Bitcoin [BTC] Open Interest at OKEx exceeds BitMex, A Paradigm shift?

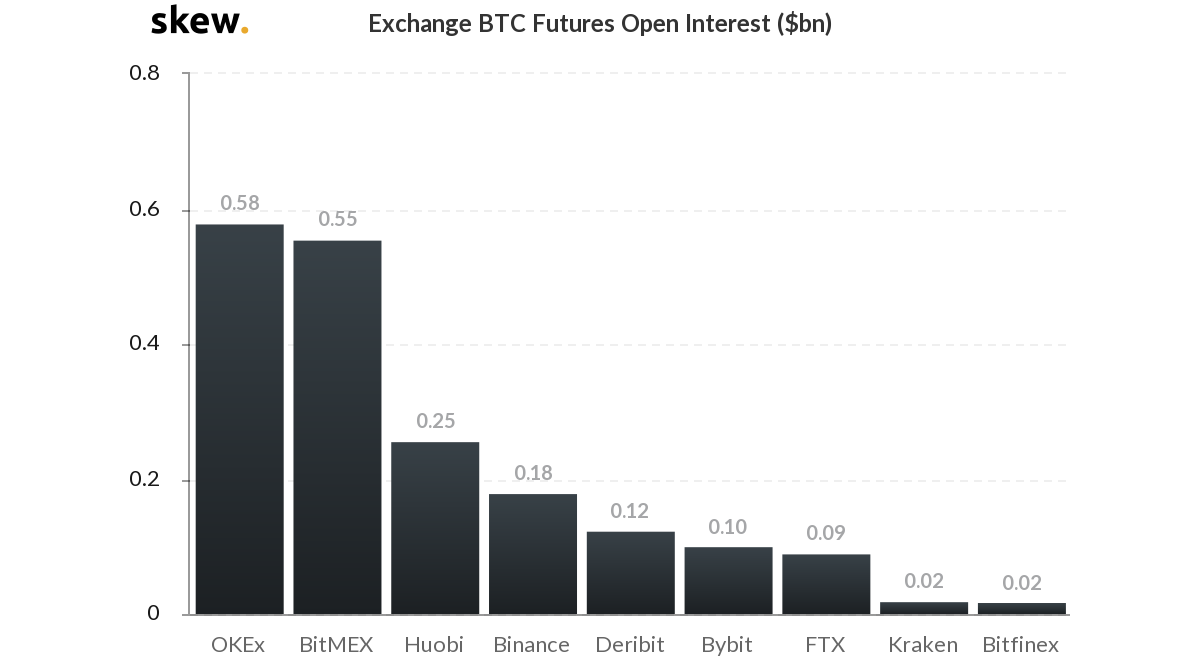

The number of Bitcoin Futures Open Interest at OkEx, a cryptocurrency derivatives trading platform, exceeds those of BitMex, the popular Bitcoin trading platform that is closely watched by traders.

And it has been like this for a while now.

