Top Cryptocurrency Market Events to Watch This Week

Highlights

- Cryptocurrency market faces volatility due to Japan’s proposed 20% Tax.

- Federal Reserve speech could signal rate cuts, affecting market sentiment.

- Labor Market data, including job reports, will influence the economic outlook.

The cryptocurrency market has seen a notable sell-off as December begins. Bitcoin has dropped below $90K, reflecting a 5% decline. Ethereum is trading under $2,900, down by 5%.

Further selling is as a result of the market slump triggered by the proposed 20% flat tax on crypto by Japan.

Meanwhile, the People Bank of China (PBOC) underlined that virtual assets cannot be the ones with the legal status of fiat currencies. As the Crypto market continues to see a decrease, let’s watch the cryptocurrency events unfolding this week.

Market Overview

Amid Japan’s hawkish 20% flat tax on crypto proposal, the market has plunged, with $BTC back below $90K and $ETH under $2,900.$BTC $86,523 (-5%)$ETH $2,836 (-5.7%)

Major Alts Losers: $ZEC -22%, $ENA -17%, $DASH -14%, $TIA & $VIRTUAL -13%.

MC $3.11T |… pic.twitter.com/b5IwuyBE4X

— CryptoRank.io (@CryptoRank_io) December 1, 2025

Cryptocurrency Events That Could Impact Markets This Week

This week, the focus is on the speech of the US Federal Reserve Chair Jerome Powell. This is preceded by the last Federal Open Market Committee (FOMC) meeting of the year. Investors will also be keen to know Powell opinions over the economy and the interest rate trends in the future.

