Kraken Subsidiary Is A Major Beneficiary Of Bitcoin ETFs In US & HK: Bloomberg

Highlights

- CF Benchmarks, a subsidiary of crypto exchange Kraken, saw a massive increase in demand for its indices amid spot Bitcoin ETFs.

- The company said it represents almost 50% market share in the crypto benchmarking market.

- CF Benchmarks CEO Sui Chung sees South Korea and Israel as potential big markets for Bitcoin ETFs.

Crypto exchange Kraken’s subsidiary is a major beneficiary of the spot Bitcoin exchange-traded funds (ETF) in the United States and Hong Kong, as per a latest report by Bloomberg. The company predicts $1 billion of assets under management (AUM) in spot Bitcoin and Ether ETFs in Hong Kong, as well as other markets to see the listing of spot crypto ETFs.

Kraken’s CF Benchmarks Gains 50% of Crypto Benchmarking Market

CF Benchmarks, a subsidiary of crypto exchange Kraken, saw a massive increase in demand for its indices amid a boon in spot Bitcoin ETFs. The United States and Hong Kong are major financial hubs bringing exposure of already established institutional investors base to Bitcoin.

The company said it represents almost 50% market share in the crypto benchmarking market as a result of launch of spot Bitcoin ETFs in the U.S. in January and in Hong Kong last year. It provides data for about $24 billion in crypto ETFs, primarily BlackRock’s iShares Bitcoin ETF with $16.2 billion AUM.

CF Benchmarks expects its revenue to almost double this year, as per the rising demand for spot Bitcoin ETF. The last available revenue data indicates it reached £6 million ($7.5 million) in 2022. In addition, the firm plans to expand headcount by around a third to more than 40. Kraken acquired CF Benchmarks in 2019.

South Korea and Israel Are Next in Crypto ETFs Race

CF Benchmarks chief executive officer Sui Chung sees them working with crypto ETFs issuers in South Korea and Israel next. South Korea has one of the largest crypto users, with high trading volumes impacting crypto prices.

“South Korea is a market where ETFs have become the wrapper of choice for long-term savings. It is also a market where digital assets have gained a high degree of adoption,” said Sui Chung.

The company expects Hong Kong-based spot Bitcoin and Ether ETFs to witness $1 billion in funds under management by year-end.

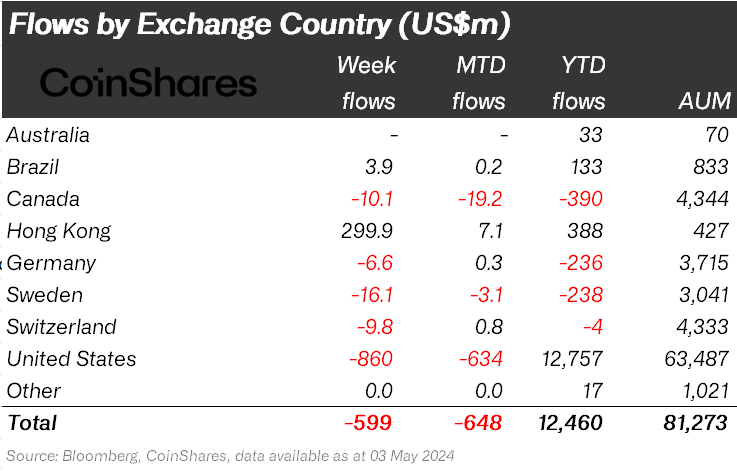

CoinShares head of research James Butterfill revealed Hong while other markets suffer outflows from digital asset products, Hong Kong saw $300 million in inflows so far this week.

Also Read:

- Pro-XRP Lawyers Say Ripple Will Lose Motion Against US SEC

- BitMEX’s Arthur Hayes To Buy These Cryptos In May

- Robert Kiyosaki Portrays Crypto Market Crash As “Time To Get Rich”

- Hong Kong Stablecoin Firm RedotPay Targets $1B Raise in Potential US. IPO Debut

- Crypto Market Crash: Glassnode & 10x Research Warn Deeper Bitcoin Price Fall Ahead

- Operation Chokepoint: Federal Reserve Advances Proposal to End Crypto Debanking

- LUNC News: Terraform Labs Administrator Sues Jane Street for Terra-LUNA Crisis

- Crypto.com Joins Ripple, Circle With Conditional Bank Charter Approval Amid WLFI’s Probe

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?