XRP Price Must Reach This Level For US Reserve Consideration, Lawyer Reveals

Highlights

- Top lawyer reveals how much XRP price should surge for its inclusion in the US Strategic Reserve asset list.

- Experts predicts a potential XRP price rally to $5 if it breaches crucial supports ahead.

- XRP may slip to $1.5 if the bearish sentiment dominates.

- Ripple's native crypto recorded a surge of around 4% today, reflecting renewed market interest.

XRP price has recorded some recovery and stayed in the green today amid a flurry of positive developments in the market. Notably, the ongoing discussions over the crypto being added to the US national reserve asset list have intensified with recent reports of Ripple CEO joining Trump’s Crypto Council board. Amid this, a top lawyer reveals how much should Ripple’s native crypto surge to qualify for the US Strategic Reserve asset.

Lawyer Reveals XRP Price Level To Fit For US Reserve

The idea of adding XRP to the US Strategic Reserve has stirred debates, particularly as several US states push forward with Bitcoin reserve initiatives. However, not all proposals align with public expectations.

A notable example is Utah’s Blockchain and Digital Innovation Amendments bill, which many believed would establish a Bitcoin Strategic Reserve. A skeptical user dismissed the speculation, stating that the bill does not mention Bitcoin at all. Block Digital co-founder Santiago Velez reinforced this view, criticizing misleading narratives surrounding the legislation.

Despite this, Ripple’s native crypto remains a topic of interest in reserve discussions. Pro-XRP lawyer Fred Rispoli weighed in, stating that under the current framework, only Bitcoin qualifies. However, he suggested that XRP could meet the requirements if its price reaches $5. This revelation has intensified market debates, as the current XRP price remains far below this threshold.

Can XRP Hit $5?

XRP price was down around 3% today and exchanged hands at $2.39, while its trading volume rose 36% to $5.38 billion. Notably, the token has touched a 24-hour high and low of $2.49 and $2.32, respectively. Notably, the current RSI level of 37 indicates a strong momentum ahead for the crypto.

Amid this, a top market expert shared a bullish forecast for Ripple’s native crypto. In a recent X post, prominent market expert Rose Premium Signals said that the recent dip is a perfect opportunity for accumulation which might trigger a potential rally ahead. Besides, the expert has set a target of $4.95 for XRP price, with $3.4 and $4.21 being the crucial levels ahead.

Simultaneously, speculations over Ripple CEO Brad Garlinghouse joining Donald Trump’s crypto advisory board have further fueled discussions. Although many have speculated if the Ripple CEO has to resign from his role at the blockchain firm, others see this as a likely opportunity for Ripple to strengthen its market dominance.

Crucial Levels To Watch For XRP Price Ahead

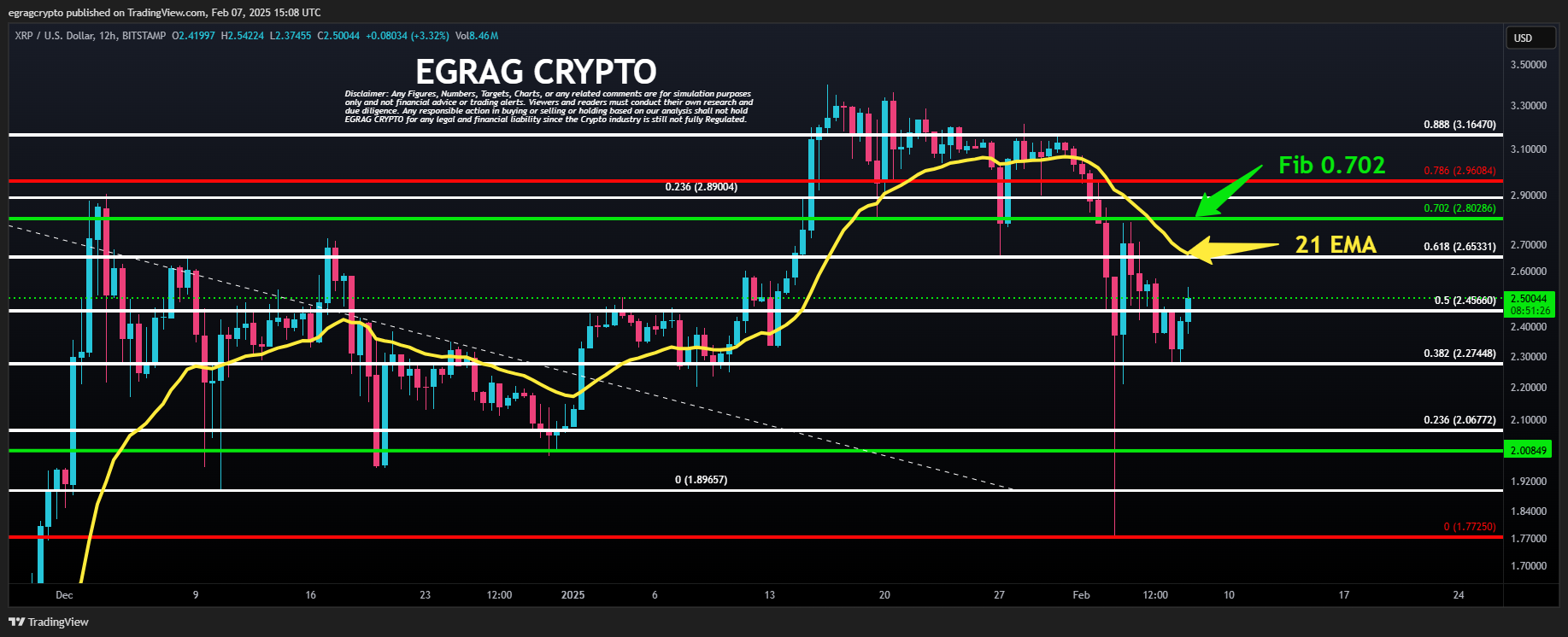

Renowned analysts have highlighted crucial levels for XRP price which has gained notable traction. For instance, expert EGRAG CRYPTO recently said that XRP needs to close the $2.67 to maintain a run towards the north ahead. Besides, he also noted a close above the $2.81 level, a “Crucial Resistance”, would trigger a massive rally ahead.

Echoing similar sentiment, another crypto analyst Dark Defender said that XRP must hold the $2.33 level to continue its upward run. He has highlighted $2.7 and $2.99 as the next targets for Ripple’s native crypto. However, he has highlighted the $2.33 and $1.99 levels as crucial supports.

What If Bearish Sentiment Dominates?

The XRP price is at a critical juncture and in a consolidation phase, with bears threatening to take control. According to popular market expert CasiTrades, key support levels to watch are $2.16, $1.88, and $1.53.

The expert emphasized the importance of a slow drop, rather than strong selling, which could drive the price even lower. The $1.88 level is particularly crucial, aligning with the 0.5 retracements and 2.618 extensions for the subwave 3 down.

Traders can expect some strength at this level, but an exhausted finish is still necessary. CasiTrades recommends spot buying each level, with a short-term bounce possible at $2.16. A stop-loss just below support can help manage risk.

The final wave down should form 5 waves or an ending diagonal, with the invalidation of another low coming with prices breaking back into consolidation around $2.90. Having said that, it appears that XRP price could fall to as low as $1.5 level if the bears dominate the market sentiment. Despite that, market watchers are closely anticipating a strong rally ahead, with the crypto potentially hitting the $5 mark to fit the US Strategic Reserve asset.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs