BTC Price Not Staying Down Much Longer, Climbs Alongside Stocks

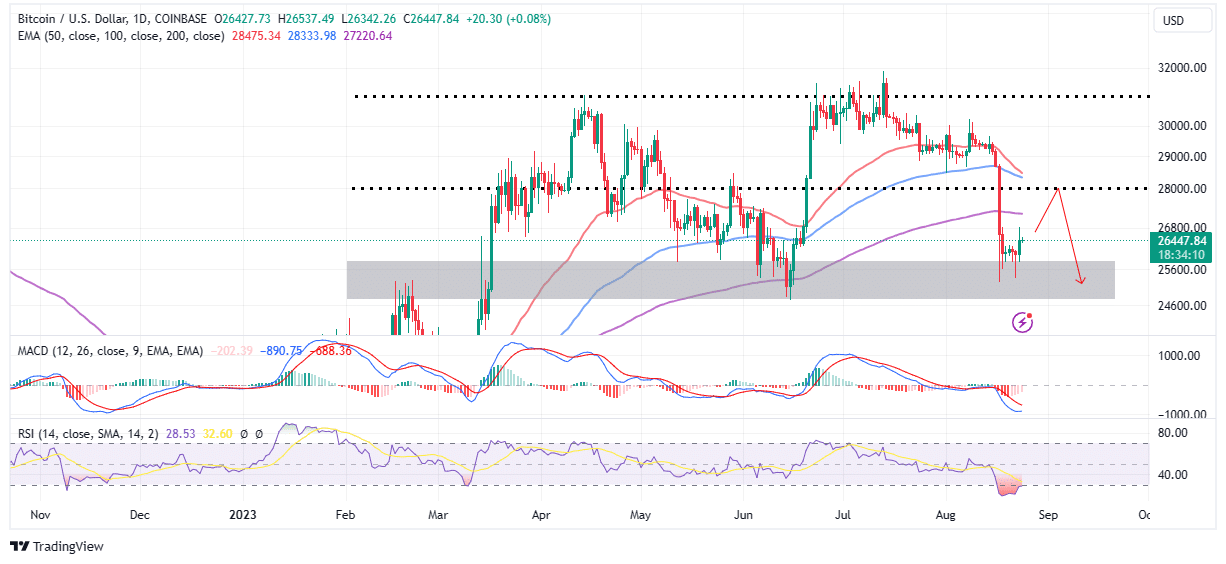

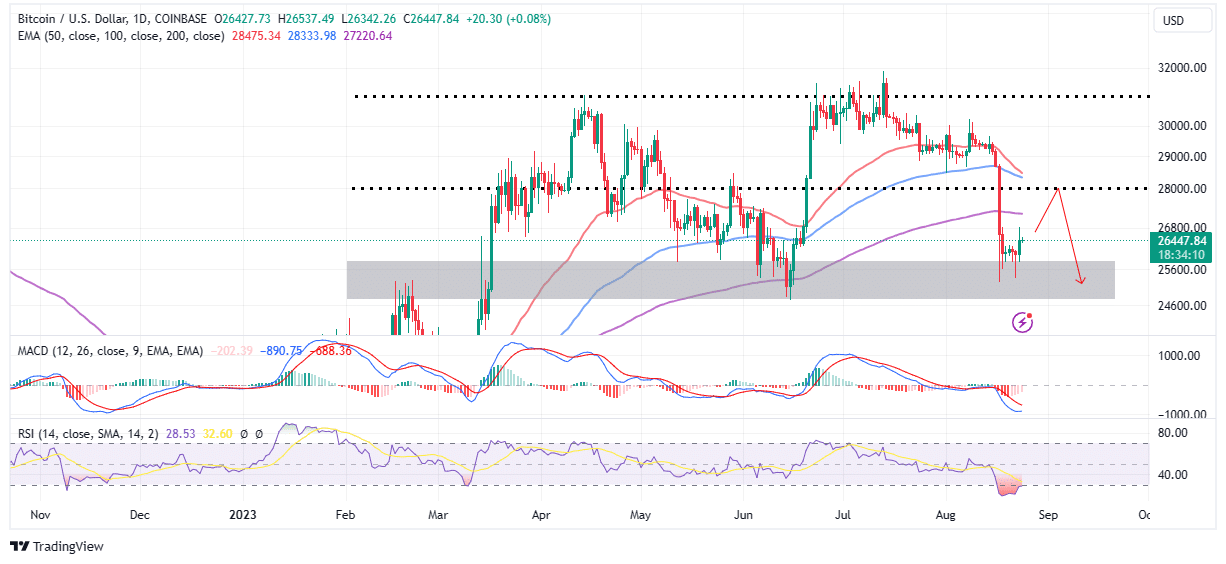

BTC price, up 1.7% on Thursday to $26,438, is attempting to recoup the losses from last week’s deleveraging event. The most prominent crypto plunged to $25,000 after an extended low volatility period marked by support at $29,000 and resistance at $30,000.

According to Dan Morehead, the founder of Pantera Capital, a digital asset investment firm, the market “has seen enough.” In a written statement, he opined that “there’s just so long markets can be down.”

Bitcoin’s performance this summer has been noticeably dismal compared to other similar periods in the past. It “experienced the longest period of negative year-over-year returns in its history, lasting 15 months.”

BTC Price Bullish Comeback

As reported previously, BTC bulls put up a strong defense at the $25,000 support/resistance, holding off a potential decline to $20,000. This bullish outlook has seen Bitcoin reclaim resistance at $26,000 and climb to $26,800.

Following the massive slump to $25,000, the Relative Strength Index (RSI) became extremely oversold, and this could be the catalyst as buyers move to seek fresh exposure to BTC.

The largest crypto could also be mirroring gains in the United States equity market, with the S&P 500 and Nasdaq Composite climbing by 1% at the close of trading on Wednesday. Wall Street gains came after the release of S&P Global’s flash US Composite PMI Index used to gauge economic activity in manufacturing and service industries.

The data suggested that economic expansion in August was on the brink of a pause. Investors harbored optimism that a deceleration in consumer expenditure might prompt the US Federal Reserve to suspend their pattern of rate hikes—promising news for the cryptocurrency market, as reflected by today’s price surges.

