XRP’s DeFi Utility Expands as Flare Introduces Modular Lending for XRP

Highlights

- The modular lending for XRP will enable FXRP holders to use their asset to borrow stablecoins or other assets.

- FXRP holders will also be able to loop capital across staking, lending and borrowing.

- This marks Flare's latest move to boost XRP's DeFi use case.

The Flare network has introduced the first-ever modular lending for XRP, marking the network’s latest move to boost the token’s DeFi use case. With this move, holders of the FXRP token, which is the 1:1 version of XRP on Flare, will be able to borrow stablecoins and other crypto assets using their holdings alongside other notable DeFi strategies.

Flare Launches Modular Lending For XRP

In a press release, Flare announced that it has partnered with Morpho and Mystic to launch modular lending, a move it noted marks a major milestone in its XRPFi vision to transform the token from a dormant asset into a “productive source of yield, credit, and composable strategy.”

Notably, this latest development comes just weeks after Flare launched the FXRP token on Hyperliquid, which was the first spot market for XRP on the decentralized exchange. The network has also taken other steps to boost DeFi strategies for XRP holders, including introducing staking through Fireflight and yield tokenization through Spectra.

Meanwhile, Flare noted that with the launch of modular lending for XRP, FXRP holders will now be able to deposit their tokens into curated and yield-bearing vaults. Furthermore, they can use the token as collateral to borrow stablecoins or other assets.

They will also be able to loop capital across staking, lending, and borrowing. The network noted that this essentially expands DeFi options for XRP holders, as they now have new ways to earn, borrow, and strategize while their underlying tokens remain on the XRP Ledger (XRPL).

Another Bullish Fundamental With Ripple’s Tokenization Move

XRP and the XRPL also got a major boost today with Billiton Diamond and Ctrl Alt’s announcement to tokenize over $280 million worth of certified polished diamonds on the XRPL with Ripple’s backing. The firms revealed that they have already minted the tokens on the XRPL, which they chose for its “fast settlement, low fees, and scalable architecture.”

Ripple will notably provide custody services for these tokenized assets. This is a positive for XRP, as tokenized real-world assets (RWAs) on the XRPL continue to grow, which could further boost the token’s adoption. Commenting on this tokenization initiative, Ripple’s executive Reece Merrick said it demonstrates how the crypto firm’s technology is bridging the gap between physical assets and the digital economy.

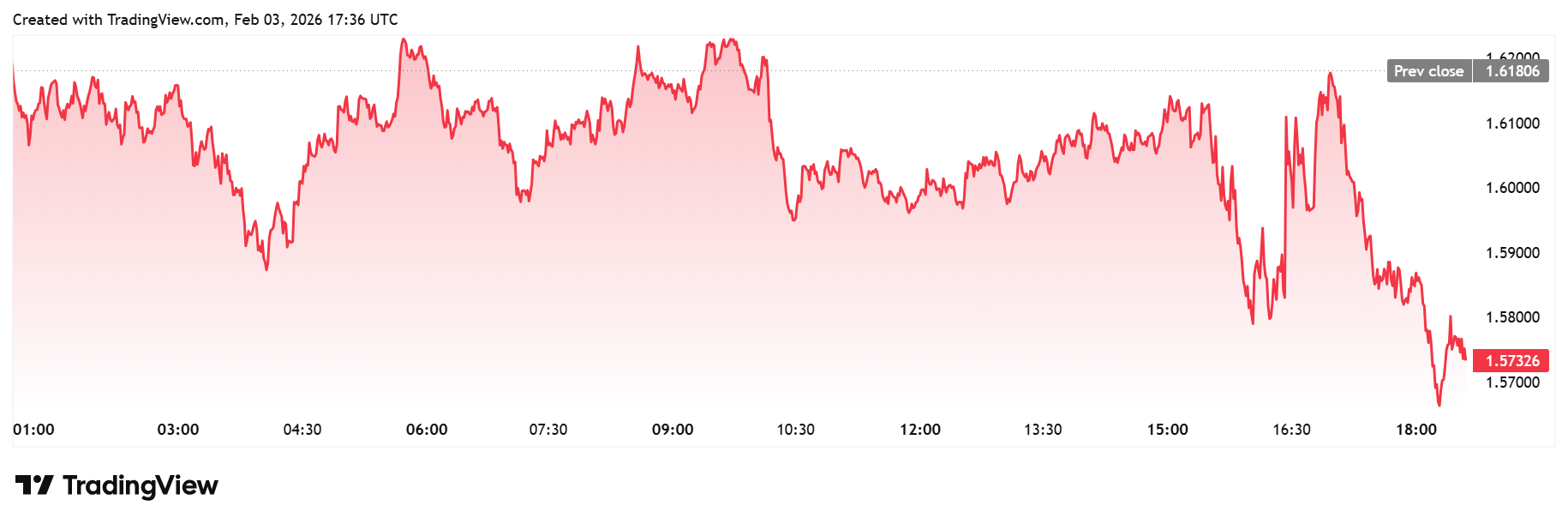

Meanwhile, the XRP price is down amid these developments. TradingView data shows that the Ripple-linked token is trading at around $1.57 at the time of writing, down over 2% in the last 24 hours.

This is due to a broader crypto market downtrend, with Bitcoin dropping below $76,000 today. Top altcoins Ethereum, Solana, BNB, ADA, and Dogecoin have also posted significant losses amid this downtrend.

- Mark Zuckerberg’s Meta Reportedly Eyes Stablecoin Integration This Year Amid Regulatory Clarity

- Coinbase Rivals Robinhood As It Rolls Out Stocks, ETFs Trading In ‘Everything Exchange’ Push

- UAE’s Second Largest Bank Eyes Bitcoin Allocation, Backs Tokenization

- Crypto Group Proposes Tax Rules To Boost Innovation As CLARITY Act Talks Progress

- XRP News: SBI Ripple Explores XRPL for Cross-Border Payments in Strategic Research

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

Claim Card

Claim Card