XRP News: Futures OI Tops $2.50B As Ripple Whales Buy Over 250M Coins

Highlights

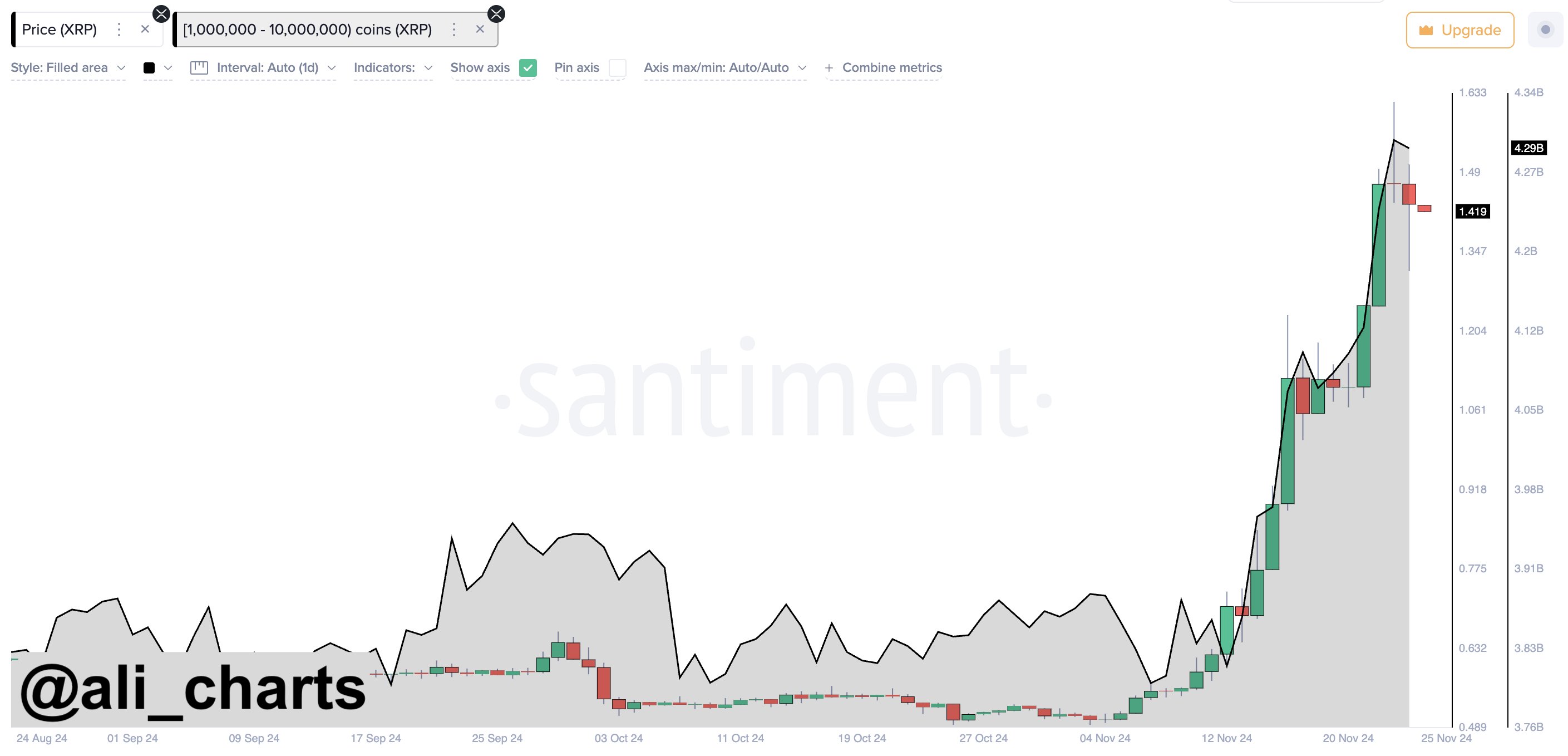

- Ripple whales purchased millions over 250 million XRP tokens.

- XRP futures open interests supassed over $2.50 billion amid bullis sentiment.

- Analysts turned bullish and gave a target of $20 amid potential end of the lawsuit.

- XRP price jumped over 4% in the last 24 hours.

XRP News: Thus far this month, Ripple have acquired a massive amount of XRP. This intensive buyup have fueled more than a 183% rally in the past 30 days. XRP price saw a 10% correction last weekend, but on-chain data revealed that whales have bought more than 250 million during the dip. Is a rally to $20 ahead as XRP futures open interest surpassed $2.50 billion?

Whales Accumulation Triggers Bullish News for XRP

Ripple whales purchased more than 250 million XRP over the weekend, according to on-chain data platform Santiment. It follows as whales moved to buy the dip after a recent selloff of XRP during the weekend.

Popular trader Ali Martinez signaled that the Ripple whales are bullish on a further rally in XRP price. The significant transactions indicate confidence in XRP or strategic accumulation. Traders must watch for potential market moves and legal resolutions of crypto lawsuits.

Whale Alert reported multiple XRP tokens transactions, including a transaction of 149,000,000 tokens worth $227 million transferred from crypto exchange Bybit to a wallet. Also, a whale accumulated 20 million XRP from South Korean exchange Upbit.

In addition, on-chain data reported 58,333,326 XRP valued at $87 million transferred from Binance to a whale wallet.

As CoinGape reported earlier, whales are accumulating the tokens massively amid bullish sentiment. Donald Trump’s win in US presidential election and US SEC Chair Gary Gensler’s resignation have fueled sentiment for the potential end of the Ripple lawsuit.

Rally Continues As Open Interests Hit Over $2.50 Billion

Ripple’s token saw a correction over the weekend but whales buying the dip came as major news for XRP investors. The recent dip came from South Korean investors. However, analysts have given a target of $2 and a long-term price target of $20 amid various bullish news for XRP.

Total XRP futures open interests have now surpassed $2.50 billion, hitting a new high. The futures OI increased to 1.59 billion XRP worth $2.50 billion amid massive buying seen on Binance and Bybit, as per Coinglass data.

XRP price has jumped by more than 7% in the past 24 hours, with the price currently trading at $1.446. The 24-hour low and high are $1.327 and $1.535, respectively. However, the trading volume has dropped by 0.87% in the last 24 hours to $11.86 billion.

This mild slip is an indication that trader interest is down and generally market-dependent.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- JPMorgan Projects Bullish Crypto Market in H2 Following CLARITY Act Approval

- Hong Kong Moves Closer to Crypto Tax Cuts Amid Stablecoin Regulatory Framework

- Popular Analyst Willy Woo Predicts Major Bitcoin Price Crash, Bear Market Bottom Timeline

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs