These DeFi Coins Have Retraced On their charts, here’s What Comes Next

Uniswap had seen bullish price action in the month of October which had then extended to even the mid of November. Ever since that, the coin has retraced and formed a bearish price pattern. At the current price level, Uniswap has been trading at a multi-month low price level. At the time of writing the coin was available for $14.47 and had registered a 7% fall over the last 24 hours.

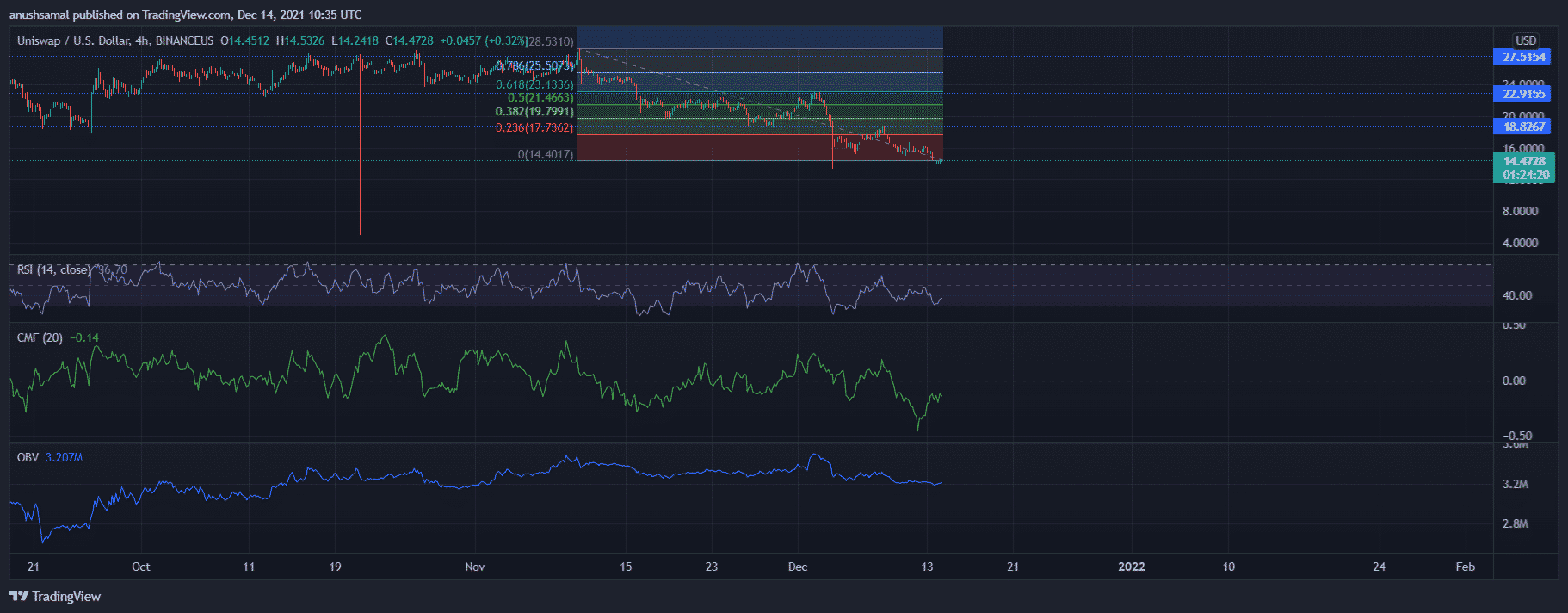

UNI/USD Four-Hour Chart

Although Uniswap had attempted to breach the bearish price movement, the coin encountered strong resistance at the 50% Fibonacci Level.

After being rejected at that level, the bulls had completely taken over the market. The immediate resistance mark stood at $18.82 and the local support rested at $14.39.

Buying strength remained low over the past few days as seen on the Relative Strength Index. Chaikin Money Flow also remained below the half-line which meant that capital outflows were more than capital inflows.

The On Balance Volume also confirms the same that selling pressure remained dominant in the market.

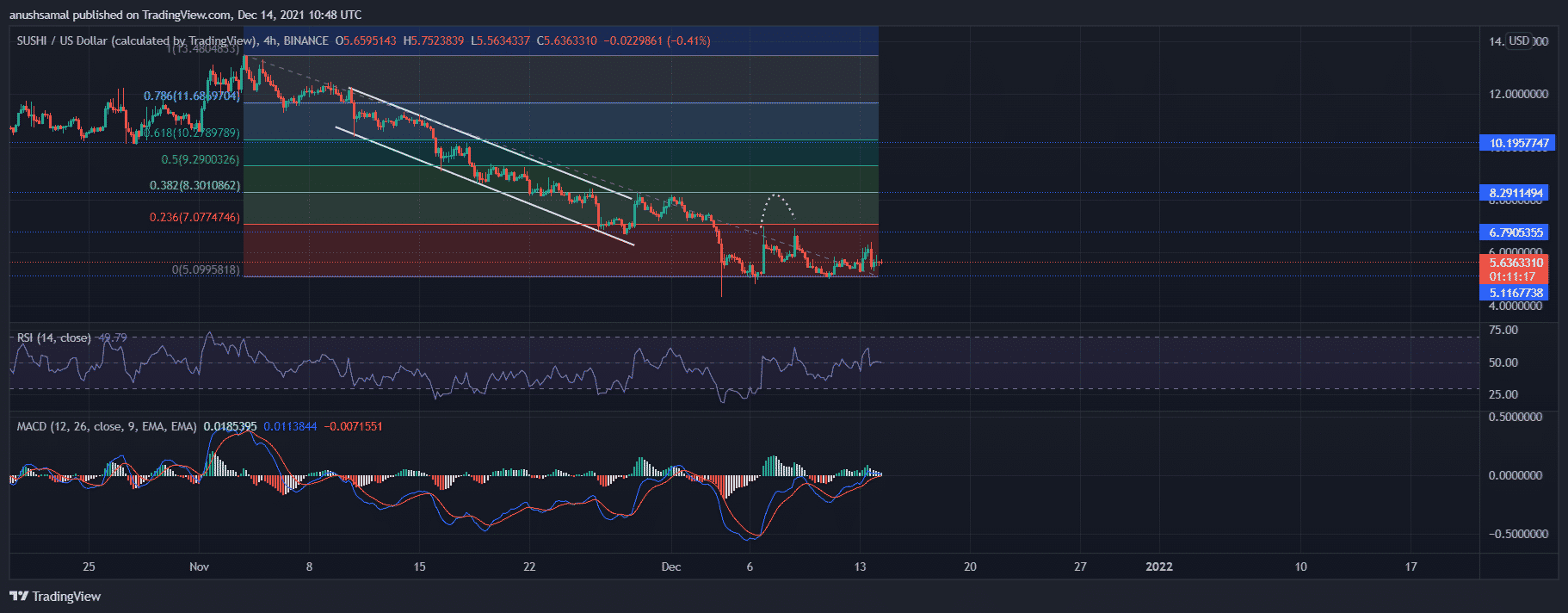

SUSHI/USD Four-Hour Chart

Sushiswap depreciated on its chart by 6.1% over the past day and was available for $5.63. From a look at the below chart, it is visible that Sushi was out of steam. The coin displayed a descending channel (in white) which meant that the token was on a downtrend.

Sushiswap despite forming a double top on December 6, couldn’t hold onto the momentum anymore. The coin met with a sell-off and had resumed its bearish thesis. Sushiswap will have a hurdle moving past its 23.6% Fibonacci level. A fall below the current price level would mean the token would be priced at $5.11. Other resistance points stood at $8.29 and $10.19 respectively.

Selling pressure was more than the buying pressure as seen on the Relative Strength Index. MACD also indicated that the coin was headed towards a bearish crossover as the green histograms were declining.

COSMOS/USD Four-Hour Chart

COSMOS was exchanging hands at $21.66 at a loss of 7.4% over the last day. Of late the coin recorded lower troughs, one after the other. As seen on the chart, the coin had formed a descending triangle, solidifying a continued downward price action. Over the last 72 hours, COSMOS displayed a double bottom, indicating intense selling pressure and prices dropping below the support line of $21.85.

Immediate resistance for the coin was at $26.03 and then at $30.55. The Relative Strength Index was below the half-line highlighting excess sellers in the market. MACD displayed bearish crossover and red histograms further validating a negative price action. On the flip side, Chaikin Money Flow pointed towards a recovery of capital inflows at the time of writing.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs