Ethereum (ETH) Might Outrun Bitcoin (BTC) to Next ATH, Here’s Why

Bitcoin (BTC) and Ethereum (ETG), the top two cryptocurrencies are currently enjoying a healthy bullish surge in August after three months of bearish consolidation. Both BTC and ETH lost more than 50% of their valuation from their all-time highs (ATH) during the market sell-off in May and June. With the start of the second leg of the bull run, the race to the new ATH has begun, and looking at some of the key factors it seems Ether might outrun BTC to post the new ATH.

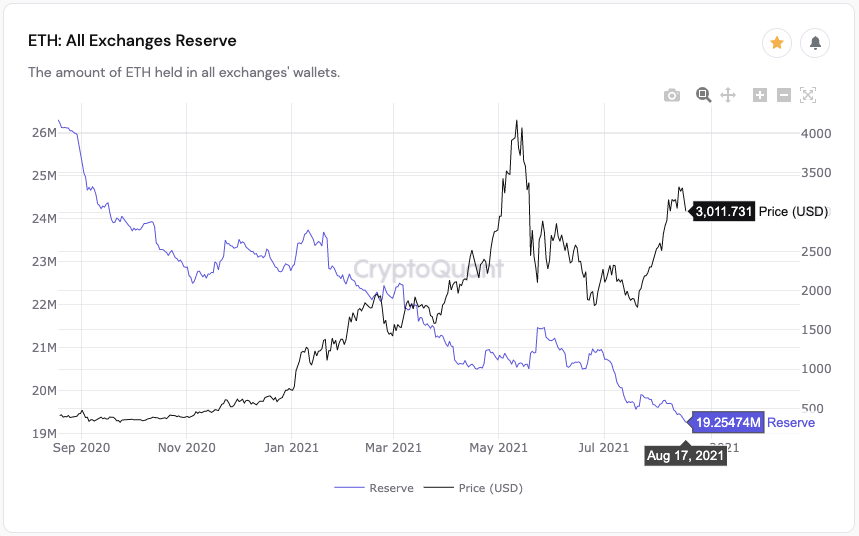

The exchange supply of Ethereum continues to deplete and reached a new two-year low yesterday. The price of the altcoin has continued to maintain its postion above $3,000 and registered a new 3-month high of $3,333 this week.

The EIP-1559 upgrade during the London Hardfork has made Ethereum a deflationary token as a part of the miner’s fee is being burnt out of supply. The burning of Ether has made the market supply of Ether scarcer since a majority of ETH being staked in ETH 2.o contracts. A total of $183 million worth of ETH has been burnt till now. The market supply of the second largest crypto continues to decline while demand is nearing an ATH.

ETH Technicals Are Strong

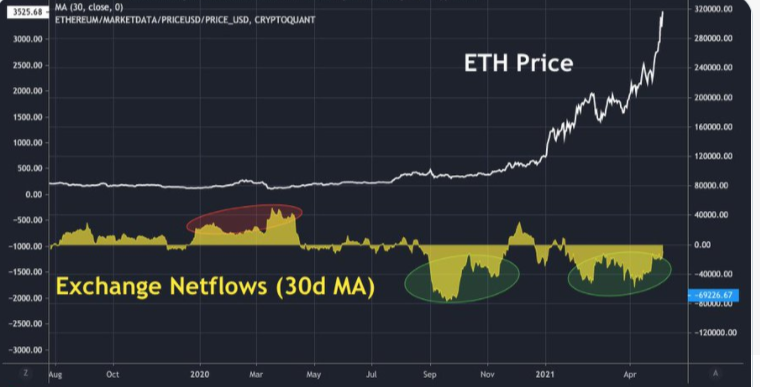

Popular analyst Ki Young Ju said that ETH looks more bullish in the long run as the sell side liquidity crisis will continue to internsify. He suggested the technical aspects of Ethereum give it an upper hand in the second leg of this bull run.

Technically, $ETH might have some corrections in the short term. But I think $ETH might outperform $BTC if the Bitcoin price going sideways or bullish.

— Ki Young Ju 주기영 (@ki_young_ju) August 18, 2021

Young also pointed towards the net exchange flow on the monthly time frame showed heavy amounts of ETH being moved away from exchanges. The brlow chart shows that the traders started moving their Ether supply with increase in price.

JP Morgan who has gone from a big-time Bitcoin critic to the first private bank offering atleast half a dozen Bitcoin and crypto investment products has said that ETH has a better market liqudity than Bitcoin and it would help it recover better and faster from the price crashes.

Bitcoin is Holding Onto $45K Strong Support

Both Bitcoin and Ethereum registered a minor dip today. Bitcoin fell from a daily high of $47,139 to a daily low of $44,346 and current trading at $45,270 with a loss of 3% over the past 24-hours. The cryptocurrency’s next resistance lies at $47.5K breaking which it can move into the $50K territory.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs