Why Ethereum (ETH) May Soon Overtake Bitcoin (BTC)?

Ethereum (ETH), the second-largest cryptocurrency by market cap has catapulted to mainstream adoption this bull season along with Bitcoin (BTC). It has become a growing choice of financial institutions and many including the likes of Goldman Sachs and JP Morgan believe it has the potential to eventually overtake BTC as the new store of value.

Goldman Sachs has joined JP Morgan to advocate for ETH as the next store of value and suggest its smart contract capabilities along with its various use cases make it the most sought-after digital asset in the current market. The financial giant’s comment came on Tuesday where it said,

“currently looks like the cryptocurrency with the highest real use potential as Ethereum, the platform on which it is the native digital currency, is the most popular development platform for smart contract applications”

Earlier JP Morgan has lauded Ethereum’s market depth and blockchain capabilities that support smart contracts and the defi ecosystem. The banking giant also predicted the ETH 2.0 could open the gates for a $40 billion staking market.

BTC vs ETH: The Fight For Next Store of Value Intensifies

Bitcoin is seen as the de facto store of value up until now often compared to digital gold. The top cryptocurrency is increasingly used as the hedge against inflation which has only grown this bull season with several Fortune 500 companies such as Microstrategy using it as a treasury hedging asset over the US Dollar. BTC more than tripled its value from 2017 high but lost nearly half of its valuation during the May market mayhem.

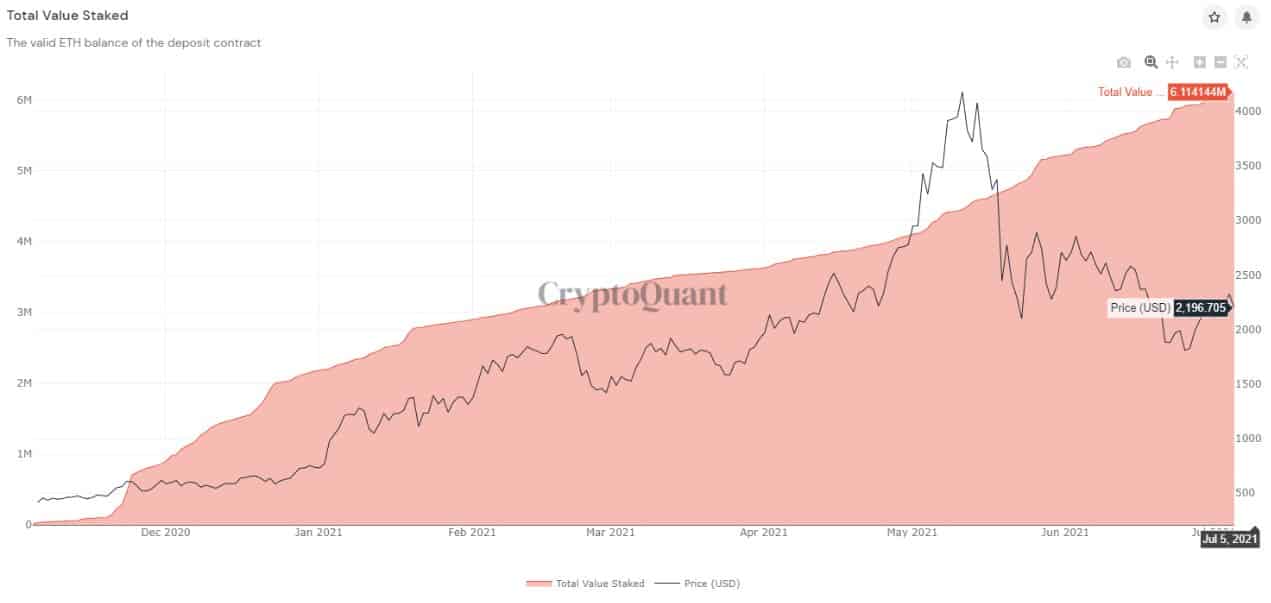

Ether on the other hand has also seen growing support from institutions especially with the upcoming transition to Proof of stake chain ETH 2.0. The ETH 2.0 blockchain staking has also led to a declining ETH supply in the market which in turn has helped its demand to go further up. The evolving Defi ecosystem and several use cases have made it one of the growing choices of institutions.

While top financial institutions such as Goldman Sachs and JP Morgan continue to advocate for Ether, both the firms have launched Bitcoin-centric funds amid growing client demand.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs