Crypto Companies Eye Public Debut As IPO Frenzy Heats Up

Crypto companies seem to be eager to make their public debut this year as the crypto market crossed the trillion-dollar market cap this bull run. Coinbase was among the first crypto companies to announce their decision to go public with an IPO in the first quarter of 2021. Bakkt became the second prominent crypto firm to announce that it would go public by merging with a SPAC company followed by eToro.

A total of 8 crypto companies till now have announced their plans to get listed on publically traded exchange this year and many might follow a similar suit. The IPO market has proven to be a great game-changer for many startups and firms over the last decade as their valuation has more than doubled soon after listing the most recent example being Airbnb IPO.

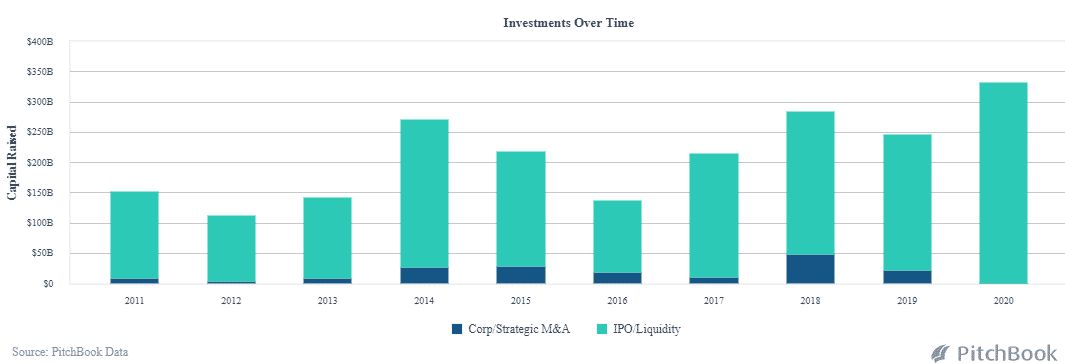

The funding rate has also seen a significant rise over the years as the amount of capital raised has increased, suggesting the rising investor interest in these public offerings.

How Crypto Companies Would Fair in Traditional Market?

The IPO market is currently a hot cake as stocks surged nearly 70% since the last fall in March, thus the time could play in crypto companies’ favor. Coinbase was valued at $8 billion in 2018 and currently holds nearly $90 billion in assets on its platform with a 45 million user base, thus making it one of the most prominent IPOs in the crypto world.

The growing interest of institutions and wall street can also drive the crypto IPO frenzy further as more crypto companies decided to cash on the bulls Sentiment. Nice Carter, co-founder of Coin Metrics said that the world is looking at the crypto industry now as the traditional financial system shows signs of crumbling and he belive the world would bet their money on the fastest growing industry. He said,

“It’s a pure-play bet on the fastest growing industry in the world, crypto, and we’re in the loosest money regime in history,”

Matt Maley, chief market strategist at Miller Tabak + Co believes the crypto IPO frenzy could also be signaling that the top companies in the space are trying to cash on the recent attention around bitcoin and crypto assets in general. He explained

“When a bunch of companies in the same sector goes public at the same time, it tells you that the people who run those companies realize that their valuations are very high. The smart guys are taking advantage of this parabolic move right now.”

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

Buy $GGs

Buy $GGs