Uniswap DAO Approves Proposal For BNB Migration; What’s Next?

Crypto News: Uniswap’s Decentralized Autonomous Organization (DAO) has recently finished the final vote that will be utilized to carry out the intended deployment of Uniswap v3 on the BNB Chain. According to the portal that tallied the votes for the referendum, almost 66% of DAO delegates voted in support of the change, which was completed on Friday.

Uniswap DAO Completes Vote

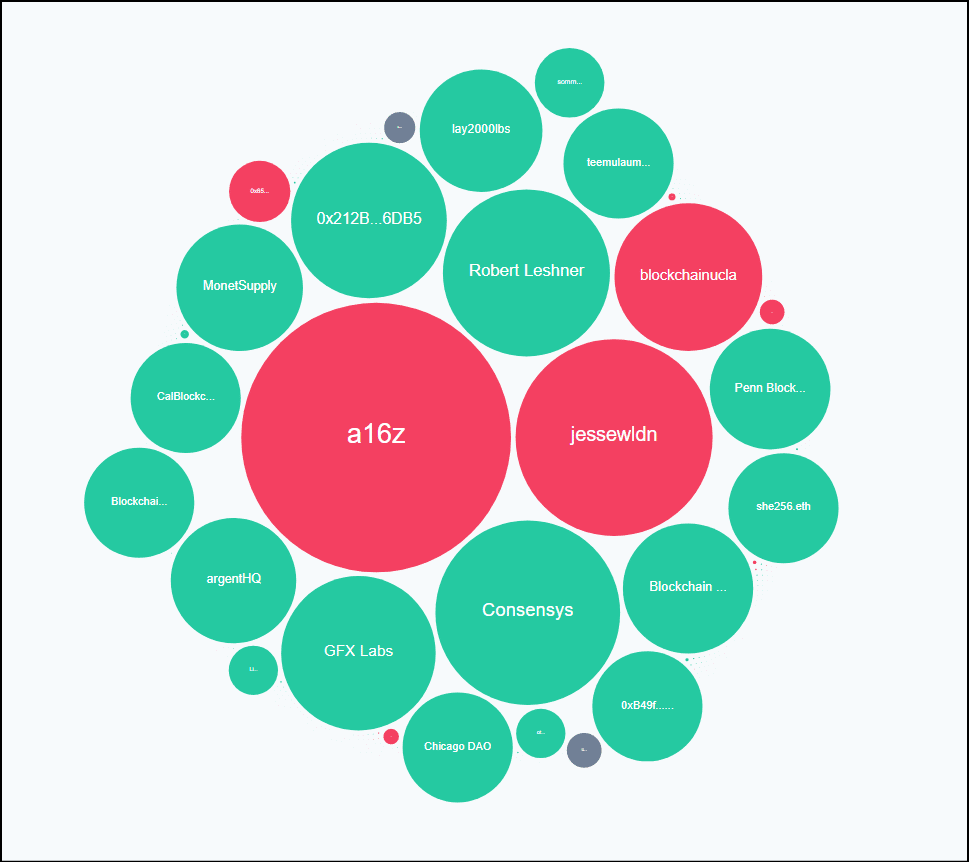

Votes in favor of the motion came from delegates with significant voting power, such as ConsenSys, the business that develops Ethereum software, and Robert Leshner, the creator of Compound Finance. During this time, the leading venture capital firm Andreessen Horowitz cast a vote against the proposition, using a total of 15 million votes in the process.

A substantial discussion over the governance procedure for the deployment of cross-chain applications has been sparked as a result of this particular vote. Many delegates, including those who offer bridges, voiced their opposition to moving forward with the deployment with Wormhole as the exclusive option for the “bridge provider”. A technique known as a bridge provider is utilized in the process of transmitting cryptographic tokens between supported networks. However, they instead called for a solution that was independent of any particular bridge. Andreessen Horowitz, for its part, advocated for the company LayerZero to win over Wormhole as the clear choice of the competition.

Read More: Check Out The Top 10 DeFi Lending Platforms Of 2023

What’s Next For Uniswap?

Following the conclusion of the vote, Plasma Labs will investigate the possibility of deploying Uniswap version 3 on the BNB Chain as early as possible. This execution may take place after the governance procedure has successfully completed a brief waiting period. According to the information provided by Plasma Labs in its proposal, Uniswap may aim to capture as much as half of PancakeSwap’s market share. On the BNB Chain, PancakeSwap is one of the most important decentralized exchanges and as per DeFiLlama, the platform currently manages a TVL worth $2.4 billion.

According to crypto news related to Uniswap’s recent proposal, the imminence of the planned deployment on BNB Chain is an issue that cannot be ignored. This is due to the fact that Uniswap’s commercial license for its v3 version will be terminated on April 1 of this year. Because of the licensing, it will be impossible for other platforms to introduce similar protocols.

UniSwap Version 3 includes the novel idea of numerous pools for each pair of tokens, with each pool charging a different exchange fee. In the past, each unique pair of tokens corresponded to a single liquidity pool, and the default charge for all swaps was 0.3% of the value of cryptos being exchanged. Even if this strategy has been successful in the past, it is probably set at a level that is too low for pools that trade in extremely volatile coins and is set at a level that is too high for pools that trade in cryptocurrencies which are relatively stable.

Also Read: Are These Tokens The Future of Crypto Gaming In 2023?

- Hong Kong Stablecoin Firm RedotPay Targets $1B Raise in Potential US. IPO Debut

- Crypto Market Crash: Glassnode & 10x Research Warn Deeper Bitcoin Price Fall Ahead

- Operation Chokepoint: Federal Reserve Advances Proposal to End Crypto Debanking

- LUNC News: Terraform Labs Administrator Sues Jane Street for Terra-LUNA Crisis

- Crypto.com Joins Ripple, Circle With Conditional Bank Charter Approval Amid WLFI’s Probe

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?