XRP and Solana Eye Breakout Amid Institutions Buying, Call Options

Highlights

- XRP and Solana recording massive demand from institutional investors.

- Call options bets of 3-4 times higher than puts signals bullish sentiment among traders.

- XRP and SOL prices near breakout for a rally.

XRP and Solana are witnessing a rebound as anticipated amid renewed positive sentiment from institutional investors and expert traders. It follows the rising expectations of three US Fed rate cuts this year after weak jobs reports, with some Wall Street giants estimating a 50 bps rate cut in September.

XRP and Solana to Rally on Rising Institutional Interest?

While retail trading remained muted in the broader crypto market, institutional investors are driving XRP and Solana prices upward. Data suggests capital rotation from top crypto assets, Bitcoin and Ethereum, into altcoins having existing ETF applications.

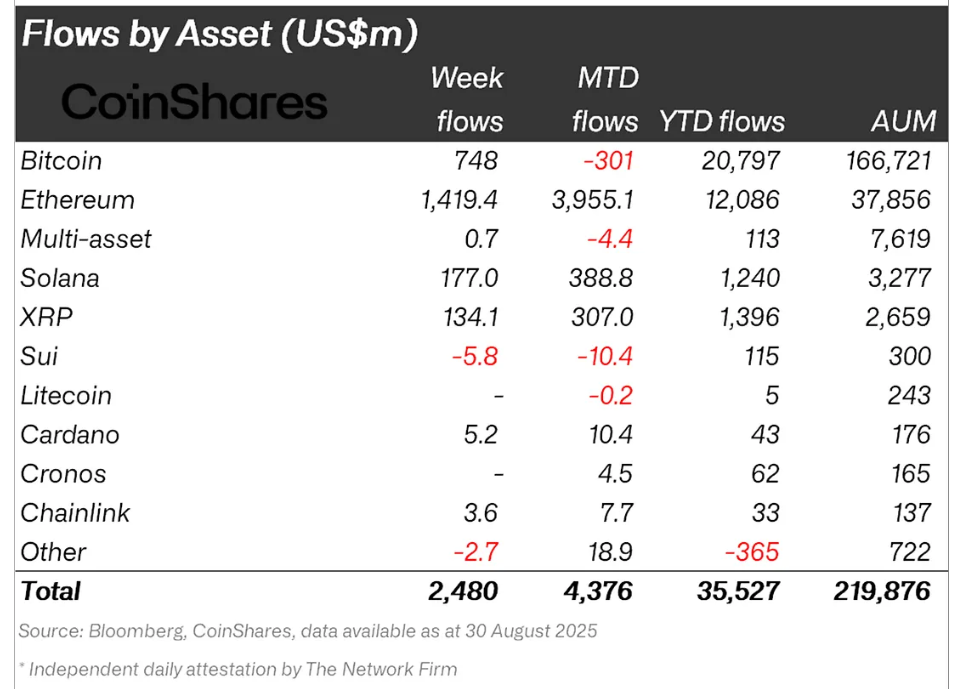

As per CoinShares inflows data, August inflows into XRP and Solana funds were $307 million and $388.80 million. Whereas the YTD inflows were $1.39 and $1.24 billion, indicating rising institutional demand in the last few weeks.

Nansen reported that solid institutional buying, bullish sentiment, and major DeFi integrations were major catalysts fueling the Solana ecosystem. In contrast, XRP saw massive growth from financial institutions despite a bearish sentiment from whales.

Massive Bullish Sentiment Among Options Traders

XRP and Solana options trading volume increased in the last 24 hours, as per Deribit. Traders are buying call options for both short and long timeframes and selling long-term puts.

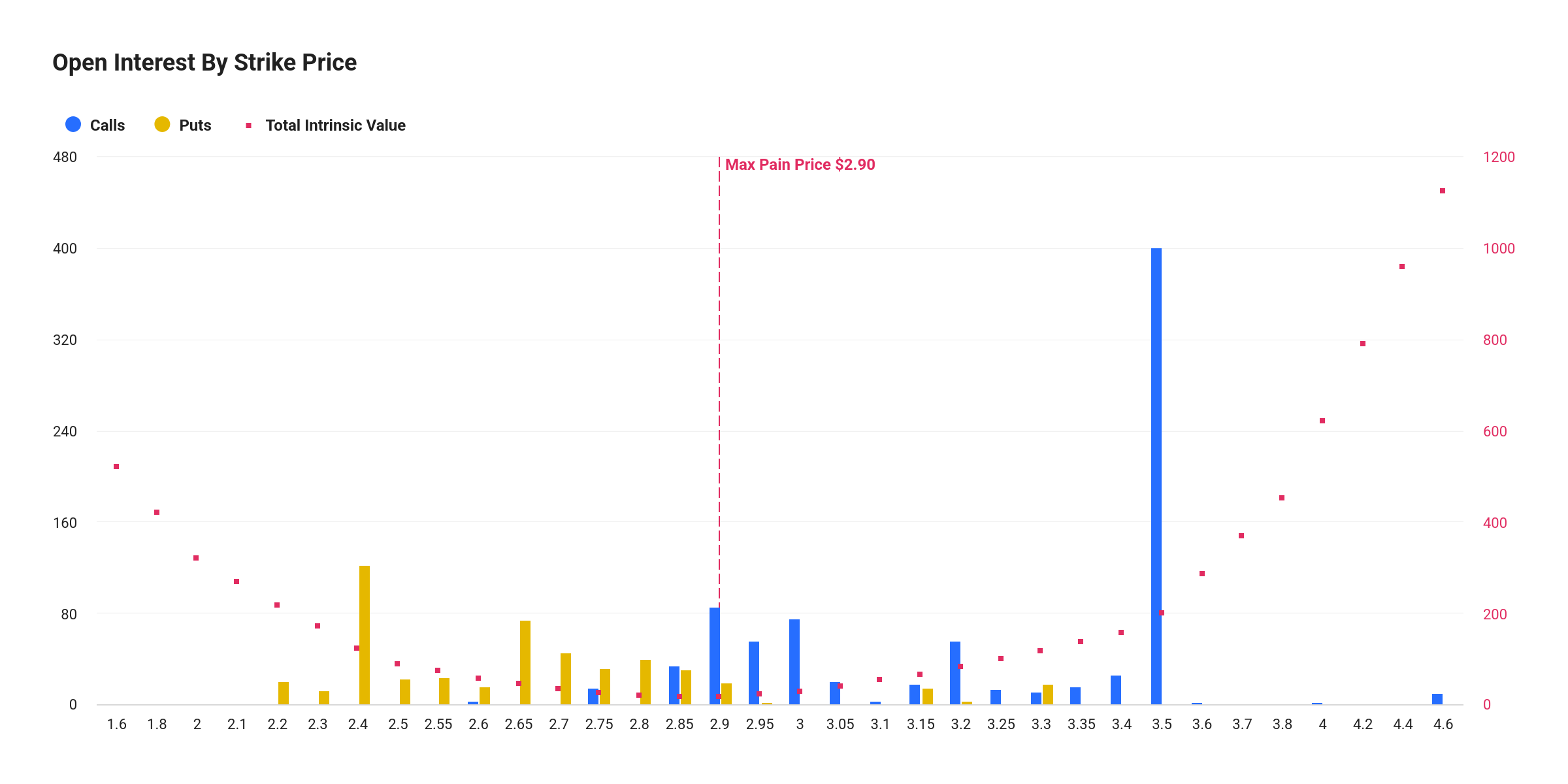

In the last 24 hours, XRP saw 3 times more calls than puts, with a put-call ratio of 0.39. Moreover, the Sept 12 options expiry data signals a bullish outlook among traders targeting $2.9, $3, and even $3.5. Notably, the max pain price was at $2.90.

XRP price is trading 4% higher at $2.94 at the time of writing. The 24-hour low and high are $2.83 and $2.94, respectively. Popular analyst Ali Martinez predicted a 25% rally after a breakout with strong volumes. Trading volume jumped almost 170% in the last 24 hours.