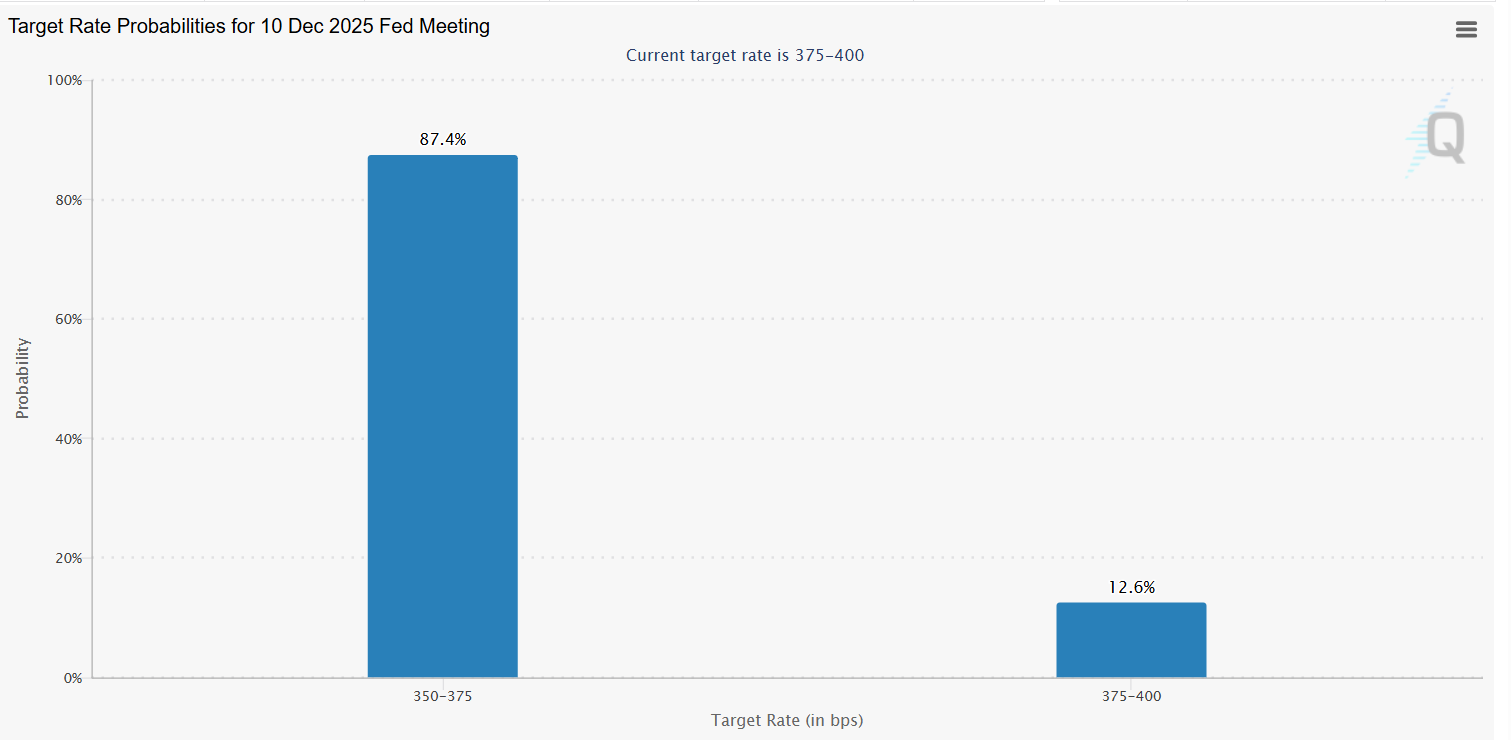

Inflation is contained, but unemployment is still low, and most people anticipate the rate to be reduced next week. Future contracts of CME indicate a likelihood of 87% of a rate cut on December 10.

The week is started on Monday with a speech of Powell and the formal withdrawal of the Federal Reserve of its quantitative tightening (QT) program.

This is a significant change of policy, especially of the cryptocurrency market. The QT may be volatile coming to its end and investors would seek any indication as to the next move by the Fed.

Cryptocurrency market is highly sensitive to such changes, because stricter policies have affected digital assets in the past. The significant economic reports of the week begin with the November ISM Manufacturing PMI data that would be released on Monday.

This report provides important information on the performance of the US manufacturing industry. The postponed September Job Openings and Labor Turnover Survey (JOLTS) information will be released on Tuesday. This shall give the added knowledge on the health of the labor market.

Economic Data and Market Implications

Wednesday is not going to be quiet, and a number of significant reports will be published. The nonfarm employment statistics in November will be one of the main concerns as they indicate an increase in employment.

The data of the November S&P Global Services PMI, as well as the ISM Non-Manufacturing PMI, will also be released. Such reports draw attention to the conditions of the service sector that is of great concern to the entire economy.

Thursday will include preliminary Jobless Claims. This will provide an overview of the prevailing situation of unemployment in the US. The US data of the trade deficit shall also be issued, further creating some context to the economic perspective.

BIG WEEK FOR MARKETS!

Monday:

• Powell Speech

• QT Ends

• PMI Data

• ISM ManufacturingWednesday:

• Additional PMI & ISM DataThursday:

• Initial Jobless Claims

• US Trade DeficitFriday:

• PCE Inflation Data pic.twitter.com/1DgUy0lqkv— Crypto Rover (@cryptorover) December 1, 2025

Friday will be the end of the week with the September Personal Consumption Expenditures (PCE) inflation report. It will be preceded by December Michigan Consumer Sentiment Index.

This week, the attention is paid to the labor markets, PMI data, and the inflation trends. Further volatility of the cryptocurrency market might depend on the economic data and the Fed decisions.

In the meantime, President Trump has already said that he has selected the new Federal Reserve Chair. He is supposed to declare his decision in the near future.

The month of December has arrived, and everyone is watching the moves of the Fed. The trend in economic data during the week is expected to dictate how 2025 will end.

Frequently Asked Questions (FAQs)

1. What caused the recent decline in the cryptocurrency market?

2. What impact does the Federal Reserve’s speech have on the cryptocurrency market?

- Operation Chokepoint: Federal Reserve Advances Proposal to End Crypto Debanking

- LUNC News: Terraform Labs Administrator Sues Jane Street for Terra-LUNA Crisis

- Crypto.com Joins Ripple, Circle With Conditional Bank Charter Approval Amid WLFI’s Probe

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?