According to the derivatives market tracking platform Coinglass, Bitcoin saw $37.7 million in total liquidations on Wednesday. This was inclusive of $9.64 million of liquidated long positions. It also marked the first time since Sunday that liquidations of BTC shorts dwarfed liquidated long positions. Market participants perceive this as a signal that sentiment is improving.

BTC Price Recovers, But There’s A Catch

Bitcoin is in the process of completing its second consecutive bullish candle on the daily chart. If the imminent seller congestion at $26,800 weakens and gives way, the next stopover would be $28,000 ahead of the anticipated climb to $30,000.

Traders seeking exposure to Bitcoin longs and are conservative may want to wait until the Moving Average Convergence (MACD) indicator flashes a buy signal. This call to buy BTC would be of importance, considering the last time there was a buy signal on the daily chart was around mid-June.

The Relative Strength Index (RSI) would make its bullish case as it rebounds from the oversold region below 30 into the neutral area and finally into the overbought territory above $70.

With September approaching and the Federal Reserve expected to release its decision on economic policy, traders should proceed with caution. The previous FOMC minutes saw members calling for more rate hikes to mitigate inflation in the US. Such rate increases are likely to dampen risk asset markets like Bitcoin and crypto, thus stretching the recovery period.

Related Articles

- FBI Arrests Tornado Cash Co-Founder for Money Laundering to North Korea

- BRICS to Strengthen Alliance With First Indian Rupee Bond

- XRP Lawsuit: US SEC’s Attorney Pascale Guerrier Withdraws

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?