Michael Saylor’s Strategy Pauses Bitcoin Buying as Crypto Market Anticipates a ‘Santa Rally’

Highlights

- Strategy bought zero Bitcoin between December 15 and 21.

- The company still holds 671,268 BTC.

- Strategy has increased its USD reserve to $2.19 billion.

- The MSTR stock is up almost 2% in today's trading session.

Michael Saylor’s Strategy has halted its weekly Bitcoin purchase, failing to buy any BTC last week. This comes as the crypto market anticipates a Santa rally, with BTC reaching $90,000 today and MSTR stock also rallying.

Strategy Bought Zero Bitcoin Last Week

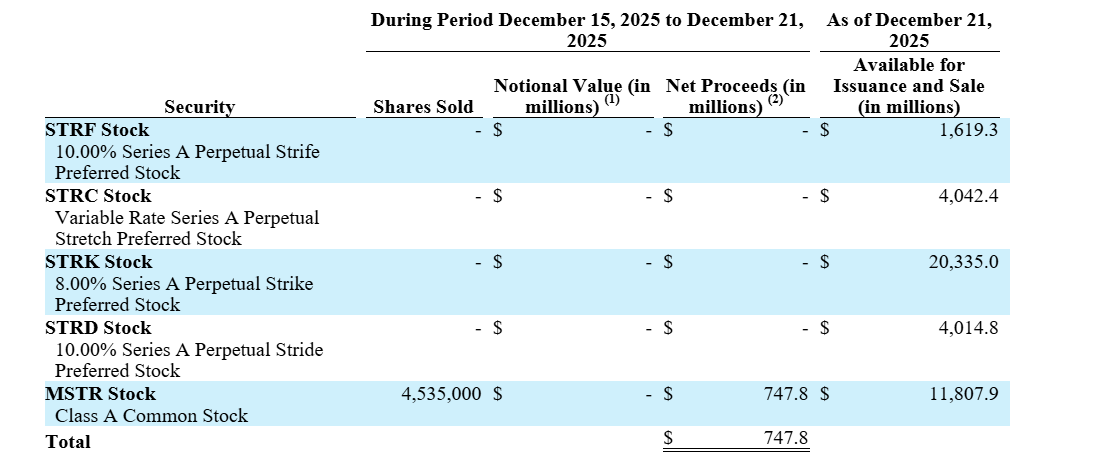

An SEC filing showed that the company didnt acquire any Bitcoin between December 15 and 21. It still holds 671,268 BTC, which it acquired for $50.33 billion at an average price of $74,972 per Bitcoin.

However, a positive is that Strategy has increased its USD reserves to $2.19 billion. The company sold just over 4.5 million MSTR shares last week, raising $748 million, to boost this reserve. This further ensures that Saylor’s company does not need to sell its Bitcoin holdings anytime to fund dividend or interest payments, even as the mNAV remains shaky.

The company noted that the maintenance of its USD reserve remains subject to its sole and absolute discretion. It also stated that it may adjust the USD reserve from time to time based on market conditions, liquidity needs, and other factors.

Strategy established the USD reserve at the start of this month with $1.44 billion, a move that instantly calmed concerns about a potential sell-off of their BTC holdings. Since then, the company has made two weekly Bitcoin purchases of almost $1 billion each.

Last week, the company announced that it bought 10,645 BTC for $980.3 Million, its largest purchase since July. Meanwhile, the decision to pause BTC purchases comes as the crypto market anticipates a Santa rally.

As CoinGape reported, Bitcoin options traders have turned slightly bullish, pointing to a potential end-of-the-year rally for the flagship crypto and broader crypto market. BTC has rallied above $90,000 today, up almost 2%, providing optimism that the crypto asset can end the year on a high.

The Strategy stock has also rallied despite the company halting its Bitcoin purchases. TradingView data shows that the stock is trading at around $167, up almost 2% from last week’s close of $164.

Schiff Proposes Gold Reserves Instead Of USD Reserves

Gold bug Peter Schiff has proposed to Saylor the idea of building a gold reserve instead of a dollar reserve. In an X post, he stated that the company seems to be building up dollar reserves as it realizes it will soon need them.

It seems to me that you are building dollar reserves as you realize you will soon need them. Given rising inflation as the Fed cuts rates and continues QE, why not build gold reserves instead of U.S. dollar reserves? That’s what Tether is doing.

— Peter Schiff (@PeterSchiff) December 22, 2025

He then questioned why the company is not building a gold reserve like Tether instead of a USD reserve, given rising inflation as the Fed cuts rates and continues quantitative easing.

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?