Veteran Trader Peter Brandt Predicts Bitcoin Price Rebound, Gold Fall to $4000

Highlights

- Peter Brandt says Bitcoin price may rebound despite being bearish for short-term.

- He predicts gold price crash to $4,430 and then to $4,000.

- BTC price hold above $68K as Bitcoin dominance no longer rising as expected.

Veteran trader Peter Brandt, who accurately predicted Bitcoin price crash below $63K, now says “BTC may go up.” He also predicts a massive correction in gold prices toward the $4,000 level.

Peter Brandt Says Bitcoin Price Faces Correction But May Rebound

Legendary technical chartist Peter Brandt thinks Bitcoin price has more downside after more than 50% crash from its all-time high. He predicted a crash to at least $58K when BTC was trading around $90K, pointing to historical bear market corrections based on its four-year cycle.

However, in an X post on Tuesday, Brandt said “Bitcoin may go up.” He anticipates a slight rebound in BTC, while maintaining a bearish forecast for short-term and a bullish stance for long-term.

Peter Brandt also rejected claims that BTC is forming an inverse head and shoulders pattern. “The level of incompetence about classical charting principles on X and YouTube is unbelievable,” he added.

Brandt’s forecast aligns with macro pressure, spot Bitcoin ETF outflows, and on-chain bearish Bitcoin price predictions.

Meanwhile, Matrixport highlights that Bitcoin’s dominance is no longer rising, pointing to a paradigm shift in the crypto market. Bitcoin dominance is moving in line with the broader crypto market’s consolidation, bouncing to 58%.

The lack of strong rebound signals capital is not rotating back for upside momentum in Bitcoin price. Experts have argued that Bitcoin price may look stuck until March.

“This dynamic may indicate that some investors are beginning to reassess Bitcoin’s relative leadership, particularly as parts of the broader crypto market show signs of relative resilience or outperformance,” Matrxiport added.

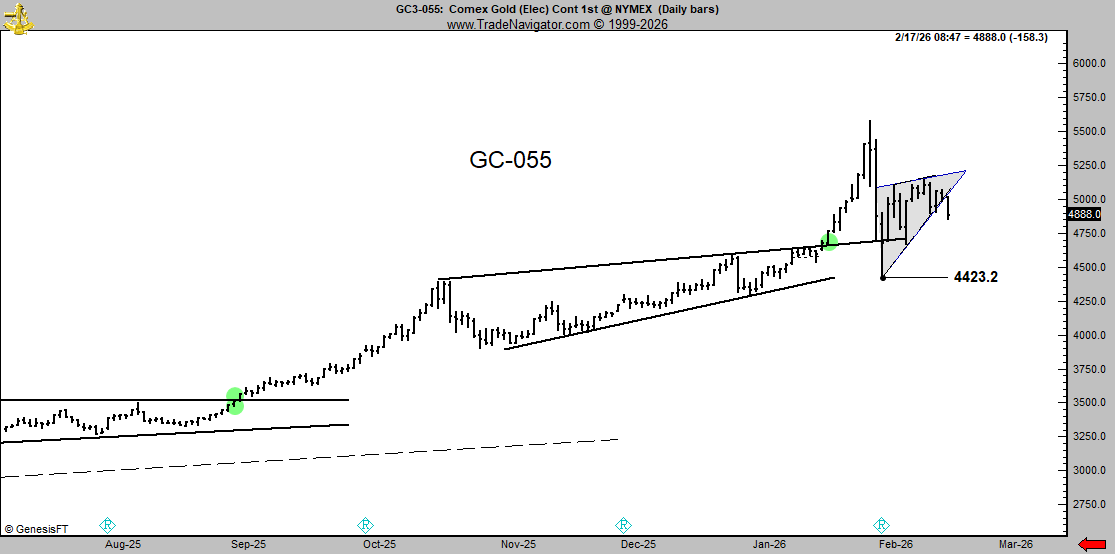

Gold Rising Wedge Signals Sharp Decline Ahead

On the other hand, Peter Brandt’s classical charting analysis reveals that gold’s recent price action has completed a corrective rising wedge pattern. He predicted a “textbook” downside outcome for an initial test to $4,430.

He also anticipate gold price to crash to $4,000. However, he considers a stronger accumulation after crashing. “I will inform members of the Factor Report community when I begin a buying program,” Peter Brandt added.

This bearish near-term call on gold contrasts with its latest upside momentum. As CoinGape reported, bullish bets on gold are surging despite a historic correction on COMEX gold futures. Traders began accumulating December calls for a target of $15,000-$20,000.

While Bitcoin price could stabilize and rebound as corrections resolve, gold may face profit-taking amid new supply and tokenized gold selloffs. Today, gold prices are rising towards $4,950, recovering some losses following a two-day decline.

- XRP News: XRPL Activates Permissioned DEX Upgrade to Boost Institutional DeFi Adoption

- WLFI Token Sees 19% Spike Ahead of World Liberty’s Mar-a-Lago Forum Today

- Peter Thiel Exits ETHZilla as Stock Slides 3% Amid Token Launch

- Bitwise, Granitshares Eyes $63B Sector With New Prediction Markets ETF Filing

- Breaking: Grayscale Sui Staking ETF to Start Trading on NYSE Arca Today

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- How Long Will Pi Network Price Rally Continue?

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k