OKEx tops with the number of Open Interest, ahead of Binance and BitMex

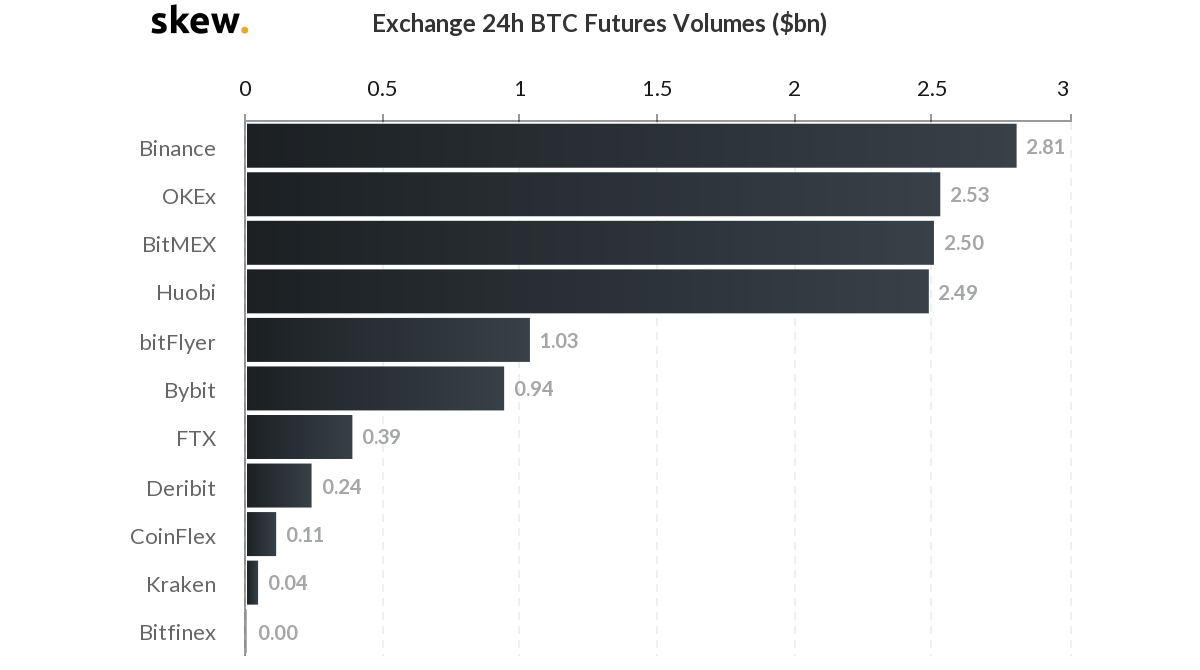

Notably, BitMex is down the trading volume leader-board.

A look at the number of trading volumes from the leading BTC futures platform reveals that BitMex is down behind Binance and OKEx.

At the time of going to press, positions worth $2.79 billion had been generated from Binance while OKEx, at second, had $2.49 million.

Interestingly, BitMex is third with $2.48 billion of trading volumes on the last trading day.

Binance seems to grow from strength to strength.

Aside from controversially acquiring CoinMarketCap for $400 million, their CEO is keen on expanding the exchange’s reach across the globe. This amid the coronavirus scare and the desperate intervention from central banks.

United States, for instance, has declared that it would shore businesses, embarking on infinite quantitative easing. The say move has been emulated by the ECB, India, China, and central banks from Africa.

Egypt has even introduced limits on withdrawals and eased. The same applies for Kenya and other leading economies from Africa.

Economy could sink into a Depression

However, despite the high number of open interest, a measure of the number of open BTC positions, traders and crypto commentators are not impressed.

Magic, a vocal crypto supporter, opined that this was not the best time to hodl any crypto.

He reasons that there is a serious risk of the global economy sliding into one of the greatest depressions.

“In my opinion, the worst thing to do with crypto, is HODL it as the world slides deeper into what will probably become the biggest depression in history. Crypto will be annihilated. Hodling may have worked in the early days, but crypto has also never experienced a recession.”

In my opinion, the worst thing to do with crypto, is HODL it as the world slides deeper into what will probably become the biggest depression in history. Crypto will be annihilated. Hodling may have worked in the early days, but crypto has also never experienced a recession.

— MAGIC (@MagicPoopCannon) April 2, 2020

Infinite QE won’t help resuscitate Markets

Meanwhile, Jay Hao, the CEO of OKEx, agrees with analysts’ sentiment.

In a blog post, he argues that the decision by the United States to embark on infinite QE won’t help in the long-term and it is like “giving more nutrition to a critically ill patient—it won’t work solely.”

He says,

“Injecting liquidity to the market via QE infinity is like giving more nutrition to a critically ill patient – it won’t work solely. Even if liquidity is enhanced, factories still won’t be able to resume production and the panic in the market won’t disappear.”

“Instead, the government should implement more proactive measures to control the spread of the coronavirus and support economic activities in order to restore the confidence of the market.”

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs