US Fed Rate ‘Hike And Pause’ Price In: Bitcoin, Ethereum, XRP, DOGE Set For Rally

The US Federal Reserve set to raise interest rates by another 25 bps during the FOMC meeting on July 26, with traders primarily focusing on a pause by the Fed than a rate hike. Dovish Fed will bring positive sentiment in the markets, driving Bitcoin and Ethereum prices upwards.

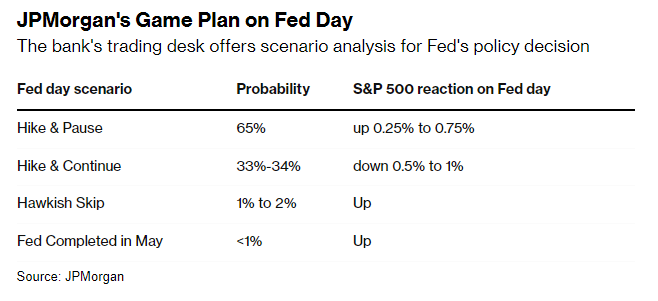

JPMorgan’s trading desk expects a “hike and pause” as the likely outcome of the FOMC meeting that will lift the market, reported Bloomberg. With the second-quarter earnings season in full swing, the Fed’s decision to either pause or confirm one more hike will bring further upside momentum. The headline inflation falling and jobs data coming close to the Fed’s expectations also signal a rate hike stop.

Wall Street banks including Morgan Stanley, Goldman Sachs, Bank of America, Citigroup, and Wells Fargo analysts also estimated a 25 bps rate hike and pause, with a possible rate hike by the year’s end. CME FedWatch Tool shows a 99% probability of a 25 bps rate hike.

Dow and S&P 500 futures are up about 0.1%, while Nasdaq 100 futures flat ahead of a key rate hike decision by the US Fed. Treasury yields and oil prices are falling, as well as, the US dollar index (DXY) moving to 101, indicating further upside in Bitcoin and other crypto prices.

Read More: Bitcoin (BTC) Exchange Supply At 5-Year Low Indicates Bullishness Ahead

Bitcoin and Ethereum Prices Set For Rally

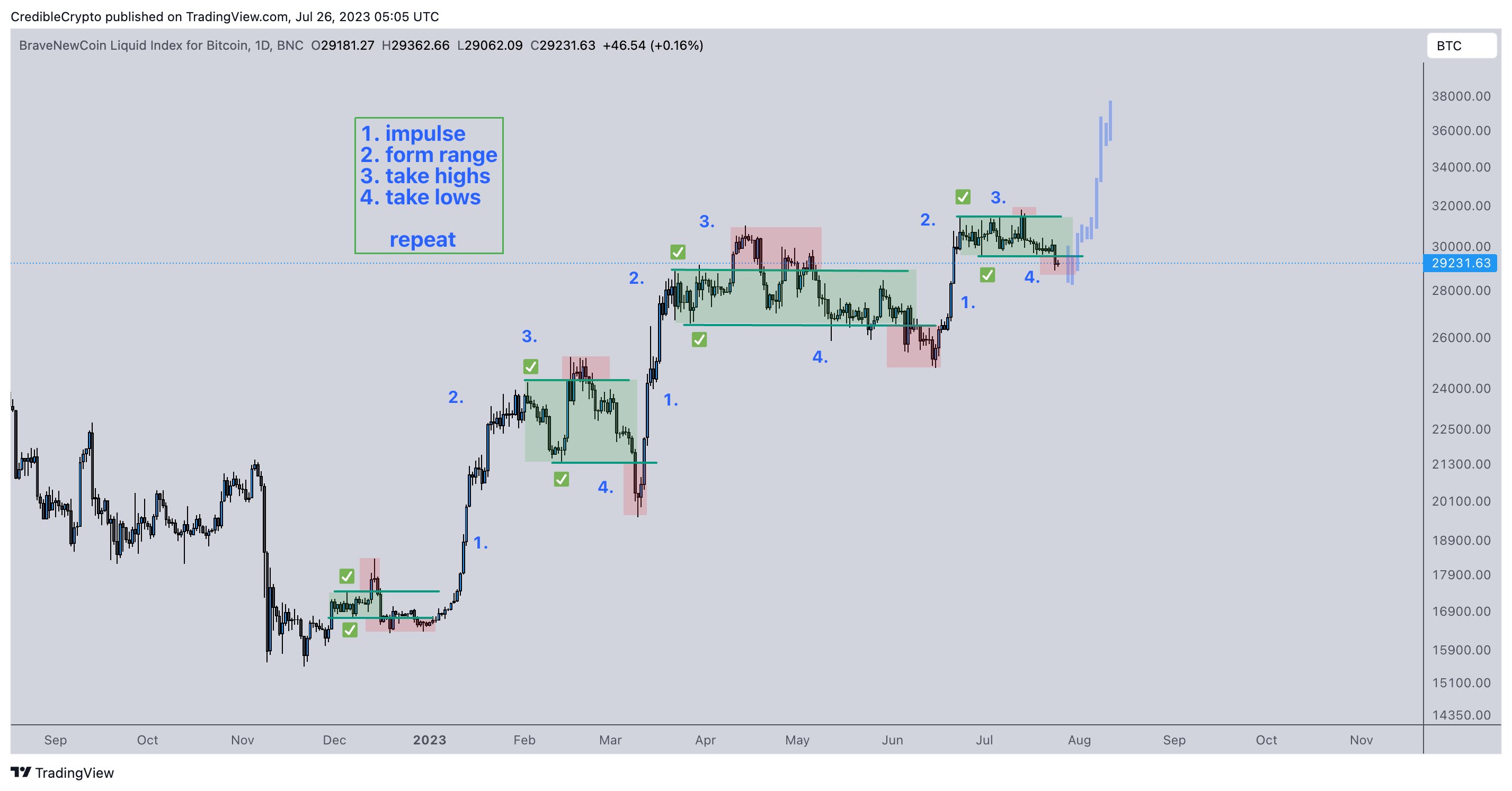

Popular analyst CredibleCrypto predicts Bitcoin price has been repeating a pattern since its bottom at $15000 and “It’s almost time for the next impulse.”

Popular analysts including Michael van de Poppe, Rekt Capital, and Crypto Tony are also bullish on Bitcoin price starting to rally after the Fed rate hike.

#Bitcoin | Expanding onchain activity can be seen when the monthly average of new wallets (green) exceeds the yearly average (grey), which suggests improving network fundamentals and growing utilization.

After a short contraction, $BTC on-chain activity is once again expanding! pic.twitter.com/ThBm8RIozO

— Ali (@ali_charts) July 25, 2023

BTC price jumped 0.5% in the past 24 hours, with the price currently trading at $29,278. The 24-hour low and high are $29097 and $29382, respectively. Meanwhile, ETH price trades above $1850, rebounding from the support.

XRP and Dogecoin (DOGE) prices are expected to continue moving upwards, continuing to lead altcoins to recovery.

Also Read: Terra Luna Classic Proposes To Improve Governance And Decentralization

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise