TORN Price Jumps 180% As US Court Overturns Sanctions Against Tornado Cash

Highlights

- US appeals court overturned OFAC sanctions against Tornado Cash.

- The appeals court the U.S. Treasury Department's OFAC acted outside its congressional authority.

- TORN price skyrockets 180%.

In a major development in the Tornado Cash lawsuit, a court has overturned the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) sanctions against the crypto mixer. As a result, TORN price jumped 130% within a few hours.

US Court Lifted Sanctions Against Tornado Cash

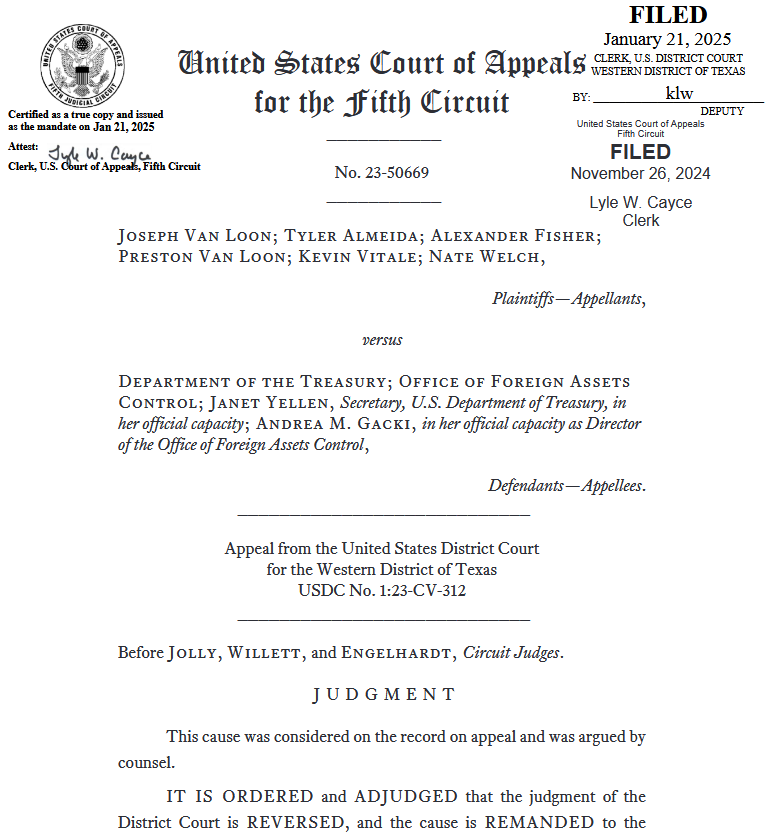

The U.S. Treasury Department acted outside its authority when it sanctioned Tornado Cash in 2022 and accused it of helping launder over $7 billion for North Korean hackers and other malicious cyber actors, as per the U.S. District Court for the Western District of Texas filing on January 21.

The appeals court ruled in favor of the plaintiffs (Van Loon et al.) against the U.S. Treasury Department, the OFAC regarding sanctions on Tornado Cash. The ruling essentially finds that OFAC’s authority to sanction “property” cannot extend to autonomous, immutable code that no one controls. Immutable smart contracts cannot be “property” because they cannot be owned or controlled by anyone.

Appeals Order As Lawsuit Precedent

The Fifth Circuit Court of Appeals’s mandate and judgment actually came in November last year. The U.S. appeals court has ruled that the Treasury Department’s OFAC exceeded its authority by sanctioning Tornado Cash’s immutable smart contracts.

The ruling by an appeals court acts as a binding precedent for district courts. It also allows parties to appeal against judgments they believe were not in line with the laws and rulings in other cases.

Crypto-friendly US President Donald Trump in the White House has cleared headwinds for the crypto industry and cases. For instance, Trump pardoned Silk Road creator Ross Ulbricht’s sentence as he promised.

TORN Price Surges

TORN price skyrockets 180% as sanctions Tornado Cash were lifted, with the price currently trading at $17.74. The 24-hour low and high are $7.80 and $25, respectively. Furthermore, the trading volume has increased by nearly 120% in the last 24 hours, indicating a rise in interest among traders.

- Satoshi-Era Whale Dumps $750M BTC as Hedge Funds Pull Out Billions in Bitcoin

- XRP Sees Largest Realized Loss Since 2022, History Points to Bullish Price Run: Report

- US Strike on Iran Possible Within Hours: Crypto Market on High Alert

- MetaSpace Will Take Its Top Web3 Gamers to Free Dubai Trip

- XRP Seller Susquehanna Confirms Long-Term Commitment to Bitcoin ETF and GBTC

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards