Trump Tariffs: U.S. President Threatens 155% Tariff on China, Bitcoin Falls

Highlights

- Trump said that the tariffs on China may increase to 155% if no deal is reached by November 1.

- The U.S. president is set to meet China's president in two weeks.

- The rising trade tensions between both countries continues to impact the crypto market.

U.S. President Donald Trump has again threathened higher tariffs on China if they fail to reach a trade deal. This comes as the Trump tariffs continues to negatively impact the crypto market, with Bitcoin dropping to as low as $104,000 last week.

Trump Tariffs On China Could Increase To 155%

Speaking during a bilateral lunch with Australia’s prime minister, the U.S. president warned that China may 155% tariffs if they do not reach a deal by November 1. However, he seemed optimistic that a deal was likely to happen by then.

Trump stated that he expects to work out a fair deal with China’s President Xi Jinping. As CoinGape earlier reported, the U.S. president will meet Jinping at an October 31 summit in Asia, just a day before the earlier announced 100% Trump tariffs on China is to take effect.

During the meeting, Trump also said that China has been “respectful” to the U.S. Meanwhile, he warned that he could threathen China with other things including airplanes if they do not agree to reach a trade deal. The president added that China is in “big trouble” if they don’t do business with the U.S.

This comes just days after the U.S. president indicated that the 100% tarriffs on China will not stand. He had earlier announced these tariffs after claiming that China had become “hostile.”

Bitcoin Falls Amid Trade Tensions

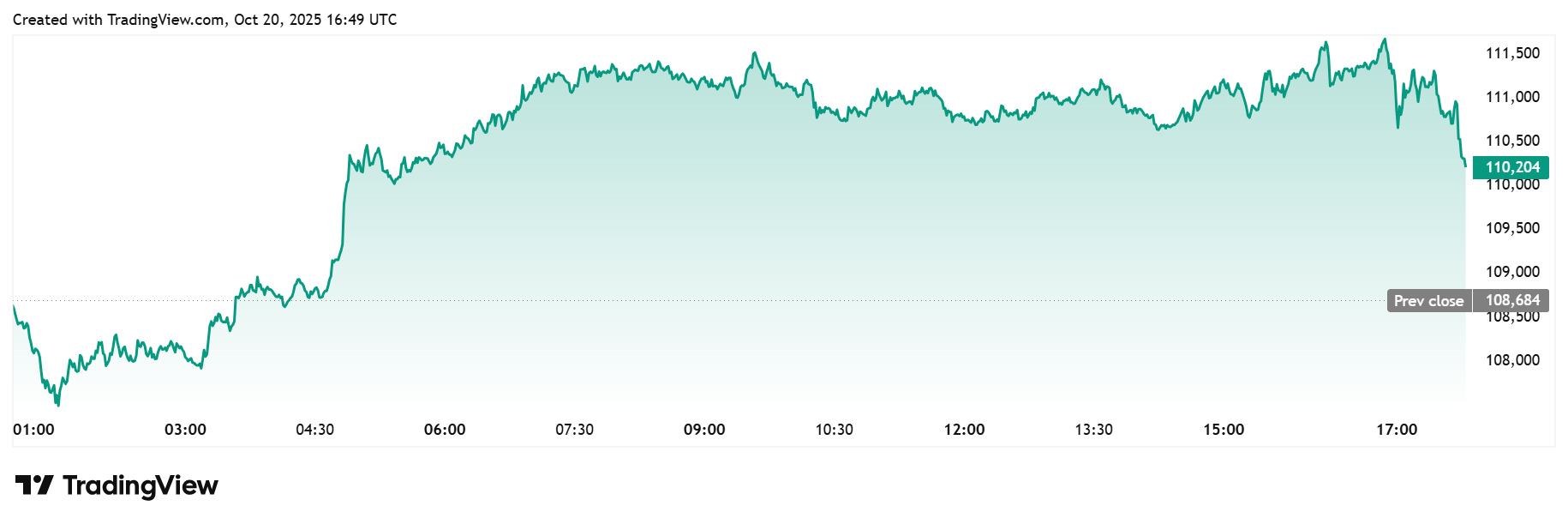

The Bitcoin price fell from around $111,000 following the latest threat of increase in the Trump tariffs. TradingView data shows that BTC had surged as much as 3% today, rising to $111,500.

However, Bitcoin has now sharply dropped to around $110,000, losing most of its intraday gains. The flagship crypto had dropped to as low as $104,000 last week on the back of rising tensions between the U.S. and China.

It is worth noting that the Trump tariffs on countries like India also remain in place. The U.S. president vowed to keep the massive tariffs on India until it stops buying Russian oil.

Bitcoin is also facing heavy selling pressure from miners and OGs amid the bearish sentiment sparked by the tariffs. Meanwhile, whales like the ‘Trump Insider Whale’ are also heavily shorting BTC. Onchain analytics platform Lookonchain revealed that the whale currently has a $121.5 million Bitcoin short position on Hyperliquid.

The #BitcoinOG(1011short) added more to his $BTC short!

Current Position: 1,100 $BTC($121.5M)

Liquidation Price: $135,320https://t.co/APD7aPjO49 pic.twitter.com/3LCztONKlh— Lookonchain (@lookonchain) October 20, 2025

- Expert Predicts Deeper Bitcoin Decline as JPMorgan CEO Warns of Similarities to the 2008 Financial Crisis

- Trump Won’t Pardon FTX’s Sam Bankman-Fried (SBF), White House Says

- Third Spot SUI ETF Goes Live as 21Shares Fund Launches on Nasdaq

- Mark Zuckerberg’s Meta Reportedly Eyes Stablecoin Integration This Year Amid Regulatory Clarity

- Coinbase Rivals Robinhood As It Rolls Out Stocks, ETFs Trading In ‘Everything Exchange’ Push

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card