BTC Price Dump Far From Over, Sub $20k Crash Incoming?

Bitcoin price continued with the sell-off during the Asian business hours on Friday, losing nearly 8% in 24 hours to $26,362. The most prominent crypto has broken out of the range channel between $29,000 and $30,000 and tested levels slightly above $25,000. In the process of this decline, BTC price might validate a double-top pattern and lead to sub-$20,000 losses before another substantive rebound.

BTC Price Signals More Losses

Bitcoin broke out of its ranging channel, only to trigger a sell-off to levels seen last in June. Indicators both micro and on-chain hint at a continued slump in prices with BTC price likely to drop to or below $20,000.

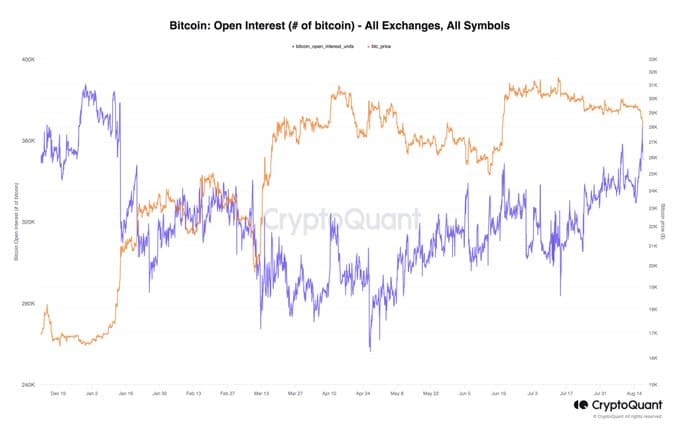

Crypto analytics platform CryptoQuant in their latest BTC market outlook said that the open interest in the futures market “was showing the build-up of short positions since at least mid-July.” In other words, the open interest was growing even as prices dipped from $32,000.

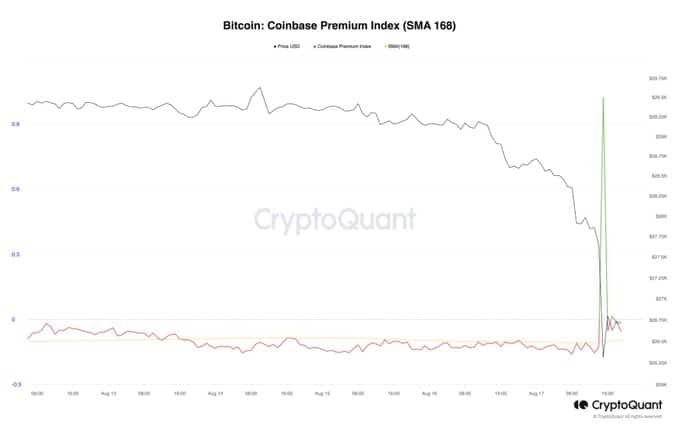

The Federal Reserve’s hawkish approach to inflation caused a significant decrease in demand for Bitcoin in the US. According to CryptoQuant “the sell-off was preceded by a period of low demand” resulting in a negative Coinbase premium.

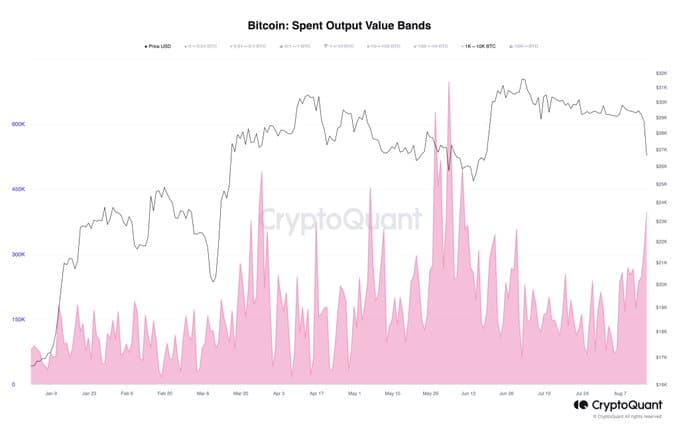

On-chain data also revealed that large holders of BTC doubled down on their “spending activity before and during the sell-off. The failure of Bitcoin to break resistance at $30,000 and sustain an uptrend, saw many withdraw their active attention. Although whale spending increased, it was not significant to turn around the market.

Long-term holders of BTC could decide to keep their positions intact, considering the Spent Output Value Bands show that increased whale spending has historically preceded price surges.

Bitcoin Sentiment In the Negative

The current sentiment in Bitcoin markets remains negative with losses likely to extend below $25,000 during the weekend. Traders would be more interested in shorting BTC as opposed to betting on an immediate recovery.

Adding credibility to the negative funding rate is the Moving Average Convergence Divergence (MACD) indicator, which reconfirmed the sell signal. This could have further exacerbated the situation, which @Onchained, a crypto analyst opined on Thursday that “the drop from $29.5k to $28.3k in BTC’s price brought the price closer to the realized price of short-term holders, considered a macro support.”

BTC price had recovered to trade at $26,200 on Friday ahead of the European session. Investors would be watching the support at $25,000 keenly because if broken, they can prepare for extended losses to sub-$20,000.

Price action below $25,000 would validate a double-top pattern, discussed in the previous BTC price analysis.

However, a rebound cannot be ruled out just yet, with some renowned traders like @DrProfitCrypto saying a recovery could begin in the range of $23.5k – $24k. Long positions entered in this region would target profit as Bitcoin recovers between $30,000 and $31,000.

Related Articles

- Grayscale Hiring ETF Experts; Is a Bitcoin ETF Incoming?

- Bear Signal Or Bear Trap? BTC Price Faces Selling Pressure

- “Bitcoin Price Above $150,000”: Fundstrat’s Tom Lee Predicts

- Crypto Exchange HashKey Launches RWA Issuance for Institutions Amid Tokenization Boom

- Just-In: Ethereum Foundation Begins Staking 70,000 ETH, Futures Open Interest Bounces

- 8 Best White Label RWA Tokenization Platform Development Companies

- Hong Kong Stablecoin Firm RedotPay Targets $1B Raise in Potential US. IPO Debut

- Crypto Market Crash: Glassnode & 10x Research Warn Deeper Bitcoin Price Fall Ahead

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

Claim Card

Claim Card