Bitcoin Funding Rate Cools Down, Traders Predict BTC Bull Run to Continue

Bitcoin today registered one of its largest price crash in a single session when its price fell from above $34,000 to a daily low of $28,772 registering a fall of over $5,000 within a few hours. The top cryptocurrency has recovered well in the past hour and currently trading just below $32,000. While many were quick to call the recent all-time-high of above $34,608 as short term top, primarily because of the significantly high funding rates on Binance.

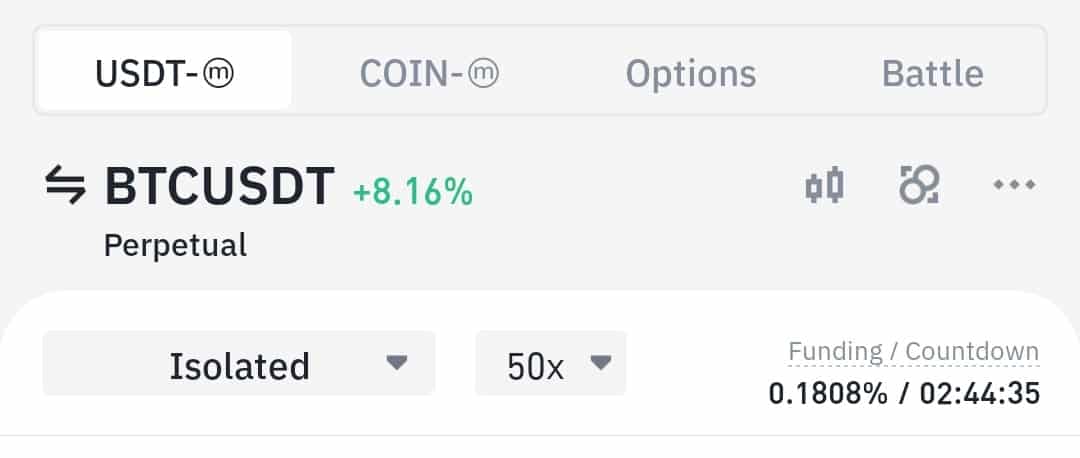

When the price of BTC started to crash the funding rate across major exchanges was near an all-time-highs.

$BTC aggregated funding rate by hour across all exchanges just hit the all-time high.

View Chart ???? https://t.co/X07LI7aayZ pic.twitter.com/hrLUEGzr45

— CryptoQuant.com (@cryptoquant_com) January 4, 2021

Many would wonder what does funding rate has to do with Bitcoin’s price, well there is a correlation that suggests,

if funding is positive, longs are paying shorts. if it is very high (>.1%) it means the market is disproportionately long and there is a lot of incentive to be short, so generally, you’d expect a correction of some sort. but none is given and the price could continue to go up a lot

Funding Rate Cools Down As the US Market Opens

Today’s market meltdown was largely attributed to Korean whales selling in heaps to take away the profit made over the past week. However, as soon as the US market opened the funding rates have come down to their average of around 0.02. This has also prompted many to predict the current bull rally to continue for another leg.

The bull market isn't over and the funding rate seems to return back.

So I just bought more $BTC and $ETH. https://t.co/msSy5tBQv8

— Ki Young Ju 주기영 (@ki_young_ju) January 4, 2021

The top cryptocurrency is currently trying to breach the $32,000 mark again to solidify its position and make it strong support, as it has done throughout this bull run. Bitcoin has managed to surpass most of the critical resistance despite numerous flash crashes owing to the ongoing institutional buying spree. Microstrategy bought nearly $650 million worth of bitcoin during the last dip at $21,925 showing the growing appetite for bitcoin.

Monday has also become quite significant for bitcoin during this bull rally as institutions such as Grayscale, Square Inc and PayPal start buying bitcoin after the two-days pause during the weekend. These incisions have helped bitcoin overcome most of the price correction within a day. Even the current $5,000 crash which might seem quite big but it was not even 20% of the current bitcoin market. Bitcoin has managed to recover from a 50% crash this March, thus bitcoin proponents were not fazed by this one either and called it another opportunity to buy the dip.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Crash Alert: Institutions Trap Retail Ahead of BTC, ETH, XRP Options Expiry & Nonfarm Payrolls

- TRON Price Bounces as SEC Drops Lawsuit Against Founder Justin Sun

- Top Crypto Exchanges to Trade Tokenized Real World Assets – Best Picks Reviewed

- Arthur Hayes Says Rising Oil Prices to Trigger Fed Money Printing, How Bitcoin Could Move?

- Crypto Market Bill Eyes Late March Markup as Key Senate Roadblocks Begin to Clear

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs