Just-In: WisdomTree Registers Top 20 Crypto Index Fund with XRP, Solana, Cardano

Highlights

- WisdomTree registers a crypto index fund in Delaware, with S-1 filing expected within days.

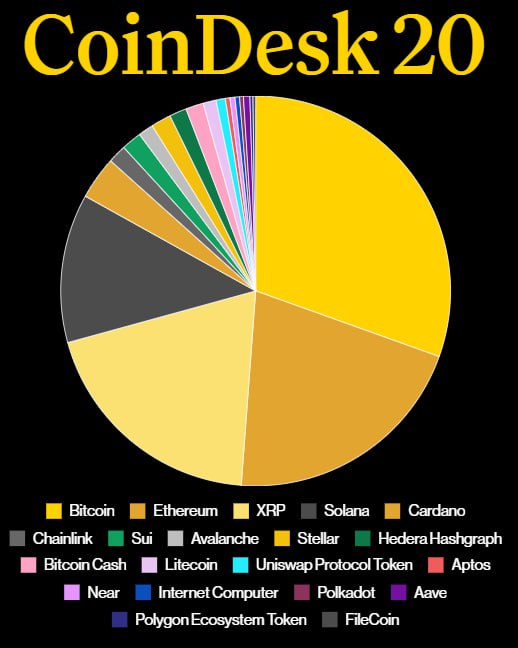

- The fund contains top 20 crypto assets, such as XRP, Solana, Cardano, Chainlink, Sui, and Hedera Hashgraph (HBAR).

- XRP, SOL, ADA price jumps 2% following the announcement.

WisdomTree has registered an index fund with the top 20 crypto assets, such as XRP, Solana, and Cardano, in Delaware on Monday. The move comes as the U.S. Securities and Exchange Commission (SEC) passed the generic listing standards for crypto funds last week, streamlining approval within 75 days.

WisdomTree Coindesk 20 Fund Registered in Delaware

In a major move within the crypto investment space, WisdomTree’s CoinDesk 20 Fund is officially registered in Delaware, according to a filing with the Delaware Division of Corporations on September 22.

The fund will offer conservative investors exposure to 20 crypto assets including Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), Cardano (ADA), Chainlink (LINK), Sui, Hedera Hashgraph (HBAR), among others.

This marks a pivotal moment in the growing acceptance and integration of digital assets into mainstream finance. Also, it implies a potential S-1 filing with the U.S. Securities and Exchange Commission (SEC) coming in a few days.

Under the new generic listing standards for crypto funds, stock exchanges will directly file with the SEC to list and trade the fund. Generic listing standards removed the 19b-4 form requirement to push for faster approval within 75 days. Bloomberg senior ETF analyst Eric Balchunas agreed that generic listing standards will prompt many new crypto ETF and ETP filings.

However, the SEC has not approved any ETF tracking spot prices of altcoins under the Securities Act of 1933. REX-Osprey and Tuttle have filed and received approval to list ETFs under the Investment Company Act of 1940. REX-Osprey XRP and Dogecoin ETFs set a record debut last week, recording massive demand from investors.

XRP, Solana, and Cardano Price Action

Traders reacted immediately to the announcement as XRP, Solana, and Cardano prices saw a 2% increase in just an hour. Crypto market crashed on Monday in response to macro jitters, monthly option expiry, and Bybit hack rumors, causing almost $2 billion in crypto liquidations.

XRP price jumped to $2.85, recovering some losses in the past 24 hours. The 24-hour low and high were $2.78 and $2.90, respectively. Furthermore, the trading volume has increased by 94% in the last 24 hours, indicating interest among traders.

Meanwhile, Solana (SOL) is trading 7% lower at $216, with an intraday low and high of $212.80 and $231.94, respectively. Cardano (ADA) saw buy-the-dip sentiment, but still down 4% in the last 24 hours. The price is exchanging hands at $0.822.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BREAKING: US Oil Prices Crash $15 in Two Hours as G7 Eyes 400M Barrel Release — Crypto Markets on Edge

- BTC Markets Moves to Offer Tokenized Assets as RWA Market Hits $26.5B Peak

- Why BTC Price is Rising Today? (March 9, 2026)

- Wall Street Expert Warns 35% Crypto Stocks Market Crash Amid U.S- Iran War Tensions

- Why Crypto Market Is Falling Today (March 8, 2026)

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

Buy $GGs

Buy $GGs