Ethereum Price Analysis: Turnaround Near $1,650; Are Gains Sustainable?

The Ethereum price analysis for today remains moderately bullish. The price traded in the green zone for the past few hours. However, still, there are many hiccups for the bulls to overcome. ETH is recovering from the recent correction as fresh buying emerges near the lower level following the consolidation.

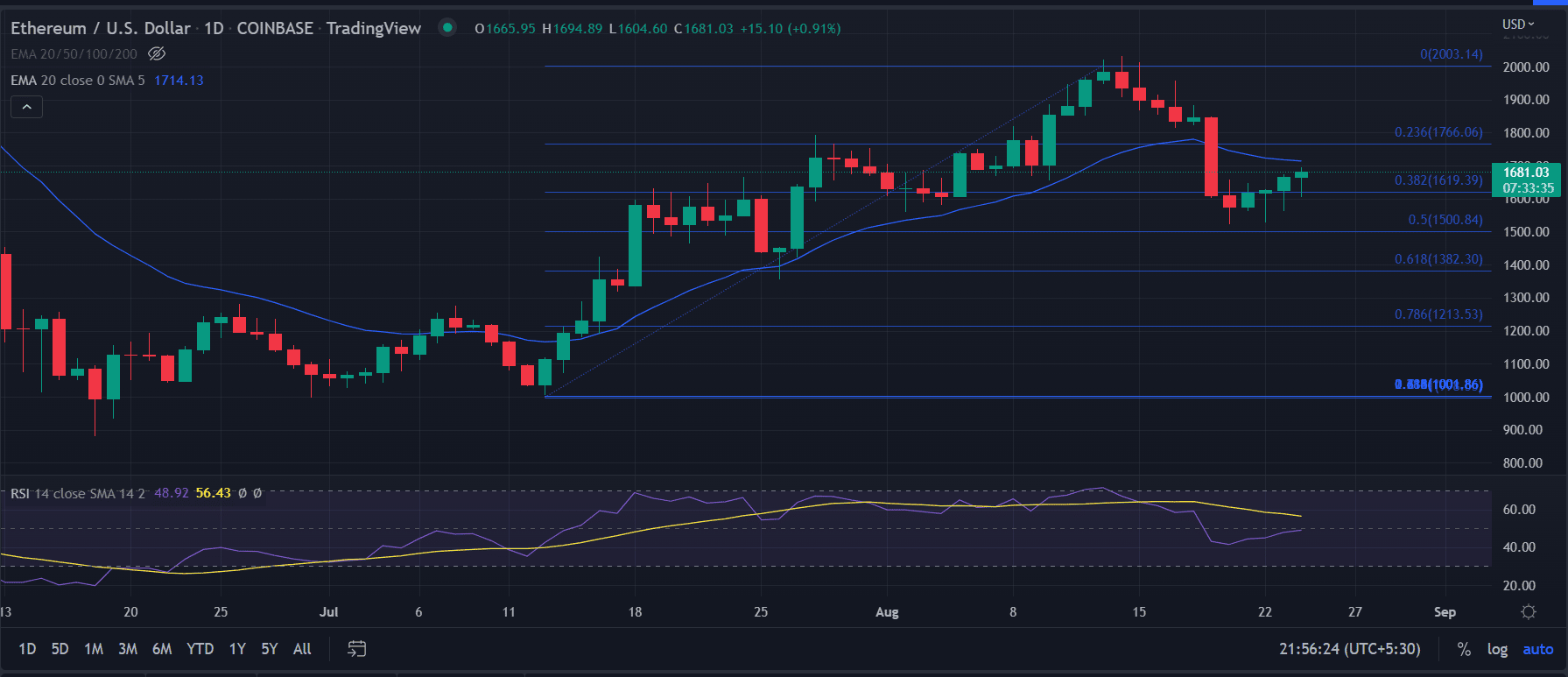

ETH went through a big sell-off in the past week as investors book their profits since mid-August as the end of the recovery rally. The price depreciated by nearly 45% from the swing highs of $2,031.39.

As of press time, ETH/USD is reading at $1,670, up 0.3% for the day. The trading volume declined modestly to $17 billion in the past 24 hours according to CoinMarketCap data.

The seconds largest coin by the market cap after Bitcoin portrays the overall market mood. There is an overall fragile recovery in the broader crypto space.

- Ethereum price extends consolidation for the third straight day.

- A bounce back from the 0.38% Fibonacci retracement acts as crucial support for the bulls.

- However, the downside risk remains intact below $1,520.

Ethereum price looks for an upside reversal

The Ethereum price analysis shows a consolidation.

On the daily time frame, ETH retraced from the swing highs of $2,031.39. However, the price quickly retraced with a depreciation of 30% toward the 0.23% Fibonacci retracement level. The Fibonacci retracment extends from the lows of $1,000 and acts as a support for the bulls.

After falling below the mentioned level, the price again finds a stoppage near the 0.50% Fibonacci retracement level.

Further, the price is still trading below the critical 20-day exponential moving average (EMA) at $1,714.

A renewed buying pressure could result in a quick recovery toward the 0.23% Fibonacci retracement level toward $1,800.

On the flip side, a break below the session’s low would continue with the correction. In that occurs, the bears could drag the price toward $1,600.

The RSI (14) trades below the average line indicate a struggle for the bulls. Currently, it reads at 40.

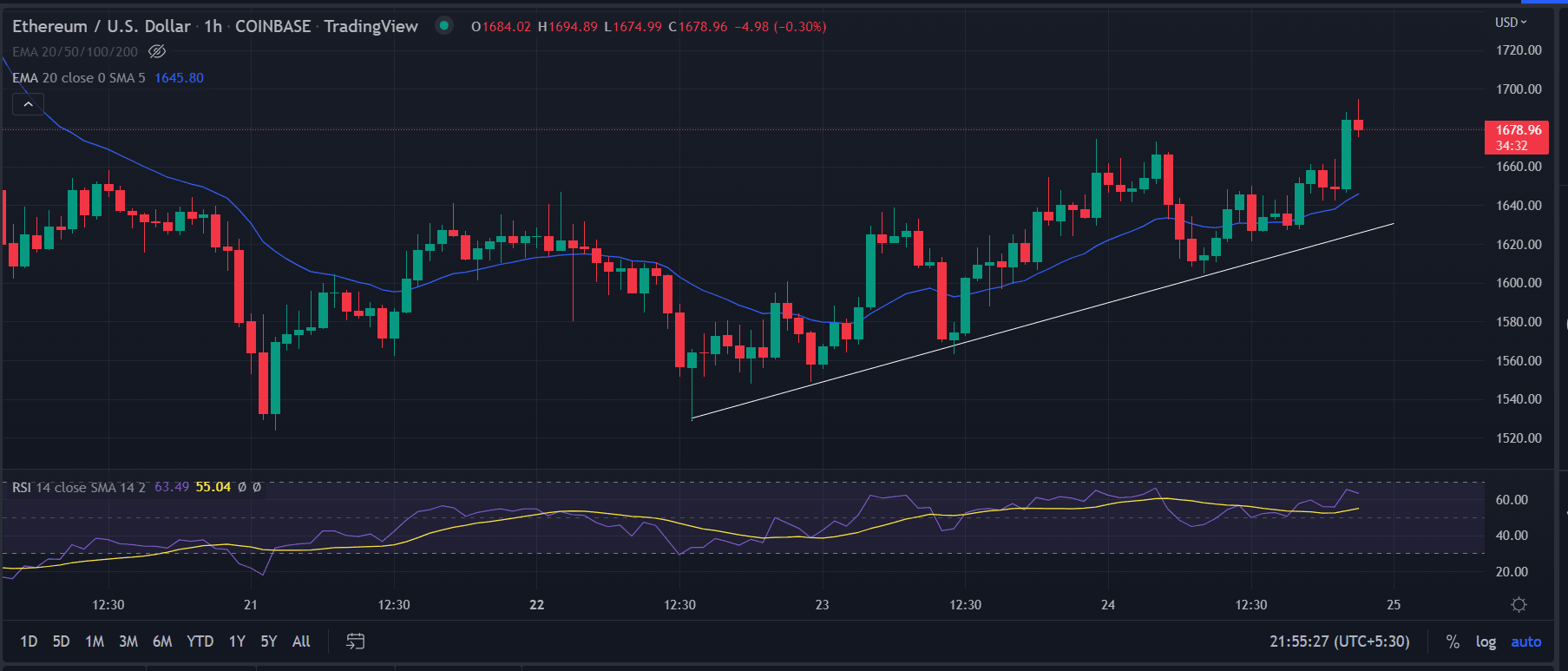

On the hourly chart, the price follows the ascending trend line from the lows of $1,540. ETH looks bullish on the short-time frame. A green candlestick in the last few hours shows a spike in buy order pushing the price toward $1,700.

However, the price faces resistance near the mentioned level, we expect a minor pullback in the price. A dip buying opportunity for sidelined investors.

Also read: Just In: It’s Official, Ethereum Confirms Mainnet Schedule For PoS Merge

On moving higher, the price could test $1,760 followed by the psychological $1,800 level.

On the other hand, a daily close below the session’s low would open the gates for $1,500.

- LUNC News: Terraform Labs Administrator Sues Jane Street for Terra-LUNA Crisis

- Crypto.com Joins Ripple, Circle With Conditional Bank Charter Approval Amid WLFI’s Probe

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?