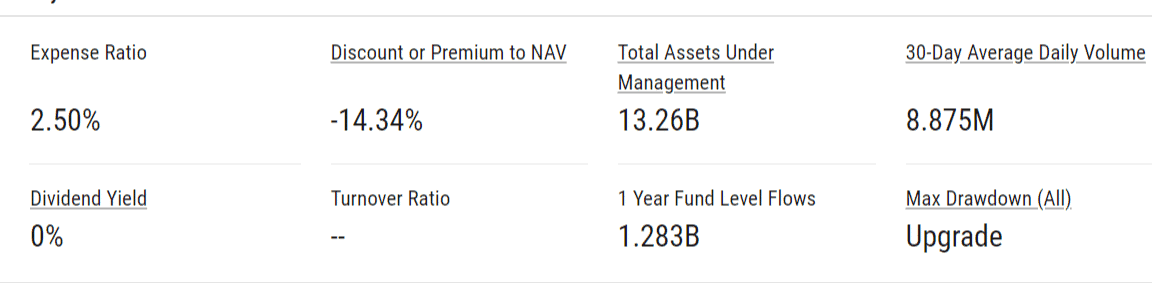

Grayscale Ethereum Trust (ETHE) Premium Sets All-Time-Low at -14.3%

Grayscale Ethereum Trust (ETHE), the institutional crypto investment fund for the second-largest cryptocurrency registered a negative 14.3% premium reaching its lowest since listing. Grayscale being the world’s largest crypto asset manager offers a range of crypto-based trust funds to invest, in absence of a regulated ETF in the United States.

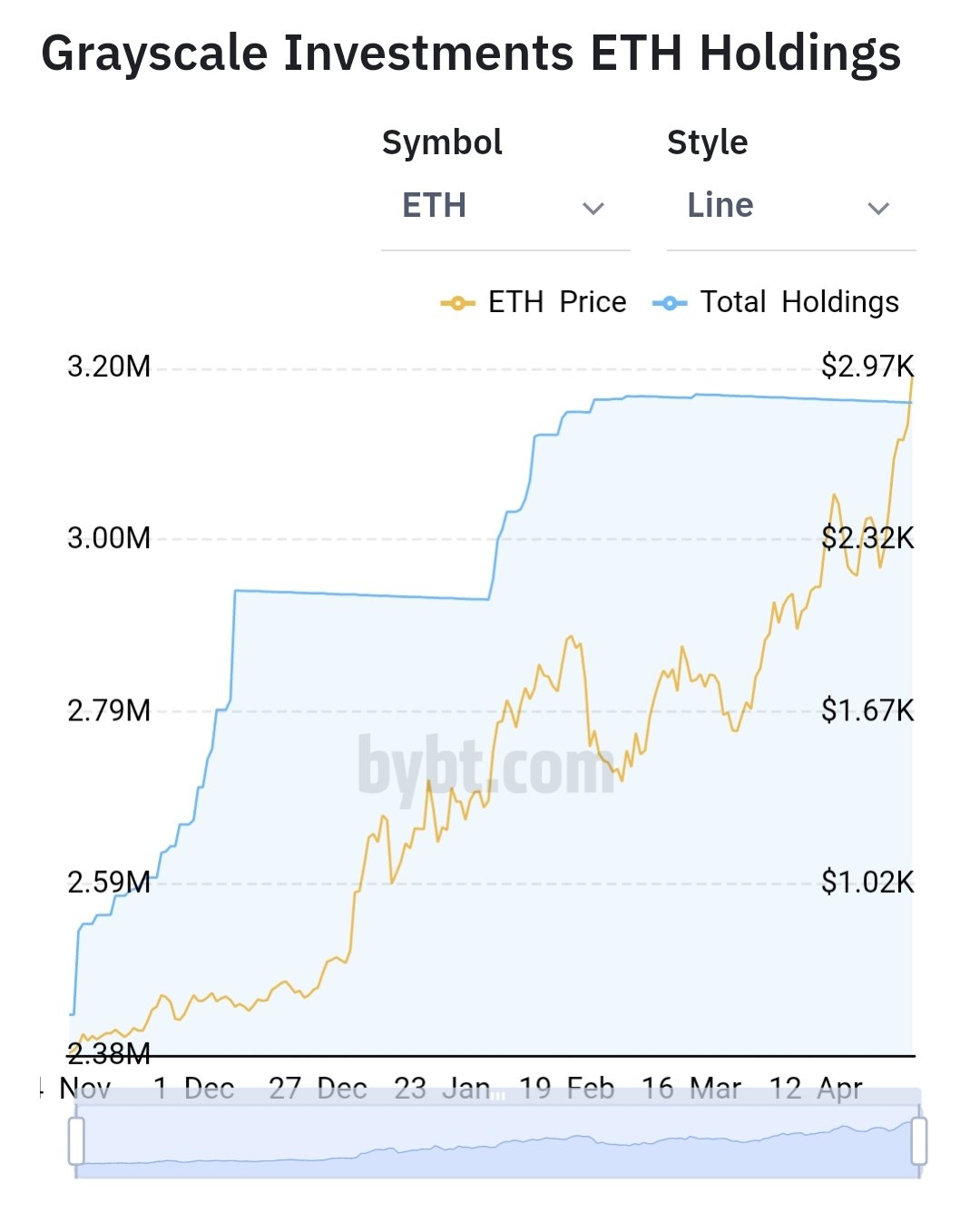

These private investment funds have also turned into an important market indicator and institutional interest and a rising premium suggests higher demand and vice versa. The Grayscale Ethereum trust fund currently holds $13 billion worth of assets out of which nearly $1.28 billion has flowed in this year.

A similar trend was seen with its highly popular GBTC fund which for the majority of its trading period has had a positive high premium rate, but over the past month the GBTC premium has come down significantly and even fell to negative during the last month’s 20% Bitcoin price correction.

ETH Price Recover After Yesterday’s Fall

Ether’s price has bounced back above $4,100 from yesterday’s crash to $3,549 and currently trading with a 9% surge at $,133. Yesterday saw another crypto blood bath with the majority of tokens falling by over 10%, but the markets rebounded sharply today, and even Dogecoin which was down over 30% has risen above $0.54 to register a 28% gain.

ETH is on a highly bullish momentum and price discovery mode where it has registered a new ATH every other day in the past couple of weeks. The aggressive price gains by ETH have helped it leap over Bitcoin in terms of year-to-date returns as well. The recent surge in price is being attributed to declining market supply as the balance of Ether on centralized exchanges reached a two-year low, and growing institutional demand, where the likes of JP Morgan has lauded the depth of the ETH market that has helped it recover from large correction quite quickly when compared against Bitcoin.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- CLARITY Act: Banks, Crypto Yet To Agree On New Crypto Bill Draft As March 1 Deadline Looms

- Michael Saylor Predicts $50T From Bonds Could Flow Into Bitcoin Ecosystem as Digital Credit Evolves

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale