SBF’s Alameda Research: $110 Million in Bitcoin Found by Liquidators

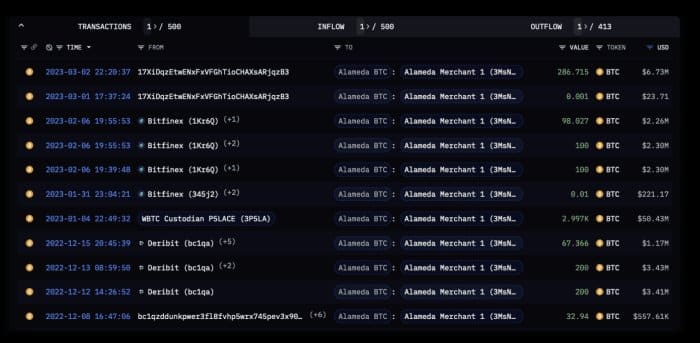

Liquidators overseeing the asset recovery of the now-disgraced Alameda Research hedge fund, founded by Sam Bankman-Fried, currently possess more than $110 million worth of bitcoin held in various wallets, according to a report provided by blockchain analysis firm Arkham Intelligence. Recent findings indicate that these wallets have been actively receiving BTC from exchanges and cold wallets as recently as March 2023.

Alameda’s BTC Holdings

The report reveals, ‘In total, Alameda’s liquidators have managed to secure 4,083 BTC (currently valued at $110.81 million) sourced from the following’:

- Other Wallets: 34.94 BTC ($948.27K)

- Deribit: 467.366 BTC ($12.68M)

- WBTC Custodian: 2997 BTC ($81.34M)

- Bitfinex: 298.027 BTC ($8.09M)

- Unlabelled Wallets (possibly an Exchange): 286.7 BTC ($7.78M)”

A screenshot from the provided report displays Alameda Research Bitcoin Holdings, as analyzed by Arkham Intelligence.

“However, this represents only a fraction of the BTC that Alameda previously controlled,” the report says.

“Wallets associated with Alameda’s BTC activity reached a peak value of over $800 million, suggesting that the firm likely holds additional BTC in centralized exchanges or unlinked cold wallets.”

The aggregation of these wallets offers insights into how the liquidators collected BTC from firm’s holdings. In April, a 1 BTC test from Alameda’s Merchant wallet was sent to a holding address controlled by Alameda’s Liquidators, named ‘Alameda Merchant 1.’ Since the start of 2023, this address has amassed 3,581 BTC, valued at around $97.19 million today.

Founded in 2017, Alameda Research is a leading quantitative cryptocurrency trading firm. The company was founded by an American entrepreneur and investor Sam Bankman-Fried and is headquartered in Central and Western Hong Kong.

FTX filed multiple lawsuits in the U.S. Bankruptcy Court for the District of Delaware on May 17 to recover funds from former FTX executives including Sam Bankman-Fried and other parties that benefitted from Embed Financial Technologies’s acquisition.

FTX Trading (Debtors), along with Alameda Research and West Realm Shires (Plaintiff) sued former CEO Sam Bankman-Fried, Nishad Singh, and Gary Wang in a lawsuit.

- LUNC News: Terraform Labs Administrator Sues Jane Street for Terra-LUNA Crisis

- Crypto.com Joins Ripple, Circle With Conditional Bank Charter Approval Amid WLFI’s Probe

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?