Yearn.finance (YFI) Price Crashes 45% Within Hours, What’s Happening?

Yearn.finance (YFI) price tumbles 45% within a few hours, falling from $14,500 to $8,300. The crypto market sets eyes on it as one of the biggest platforms in the DeFi ecosystem witnessing a massive selloff, causing people to speculate whether any suspicious things are happening with yearn.finance.

Yearn.finance (YFI) Tumbles 45%

In a surprising move on November 18, Yearn.finance (YFI) fell 45% within hours, losing most of its recent gains. The move comes as investors liquidated their YFI holdings amid the recent selloff in the border crypto market.

YFI price has rallied more than 160% in November, touching a high of $15,591. In the last 24 hours, the price tumbled from $15,591 to $8,421. Over $250 million in market cap vanished in hours, down from $525 million to $275 million. The market cap is again rising, but investors have lost confidence due to the sudden fall.

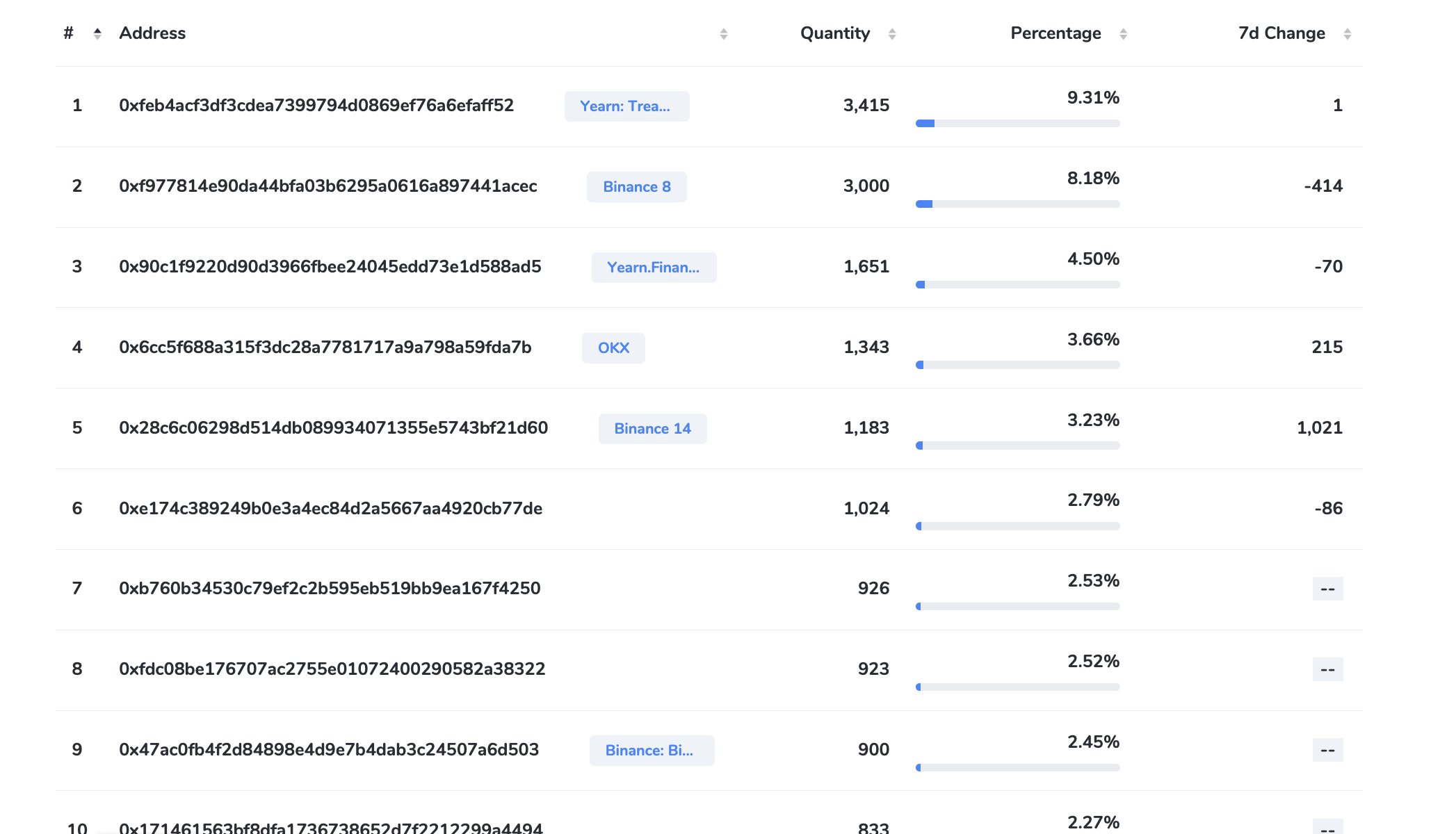

Some believe it’s an apparent exit scam by insiders as nearly half of the entire supply for YFI is held in 10 wallets. These include crypto exchanges’ wallet addresses.

According to Coinglass data, YFI saw more than $5 million in liquidation in the last 24 hours. YFI contract positions once reached as high as $162 million. Currently, YFI positions on major platforms have dropped. Furthermore, YFI open interest (OI) has increased significantly, indicating that traders are making short positions on YFI.

Also Read: Bloomberg Analysts Expect Delays In All ETFs As US SEC Defers Two Spot Bitcoin ETF

Altcoins Continue to Pull Back

Major altcoins remain under pressure amid the broader market selloff, with Bitcoin slowly regaining dominance. The market cap has fallen by almost $25 billion in 2 days. Analysts expect more pullbacks before another capital inflow back into altcoins.

ETH, XRP, SOL, ADA, and other major altcoins fell nearly 3% in the last 24 hours. DeFi tokens are taking a hit and dragging the global market cap further lower.

Also Read: Greg Brockman And Sam Altman Shocked On OpenAI’s Board Decision, Shared Views

- Hong Kong Stablecoin Firm RedotPay Targets $1B Raise in Potential US. IPO Debut

- Crypto Market Crash: Glassnode & 10x Research Warn Deeper Bitcoin Price Fall Ahead

- Operation Chokepoint: Federal Reserve Advances Proposal to End Crypto Debanking

- LUNC News: Terraform Labs Administrator Sues Jane Street for Terra-LUNA Crisis

- Crypto.com Joins Ripple, Circle With Conditional Bank Charter Approval Amid WLFI’s Probe

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?