These DeFi Players Are Eating Into the Ethereum (ETH) Market Share

To date, the Ethereum (ETH) blockchain network remains the most preferred choice for developers to build decentralized finance (DeFi) applications. However, the Defi industry is slowly moving towards a multichain future.

As said, the Ethereum blockchain enjoys a lion’s share when it comes to hosting DeFi applications on the platform. However, higher DeFi and NFT activity taking place on Ethereum have resulted in rising gas fees and network congestion. This is likely to continue further before the blockchain makes a complete transition to Ethereum 2.0 PoS.

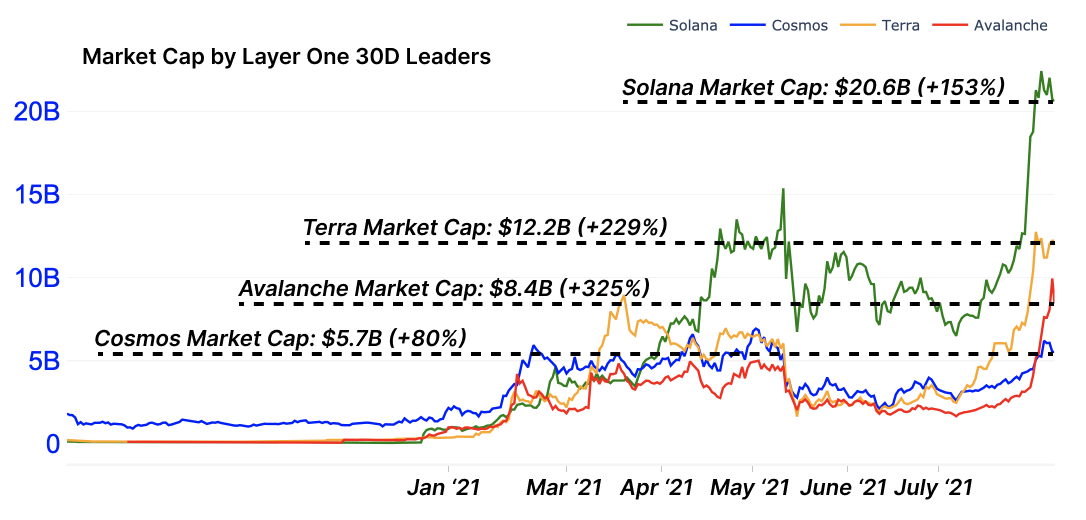

On-chain data provider Glassnode explains that a number of Ethereum-alternative DeFi layers have been gaining traction. Relative to the ETH, emerging players like Solana (SOL), Cosmos (ATOM), Avalanche (AVAX), and Terra (LUNA) have started gaining significant traction. Besides, the native cryptocurrencies have also posted gains to the tune of 80% and much higher.

Besides, along with the rising prices of these DeFi tokens, network activity has increased simultaneously. DeFi player Avalanche recently announced $180 million in liquidity mining incentives thereby triggering a massive rally in its total value locked (TVL).

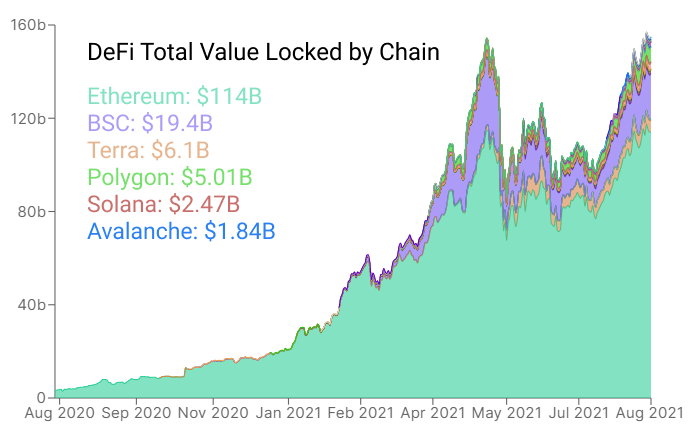

The TVL for Avalanche has jumped from zero to a staggering $1.8 billion. This is a staggering 620% jump in just seven days.

The overall DeFi TVL shot to a new all-time high of $157 billion over the last week. Here’s a look into how each of the payers is contributing and how much catching up they have to do beat Ethereum.

Developments With Avalanche, Solana, and Terra

The Proof-of-Stake Avalanche DeFi platform has claimed to have the most validators. The $180 million incentives paid in native AVAX tokens has triggered increased usage and migration to the Avalanche network.

Avalanche-based lending market BENQi is the first Avalanche project to reach $1 billion in liquidity. Furthermore, Glassnode explains:

The chain’s largest DEX is Pangolin, though the second largest DEX, Trader Joe, is right on its heels. Pangolin has seen enormous growth, benefiting from increased interest in the Avalanche ecosystem. It has watched its daily DEX volume go from $4M average daily volume to over $300M in daily volume, a 75x increase.

Solana has been another Defi project which has been in the limelight. Last week, Solana (SOL) touched an all-time high making its way to the top ten crypto list. However, the hardware costs required to operate a validator on the Solana network are much higher.

To reduce the entry barrier, Solana designers expect that the upcoming Morre’s Law will bring the cost of computing down. The Solana network is currently maintaining throughput of 1000 transactions per second.

The largest DeFi player in the Solana ecosystem is DEX Raydium which has over $1 billion on Total Value Locked (TVL).

Built off the Cosmos IBC, the Terra blockchain network brings along the key advantage of interoperability. This makes it a leader in the Cosmos ecosystem. LUNA, the native token of Terra serves as the backbone of the Terra blockchain supporting its UST stablecoin as well as offering the required security.

- Crypto Exchange HashKey Launches RWA Issuance for Institutions Amid Tokenization Boom

- Just-In: Ethereum Foundation Begins Staking 70,000 ETH, Futures Open Interest Bounces

- 8 Best White Label RWA Tokenization Platform Development Companies

- Hong Kong Stablecoin Firm RedotPay Targets $1B Raise in Potential US. IPO Debut

- Crypto Market Crash: Glassnode & 10x Research Warn Deeper Bitcoin Price Fall Ahead

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

Claim Card

Claim Card