Whale Re-accumulation Pushes Bitcoin (BTC) Above $51,000, Broader Market Recovers

After a brutal sell-off over the last four days, the world’s largest cryptocurrency Bitcoin has shown a healthy bounce back gaining 5%. The Bitcoin price has surged back above its 200-day moving average of $50,000.

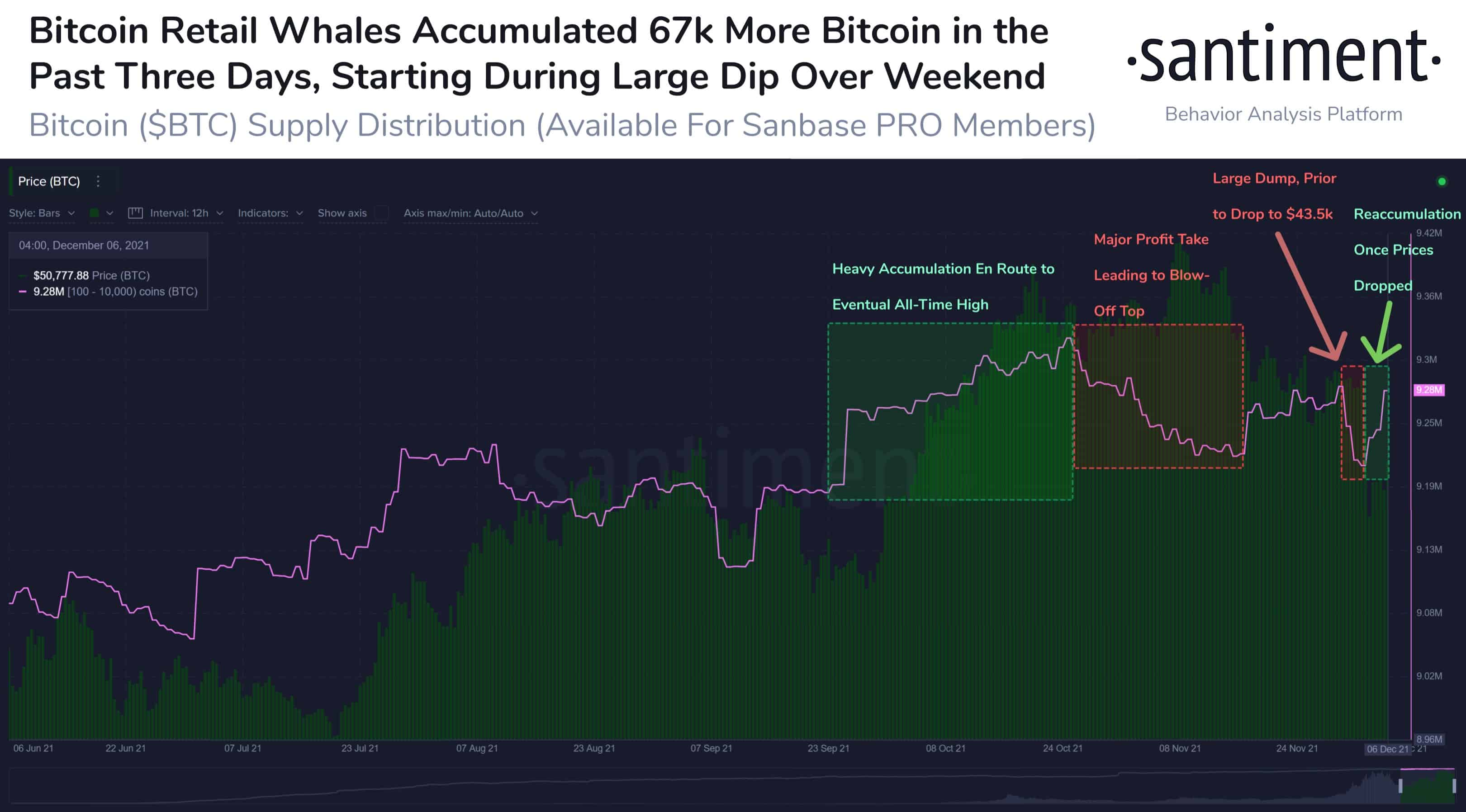

As of press time, BTC is trading 4.36% up at a price of $51,230 with its market cap just short of $1 trillion. Amid the recent market sell-off, Bitcoin tested its support at $43,500 before bouncing back once again. during this price correction, the Bitcoin mega whale addresses have been accumulating heavily. As on-chain data provider Santiment explains:

Bitcoin has recovered back to $50.1k Monday, and whale traders played the dip to perfection. Beginning during the dump to $43.5k, addresses holding 100 to 10k $BTC have accumulated 67k more $BTC after dumping the same amount before the price drop.

As we know that bitcoin and the broader crypto market have been under the pressure of changing macros with the spread of the Covid Omicron variant. Speaking to Bloomberg, Chris Kline, COO and co-founder of Bitcoin IRA said:

“There is a sentiment of uncertainty across all markets as we approach the end of the year. This is a healthy pullback as all markets look to readjust to the new Fed policies, inflation, and Covid concerns. Inflation is not going away anytime soon and investors are taking note of that, looking to hedge with tools like crypto.”

Colombia’s Largest Bank to Facilitate Bitcoin Trading

As Bitcoin gains global prominence, more and more countries are looking to accommodate the asset class. As per the latest report, Colombia’s biggest bank, Bancolombia, is looking to facilitate Bitcoin trading for its customers.

For this, the bank has collaborated with crypto exchange Gemini to facilitate Bitcoin trading. Interestingly, this partnership is part of the government-sponsored pilot program and will launch on December 14.

The Colombian government has introduced this one year pilot program via the country’s own financial regulator – Superintendencia Financiera de Colombia (SFC). This will help to bring Bitcoin and other cryptocurrencies to its citizens in a more straightforward fashion.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

Buy $GGs

Buy $GGs