Crypto ETF News: Bitwise Launches Chainlink ETF as Institutional Inflows Return

Highlights

- The new Chainlink ETF offered by Bitwise offers a regulated exposure to LINK, which is easier for traditional investors.

- The Grayscale ETF had net inflows of almost $64 million as the waiving of fees and the sound custody framework is set to attract institutions.

- After the announcement of the ETF launch, LINK recovered, although it remains volatile in the short-term.

Institutional crypto ETF interest is stabilizing with Bitwise unveiling a new Chainlink exchange-traded fund. The transition increases regulated access to LINK at a time when capital flows across crypto investment vehicles were improving.

Bitwise Chainlink ETF Goes Live

The product trades under a ticker of CLNK on NYSE Arca after Bitwise spot Chainlink ETF received approval to trade at the exchange. Chainlink ETF is an index of the current spot price of Chainlink, which allows an investor access to this index using standard brokerage accounts without holding the individual tokens.

According to the announcement, it levies a 0.34% fund management fee, and waives the initial fee in the first three months or up to the first $500 million as an incentive. Chainlink tokens in the fund is secured with Coinbase Custody in segregated institutional cold accounts.

Also, the net asset value has been pegged on the CME CF Chainlink-Dollar Reference rate, balancing the product’s price with commodity indices of regulated crypto ETFs.

What Is Driving Institutional Capital into LINK?

The trust does not stake at inception, although Bitwise can revise filings subsequently to provide a chance to stake, following regulatory approval. The framework minimizes the risk of custody and reduces initial expenses. This makes incorporating LINK exposure into current institutional portfolios becomes easier.

The first U.S. Chainlink ETF, GLNK, by Grayscale makes the CLNK launch a strong competition. There are early signs of stability in the flows into LINK ETFs, as the cumulative net investment in the funds is about $64 million and total assets about $88 million.

The latest session showed no change in this regard as the number of inflows was flat, but this was because there is no increase in outflows. These are signs that institutions are not leaving their positions but consolidating, a long-term positioning factor.

Will ETF News Help Chainlink Price Soar?

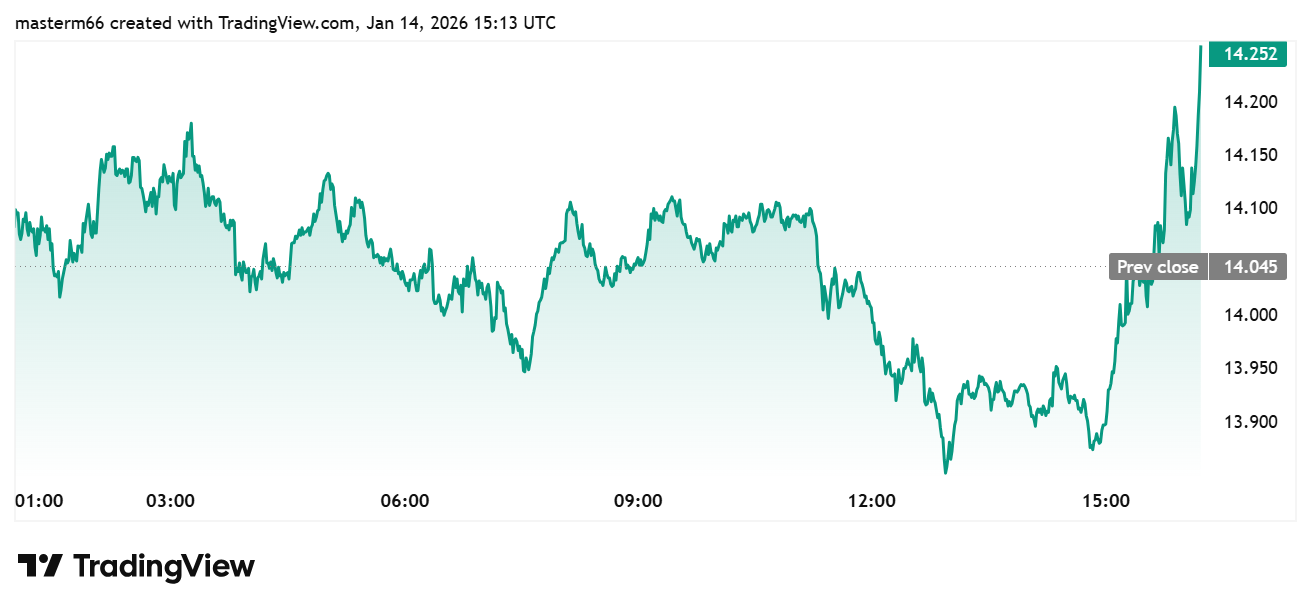

The last trading session saw LINK price trade almost at $14.25, which is an improvement from the previous session when it was at about $14.04. This was after a sharp intraday reversal.

The price fell below $13.90 in the early stages, but since then went in the opposite direction, gaining strength, moving LINK to the highest level of the session.

This means that buyers intervened strongly around intraday support. Price action after ETF launches is often sought by the market participants. In this instance, the recovery by LINK is in line with the rise in the sentiment regarding regulated access.

- Crypto Exchange HashKey Launches RWA Issuance for Institutions Amid Tokenization Boom

- Just-In: Ethereum Foundation Begins Staking 70,000 ETH, Futures Open Interest Bounces

- 8 Best White Label RWA Tokenization Platform Development Companies

- Hong Kong Stablecoin Firm RedotPay Targets $1B Raise in Potential US. IPO Debut

- Crypto Market Crash: Glassnode & 10x Research Warn Deeper Bitcoin Price Fall Ahead

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

Claim Card

Claim Card