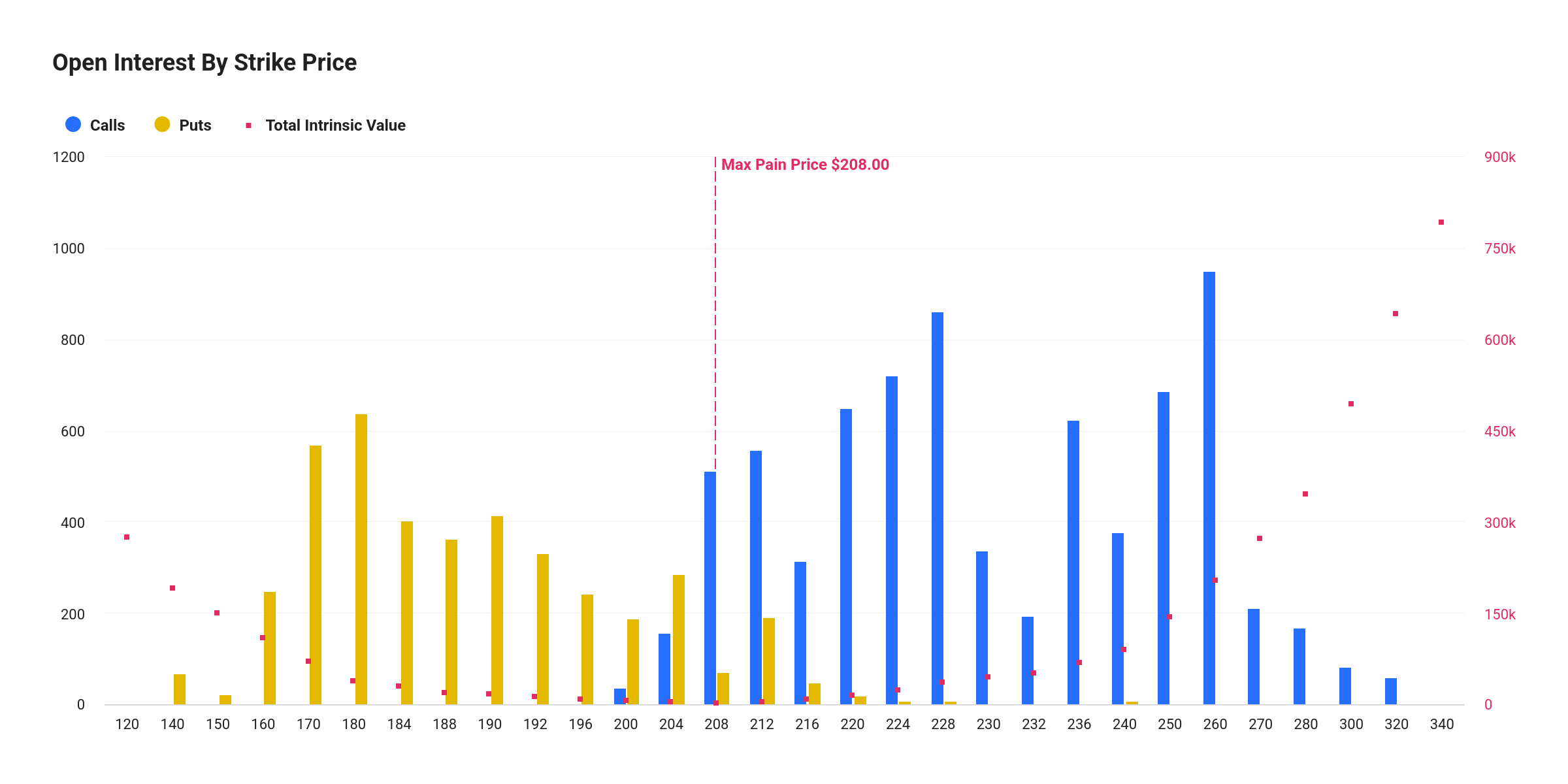

Meanwhile, Solana saw 4 times more calls than puts, with a put-call ratio of 0.24. Moreover, the Sept 12 options expiry data signals a bullish outlook among traders targeting $220, $228, and even a high of $260. Notably, the max pain price was at $208.

SOL price jumped more than 5% in the last 24 hours, with the price currently trading at $214.06. The 24-hour low and high are $201.59 and $212.07, respectively. Furthermore, trading volume has increased by 115% over the past 24 hours.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- ZachXBT Names Axiom Exchange in Alleged Employee Crypto Insider Trading Investigation

- Bitcoin Falls as U.S. Jobless Claims Signal Labor Market Rebound

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs