Will Bitcoin Rally Continue After US FOMC, Powell’s Speech, & PCE Data?

Highlights

- Bitcoin is expected to continue its rally amid a flurry of economic events scheduled this week.

- The crypto market awaits the upcoming US FOMC, Fed Chair Jerome Powell's speech, and US PCE inflation data.

- A top crypto market expert hints at a potential timeline for BTC to reach its top amid this bull cycle.

The crypto market enters a crucial week with a flurry of key economic events like the US FOMC, Fed Chair Jerome Powell’s speech, and others, scheduled. Notably, the investors will keep close track of the events as they could significantly impact the Bitcoin price as well as the broader crypto market ahead. Besides, the US PCE inflation data is also awaited, as last week’s data showed a spike in inflationary pressures while sparking concerns over a potential hawkish move ahead by the Fed.

Crypto Market Awaits US FOMC & Other Key Events

As Bitcoin price noted a strong rally recently, crossing the brief $100K mark, investors are now eyeing the upcoming key economic events. The events are likely to shape the sentiment of the broader financial sector ahead, let alone the crypto market.

Notably, the week will kick off with S&P US Manufacturing PMI on Monday, December 16, which would provide cues on the economic health of the nation. In addition, it would be followed by the US Retail Sales data, which is scheduled for Tuesday, December 17.

Following that, one of the most awaited events, the US FOMC interest-rate decision will come on Wednesday, December 18. The investors will keep close track of the event for clarity on the Fed’s stance with their rate-cut plans. According to the CME FedWatch Tool, there is a 96% chance of a 25 bps Fed rate cut at the upcoming FOMC this week.

Jerome Powell’s Speech & PCE Inflation In Focus

Meanwhile, the Fed Chair Jerome Powell’s press conference after the FOMC would also be closely watched by the traders. The comments from Jerome Powell would provide further insights into the Fed’s upcoming stance with their monetary policy plans. While dovish comments would fuel the Bitcoin price higher along with the top altcoins, any hawkish remarks might dampen the market sentiment.

On the other hand, the second revision of the US Gross Domestic Product (GDP) data for the third quarter is scheduled for Thursday. This would also shed light on the economic health of the nation to the investors. Lastly, the US PCE inflation data is scheduled for Friday, December 20. This PCE data would provide insights on the current inflationary pressure in the nation.

The market participants eagerly awaited the PCE inflation figures this week, especially after last week’s US PPI data came in hotter-than-anticipated at 3%. On the other hand, the US CPI inflation data last week also showed a spike, but it comes as per the market expectations.

What’s Next For Bitcoin Price?

The economic events are likely to impact the broader market sentiment, which in turn could also affect the Bitcoin price’s run ahead. However, despite the soaring inflation, the rate-cut bets remained constant among traders, which hints at a bullish momentum ahead. Besides, the soaring institutional interest, as evidenced by the robust US Spot BTC ETF inflow, has also fueled market sentiment. Recently, a top expert predicted Bitcoin ETF AUM to overtake Gold ETF by year-end, boosting market optimism.

Also, historical data by CoinGlass showed that BTC has usually showcased a positive performance in the final quarter. Although historical data doesn’t guarantee future performance, the market hope remains high. Despite volatile trading last week, the flagship crypto has maintained its position above the $100K mark, indicating its strong appeal among traders.

Besides, the market experts have also remained bullish on BTC’s trajectory ahead. For context, Matrixport has recently predicted BTC to hit $160K by 2025, sparking market optimism. Echoing a similar sentiment, popular market expert Crypto Rover said that if BTC holds above the $102 mark, it is poised to hit the $120K mark next.

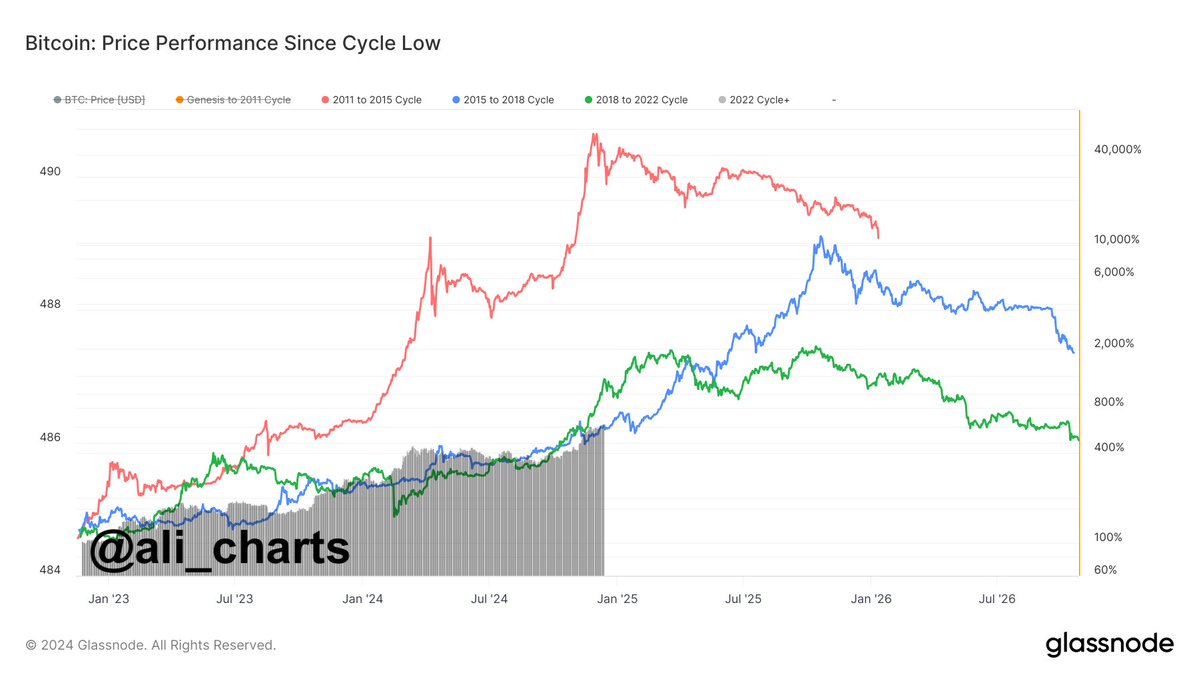

Meanwhile, another popular market expert Ali Martinez has recently shared a potential timeline for Bitcoin price to reach its top. In a recent X post, Martinez said that if the flagship crypto follows its historical path, it could potentially reach its top in October 2025 amid this bull run.

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?