Ethereum (ETH) London Hardfork Would Make These Tokens Obsolete

The world’s second-largest cryptocurrency Ethereum is heading for a major on-chain upgrade with the upcoming London Hardfork. The upgrade is scheduled to take place by August 5 which would solve the long-pending gas fee problem on the network and also make Ether supply deflationary. Crypto enthusiasts are eagerly waiting for the upgrade and hope it would bring a positive impact on the token price. However, the London Hardfork is not good news for everybody as several gas tokens will go obsolete.

1Inch, a popular DEX protocol revealed that the upcoming upgrade on the Ethereum blockchain would make two of its popular transaction tokens useless. The tokens would be Ethereum gas token GST2 and an improved version of the same developed by 1Inch network called CHI. The firm revealed the news in an official blog post which read,

“As transparency has always been a major value for the 1inch Network, it is essential to share with you that the upcoming Ethereum upgrade, known as the London hard fork, will have an impact on some of the network’s tokens, making them obsolete.”

The reason for obsoleteness is the implementation of EIP-1559 that would remove the need for traders to incentivize miners. Both these tokens were used as gas reward tokens for paying miners. After the implementation, traders would directly interact with the network and pay gas fees to the network instead of miners. The network would decide a base price for processing transactions and that would be transferred to the miner’s account. The remaining ETH would be burnt, removing it completely from the circulating supply.

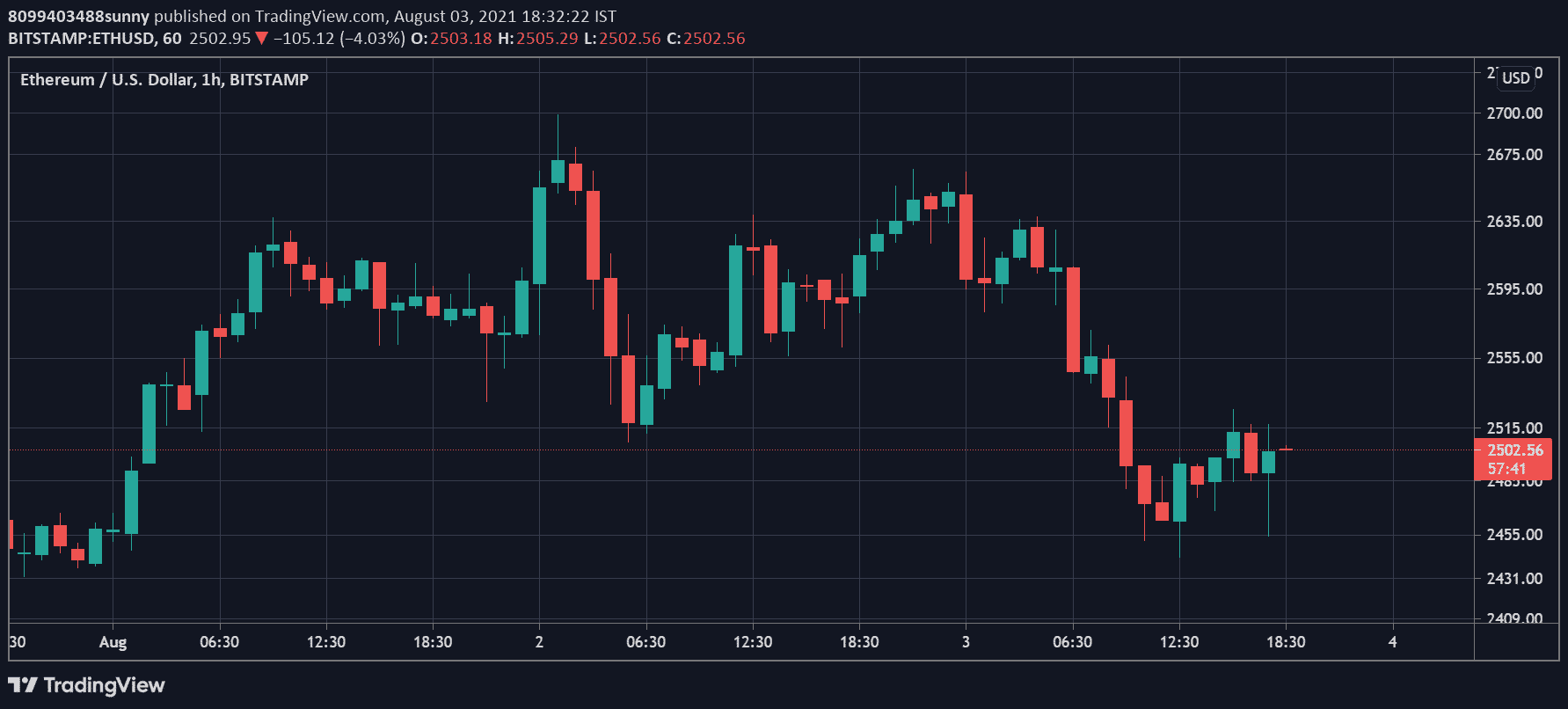

ETH Price Eyes New Monthly High

Ether’s price has recovered along with the other crypto tokens over the past week, registering a new monthly high of $2,695. The price of ETH is currently trading above $2,500 and investors hope for a new monthly high in the coming days in anticipation of a successful upgrade.

The world’s second-largest cryptocurrency has 42.62% from its all-time high of $4,362, but hopes for another leg of bullish price action is quite high given the blockchain is nearing its transition from Proof-of-Work to Proof-of-stake.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs