Beware, Bitcoin Jumping Back Above $30,000 Could Be A Dead Cat Bounce, Here’s why

After a choppy Thursday, Bitcoin has once again surged over 3.5% moving past $30,000. Yesterday, we reported how it could be a classic case of a bull trap. Today’s bounce back above $30,000 levels could just be a dead cat bounce.

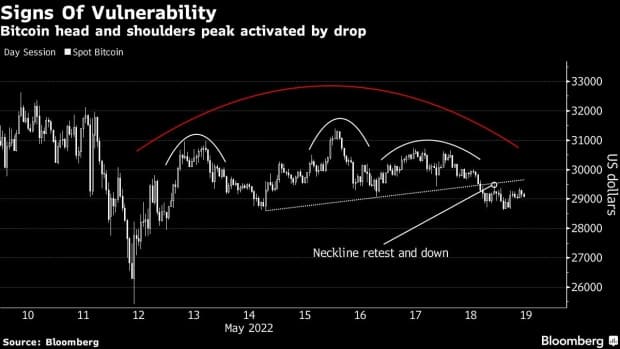

Bloomberg shared a technical chart wherein it states that the Bitcoin rally looks absolutely shaky. As of press time, Bitcoin is trading at $30,051 with a market cap of $575 billion. Bloomberg’s technical shows that if Bitcoin fails to advance past $30,800 levels, it can face further downside.

The report notes: “Bitcoin, which has rebounded about 15% from its crash lows of last week, is looking increasingly vulnerable to another drawdown. The bounce has traced a so-called “saucer top” formation on the hourly chart, within which a bearish “head and shoulders” top has been activated due to the price falling back below the neckline. The pattern suggests Bitcoin would have to advance past $30,800 to shrug off the technical downside risk”.

Bitcoin Whales Holding Strong

The recent market correction hasn’t deterred some of the biggest Bitcoin holders. Microstrategy CEO Michael Saylor said that he’s in for the long term and holding firm. He also added that he will continue to buy at every top and bottom. Speaking to Yahoo Finance, Saylor said:

“There’s no price target. I expect we’ll be buying bitcoin at the local top forever. And I expect bitcoin is going to go into the millions. So we’re very patient. We think it’s the future of money.”

There’s growing speculation that the recent TerraUSD collapse will lead to more regulatory intervention and scrutiny. Speaking about it, he said: “That’ll be good for the industry. Over time, I think as people get educated and as they get more comfortable, I think we’ll recover from this drawdown.”

He added that regulators accelerating crypto regulations would be beneficial for Bitcoin. Saylor added: “Once people figure out why bitcoin is superior to everything else, then the institutions are going to come in with large sums of money, and we’re not going to have to struggle through this massive explanation of why we’re different than 19,000 other crypto tokens”.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs