Why The Bitcoin Price Is A ‘Good’ Indicator On US Election Day

Highlights

- Bloomberg analyst Eric Balchunas said that the Bitcoin price is a good indicator on US election day.

- According to him, this is because Bitcoin was an important issue in the build-up to the election.

- The Bitcoin price retested $70,000 as the US election kicks off.

The Bitcoin price is again looking to reclaim the $70,000 level on the US election day. Following a brief break above this price level, Bloomberg analyst Eric Balchunas commented on why the flagship crypto could be an important indicator as the election kicks off.

Why Bitcoin Price Is Important On US Election Day

In an X post, Bloomberg analyst Eric Balchunas opined that Bitcoin price looks like a clean indicator to watch as the US election takes place today. He explained that he holds this belief because it was an issue when Donald Trump and Kamala Harris campaigned.

Indeed, Bitcoin and cryptocurrencies, in general, were at the heart of the build-up to this election. Donald Trump has declared his support for Bitcoin and cryptocurrencies since the start of the year. The former US president also recently promised to end Kamala Harris’ war on Bitcoin if elected.

On the other hand, Kamala Harris failed to clearly state her position regarding crypto, although she mentioned it in relation to other issues.

Balchunas’ comment came as the Bitcoin price touched $70,000 as the election kicked off. Bitwise Chief Investment Officer (CIO) Matt Hougan also agreed with the Bloomberg analyst and said he has been thinking the same. In response, Balchunas remarked that Bitcoin’s movement looks to be correlated with Trump’s odds.

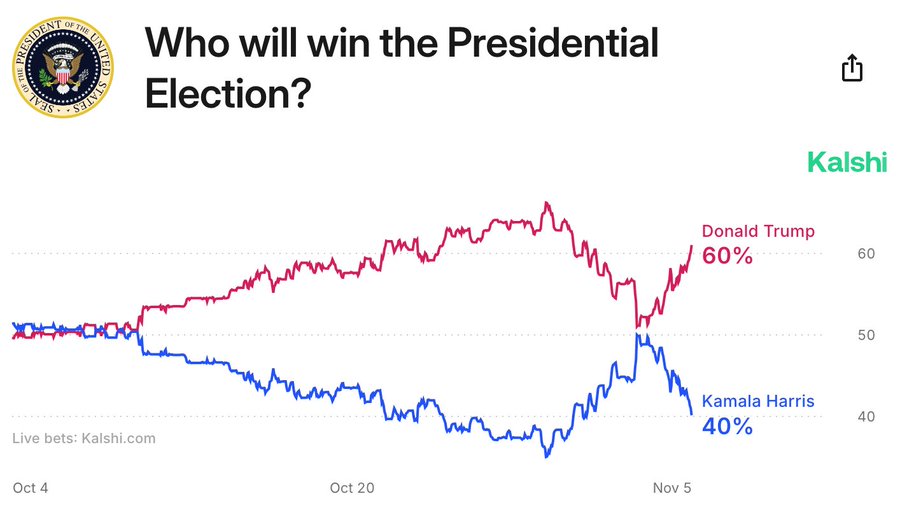

Indeed, this could be true as the latest Kalshi data shows that Donald Trump’s odds of winning the elections are back at 60% on Election Day. This development presents a bullish outlook for the flagship crypto since the former US president is the pro-crypto candidate.

BTC Doesn’t Care About The Winner But A Trump Victory Might Still Matter

History shows that the Bitcoin price will thrive regardless of who wins the US elections. The flagship crypto has always reached new all-time highs after every US presidential election cycle. This time looks unlikely to be different whether Donald Trump or Kamala Harris wins.

However, a Trump victory might still matter for other reasons. Crypto analyst Crypto Kaleo explained how the potential winner could determine what direction the crypto industry heads in. He added that they can shape the crypto industry and determine where it continues to grow.

The analyst made this statement in relation to crypto regulation in the US. While the Bitcoin price may be unaffected by the result of the election, the crypto industry in the country could suffer a great deal, especially if the regulatory environment in the next administration is similar to the one under the Biden administration.

This is why Donald Trump looks to be the favored candidate in the crypto community. The former US president has promised to fire the US Securities and Exchange Commission (SEC) Chair Gary Gensler on day one.

Although there are still legal debates about whether Trump can only demote Gensler, this is undoubtedly significant, considering how the SEC, under Gensler, has clamped down on crypto firms in the US through enforcement actions.

The need for regulatory clarity has forced crypto firms like Coinbase to sue the US FDIC with the top crypto exchange securing a major win the FOIA case. However, the need for these legal battles could be a thing of the past under a potential Donald Trump administration.

- LUNC News: Terraform Labs Administrator Sues Jane Street for Terra-LUNA Crisis

- Crypto.com Joins Ripple, Circle With Conditional Bank Charter Approval Amid WLFI’s Probe

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?