Whale’s Quick Bitcoin Buy on Fake ETF News Ends in Loss

In recent events, the cryptocurrency industry faced turmoil following false information from Cointelegraph about approving a spot Bitcoin ETF. The incorrect news promptly fueled a significant, albeit temporary, increase in Bitcoin’s price, reaching $30,000. However, reality struck when BlackRock, a global investment management giant, negated the ETF confirmation, causing Bitcoin to retract to $28,000.

The aftermath was particularly harsh for investors who acted on Fear of Missing Out (FOMO). They rushed to purchase Bitcoin during its brief surge, only to encounter substantial financial losses once the truth surfaced. Such rapid fluctuations underscore the crypto market’s volatility and sensitivity to real and fabricated news.

Whale’s FOMO Move Leads to Loss

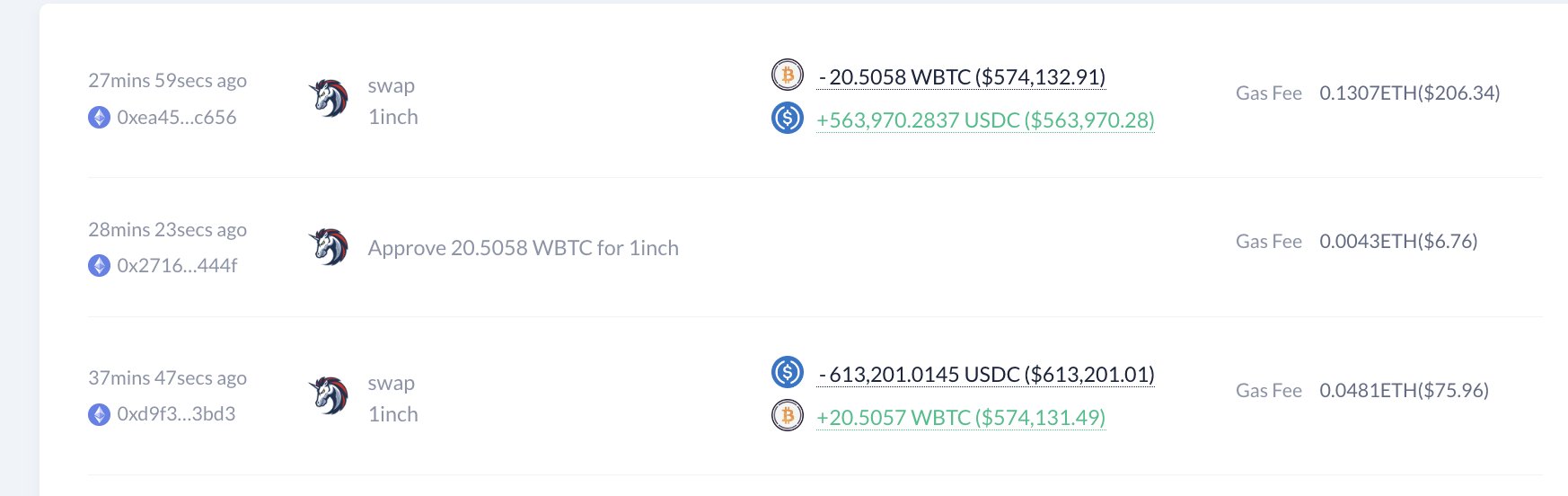

Adding to the market’s tumultuous scenario, data analytics firm Look On-Chain reported a notable incident involving a whale. This individual, driven by the fake ETF news, purchased 20.5 wrapped Bitcoin (WBTC) from sheer FOMO. When the whale realized the misinformation, a hasty sell-off ensued.

This decision resulted in a loss of $49,000 within a mere 10-minute window. The whale initially expended 613,201 USDC (a stablecoin pegged to the US dollar) for the WBTC and sold the assets for only 563,970 USDC.

Grayscale Bitcoin ETF Gains Court Support

Meanwhile, the SEC has not opposed a recent court decision favoring Grayscale Investments regarding its spot Bitcoin ETF proposal. In August, the District of Columbia Court of Appeals ruling against the SEC’s earlier disapproval of the ETF. The court’s decision marked a significant turn in a saga that has captivated industry participants for over a decade.

This development followed the court’s conclusion that the SEC’s initial rejection was unfounded. Consequently, the crypto community’s longstanding aspiration to introduce a Bitcoin ETF could see the light, post legal challenges and extensive scrutiny.

Read Also: Upbit Follows Ripple With Major License Approval In Singapore

- Bitcoin vs Gold Feb 2026: Which Asset Could Spike Next?

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible