical platform Lookonchain revealed that Trump Media bought 451 Bitcoin for approximately $40.3 million. The deal bumped the company’s total holdings up to 11,542 BTC, worth more than $1 billion.

The purchase follows disclosures made earlier in 2025. Trump Media previously reported holding roughly $2 billion in Bitcoin and related digital asset exposure. The company has positioned Bitcoin as a core treasury asset.

CFTC Chairman Highlights Market Structure Legislation

The regulatory focus intensified following Senate confirmation of Michael Selig as the 16th chairman of the Commodity Futures Trading Commission. In an X post, CFTC chairman said that lawmakers are “poised” to move forward with legislation that will regulate digital asset markets. He said expanding participation and fast-paced technological change have been major drivers,

Selig thanks President Donald Trump for naming him to chair the agency. He added that the CFTC is moving into a new era as technology transforms market behavior. He also underscored continuity in the agency amid a transition.

The CFTC chairman said Congress is soon to be sending crypto market structure bill to the president’s desk. He said the effort was needed to bring oversight into the “modern era.” CFTC chairman said regulatory structures in place were designed for earlier market formulations.

Legislation Seeks to Clarify Federal Crypto Oversight

The bill would establish federal guidelines for digital tokens. It also clarifies the division of authority between the CFTC and the Securities and Exchange Commission.

The Senate bill is called the Responsible Financial Innovation Act. It expands on the House of Representatives’ CLARITY Act, which it approved in July. Consideration had been suspended over the holiday break. The Senate Banking Committee is on track to hold a markup the crypto bill in January, with the possibility of a floor vote.

White House AI and crypto adviser David Sacks called the moment a critical juncture for digital asset regulation. Leadership at the CFTC and SEC is in sync on making the rules clearer, he said. His comments followed renewed legislative activity tied to the market structure proposal.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- CLARITY Act: Banks, Crypto Yet To Agree On New Crypto Bill Draft As March 1 Deadline Looms

- Michael Saylor Predicts $50T From Bonds Could Flow Into Bitcoin Ecosystem as Digital Credit Evolves

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale