XRP Freefall Alert: Expert Explains What to Do if XRP Price Drop Below $1

Highlights

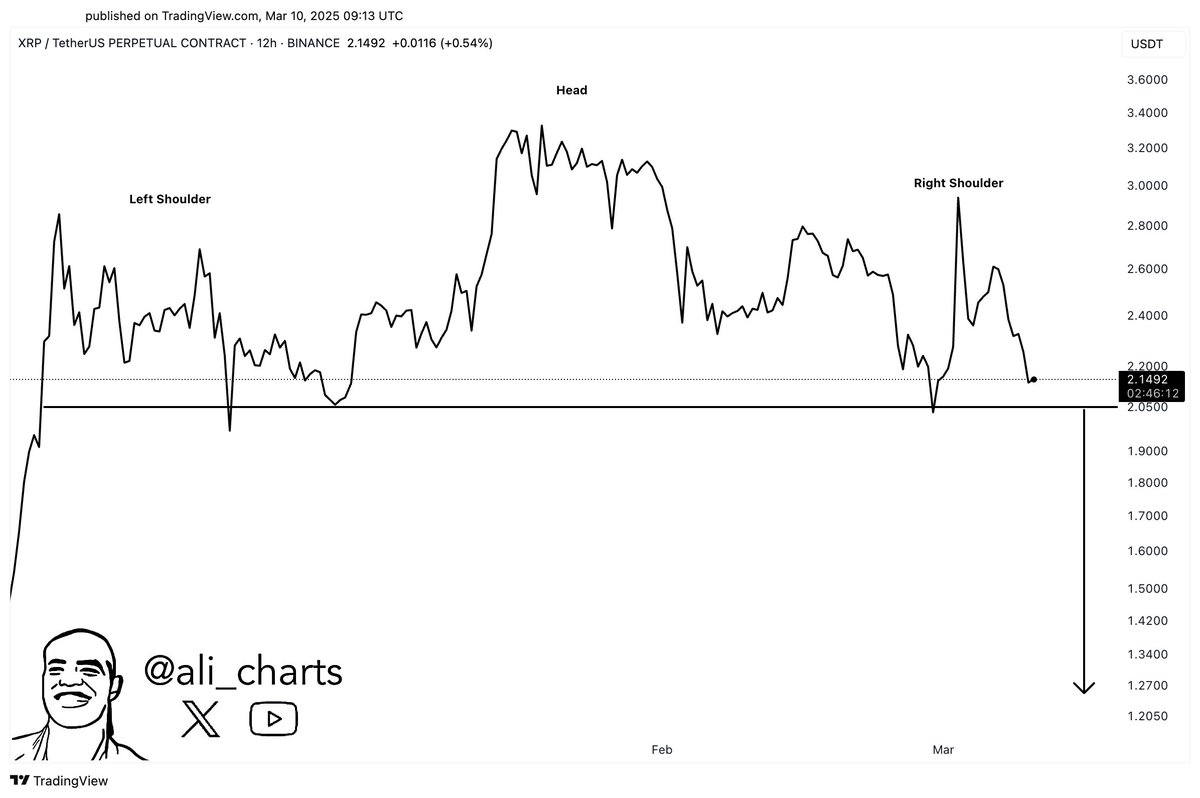

- XRP forms bearish 'Head and Shoulders' pattern; risks falling below $2.

- If XRP breaks $2 support, potential drop to $1.20 aligns with Nov 2024 volumes.

- XRP's legal battle with US SEC looming end could pivot price; RSI nears critical breakout point.

XRP price is currently facing a steep decline, and analysts are warning investors about the potential for further losses. Recently, a bearish pattern has formed, leaving many wondering if XRP’s price could drop even further.

The cryptocurrency has been under pressure, and if the $2 support level breaks, experts suggest that XRP price might head for even lower levels, possibly dropping below $1.

Head and Shoulders Pattern Forms a Bearish Signal

According to market analyst Steph, XRP is currently forming a classic “Head and Shoulders” pattern, a known bearish signal. This pattern indicates that the price could soon experience a significant downturn if the $2 support level is lost.

#XRP HUUUUUGE WARNING!!!!!!!!! pic.twitter.com/lllwRykRsN

— STEPH IS CRYPTO (@Steph_iscrypto) March 10, 2025

The formation of the left shoulder, head, and right shoulder has become clearer, with the price hovering near the $2 mark. If the XRP price falls below this critical level, further declines could follow.

Steph emphasized the importance of confirming the breakdown with a daily or weekly candle close below the $2 level. At the time of his analysis, XRP price was trading at $2.14 after briefly dipping to $1.92. Despite a brief recovery, analysts caution that the downward pressure may continue if XRP fails to hold the $2 support.

What Happens if XRP Price Drops Below $2?

If XRP loses the $2 support level, the price could fall to between $1.20 and $1.17, based on the length of the head in the Head and Shoulders pattern. This level is significant because it aligns with historical trading volume observed in November 2024.

If the market confirms this breakdown with increased trading volume, the bearish outlook could become a reality. Analysts also warn that if XRP price dips below $1.20, the situation could worsen, with some projecting a price as low as $1.00 or even lower.

Should the XRP price fall below the $1 support level, analysts suggest setting buy orders below $1 to take advantage of potential short-term gains once the price stabilizes. Concurrently, XRP’s cumulative volume delta (CVD) has turned negative, indicating that more selling pressure is outweighing buying interest.

While the risk of a flash crash to $0.90 is present, most experts agree that the chances of this scenario are low. Investors should watch for key levels like $1.20, which is considered a strong support level. If this support holds, there may be an opportunity for a recovery back to the $2 range.

Ripple Effect of the SEC Lawsuit on XRP’s Price

XRP’s legal battle with the U.S. Securities and Exchange Commission (SEC) continues to influence its price. The case has been ongoing for several years, and while some reports suggest a resolution may be near, it remains uncertain how the outcome will impact XRP.

If Ripple wins the case, it could lead to a rapid XRP price increase. However, if the company loses or faces further legal challenges, the price of XRP could face additional downward pressure. While the bearish outlook remains prominent, XRP’s momentum oscillator, the Relative Strength Index (RSI), is currently approaching a critical level that could signal a major breakout.

$XRP's momentum oscillator (RSI) is currently nearing an even LARGER pattern BREAKOUT and one if its most recent led into a nearly +500% PRICE INCREASE!

These prices can be setting up for yet another monstrous bullish move… pic.twitter.com/kqZbEIjlne

— JAVON⚡️MARKS (@JavonTM1) March 12, 2025

In previous instances, similar RSI patterns have preceded substantial price increases, with one such occurrence leading to a nearly +500% surge in XRP’s price.

Analysts also believe that Bitcoin’s price movements play a crucial role in XRP’s direction. If Bitcoin faces a significant decline, XRP price could experience a chain reaction, further pushing its price down. Consequently, as Bitcoin trades near the $83,000 mark, any substantial drop below the $72,000 support level could bring XRP prices closer to the $1.20 range, or even lower.

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?