Spot Bitcoin ETFs Inflow At 3-Week High, Institutions Buying Heavily Ahead Key Events

Highlights

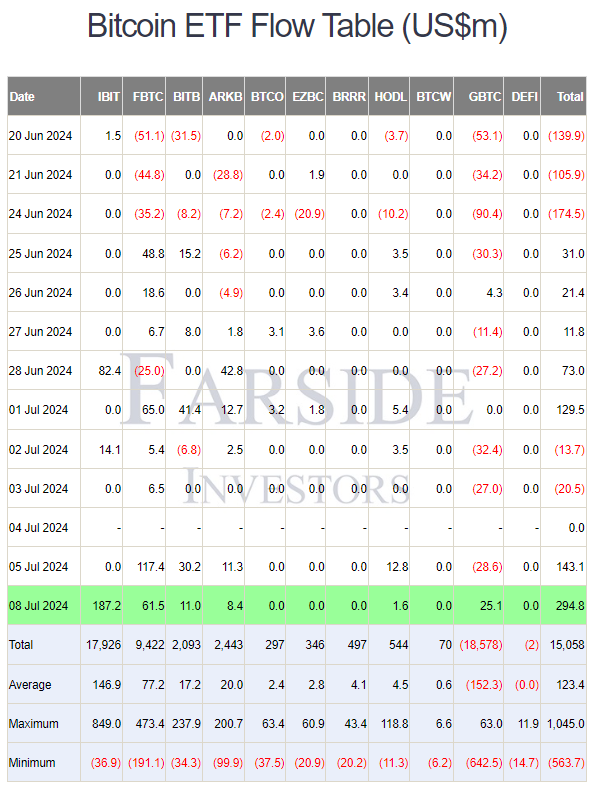

- Spot Bitcoin ETFs in the United States recorded $295 million in net inflows.

- BlackRock’s iShares Bitcoin ETF (IBIT) saw $187.2 in inflow, highest in the last few weeks.

- BTC price jumps over 3% to move towards $60k.

Spot Bitcoin ETFs saw nearly $295 million in net inflows on Monday, recording inflows for two consecutive days and starting the week with massive buying. This indicates institutional investors are buying heavily despite the German govt BTC selloff and key macroeconomic events this week.

Spot Bitcoin ETFs Inflow Hints At Upcoming Market Rally

Spot Bitcoin ETFs in the U.S. recorded a total net inflow of $294.8 million, the highest inflow in 21 days. It follows as institutional investors continue to buy the dip. Crypto asset investment products globally saw a $441 million inflow last week as crypto weakness by Mt Gox and the German Government selling pressure were seen as a buying opportunity, reported CoinShares.

According to Bloomberg and Farside Investors, BlackRock’s iShares Bitcoin ETF (IBIT) recorded $187.2 in inflow, the highest inflow not seen in the last few weeks. Following the latest inflow, BlackRock’s net inflow hit over $17.9 billion and BTC holding is valued at nearly $18 billion.

Fidelity Bitcoin ETF (FBTC) saw $61.5 in inflow on Monday, with the total inflow reaching $9.42 billion. Bitwise Bitcoin ETF (BITB), Ark 21Shares (ARKB) Bitcoin ETF, and VanEck Bitcoin ETF (HODL) also saw inflows of $11 million, $8.4 million, and $1.6 million, respectively. Other spot Bitcoin ETFs saw zero net inflows.

Notably, Grayscale Bitcoin Trust (GBTC) also recorded inflows of $25.1 million after consecutive outflows in the previous days. GBTC buys 450 BTC, indicating strong demand from institutional investors.

Also Read: Matrixport Reveals Ethereum ETF Launch Timeline, Bernstein Targets ETH To $6,600

BTC Price To Rally Above $60k

Institutional buying signals high chances of Bitcoin rally to above $60k. Experts are overall bullish on BTC price and believe Mt. Gox creditors are not likely to sell their Bitcoin in this bull market.

In 6 months, US-listed Bitcoin ETFs brought in over $14.7B in net inflows. Key takeaway? Interest in #Bitcoin and digital assets remains high.

Token prices and market caps fluctuate, but the long-term fundamentals of our industry is strong.

Stay focused and keep building! 🚀

— Richard Teng (@_RichardTeng) July 9, 2024

BTC price has jumped over 3% in the last 24 hours, with the price currently trading at $57,603 as traders adjusted positions based on Wall Street’s bullish outlook on rate cuts. The 24-hour low and high are $55,240 and $58,131, respectively. Furthermore, the trading volume has increased by 36% in the last 24 hours, indicating a rise in interest among traders.

Derivatives market data shows massive buying by futures and options traders. BTC futures open interest across exchanges soared 2.60% in the last 24 hours. Buying is recorded on CME and Kraken, which implies higher demand in the US.

However, traders must remain cautious due to the Fed Chair Jerome Powell speech, CPI and PPI inflation data due this week.

Also Read: What Could be The Maximum Impact of Mt. Gox Creditors Selling Their Bitcoins?

- Operation Chokepoint: Federal Reserve Advances Proposal to End Crypto Debanking

- LUNC News: Terraform Labs Administrator Sues Jane Street for Terra-LUNA Crisis

- Crypto.com Joins Ripple, Circle With Conditional Bank Charter Approval Amid WLFI’s Probe

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?