BTCUSDT Open Interest Tumbles Amid Coinbase-US IRS Debacle, Bitcoin Crash Imminent?

Bitcoin failed to build upside momentum on Hong Kong’s crypto regulatory regime launch on June 1. BTC price tumbled 2%, extending Wednesday’s downfall as Bitcoin closed the month 10% lower for the first time this year.

Several factors including macro, technical, and regulatory challenges are heavily impacting the crypto market, causing a market-wide selloff.

Bitcoin Price Falls As US IRS Can Access Coinbase’s User Trading Data

Whales and investors dumping and moving their Bitcoin and crypto holdings off Coinbase as a court ruling revealed that the US Internal Revenue Service (IRS) can access user trading data on Coinbase. Whales dumped and moved over $1 billion in Bitcoin off Coinbase in the last few days.

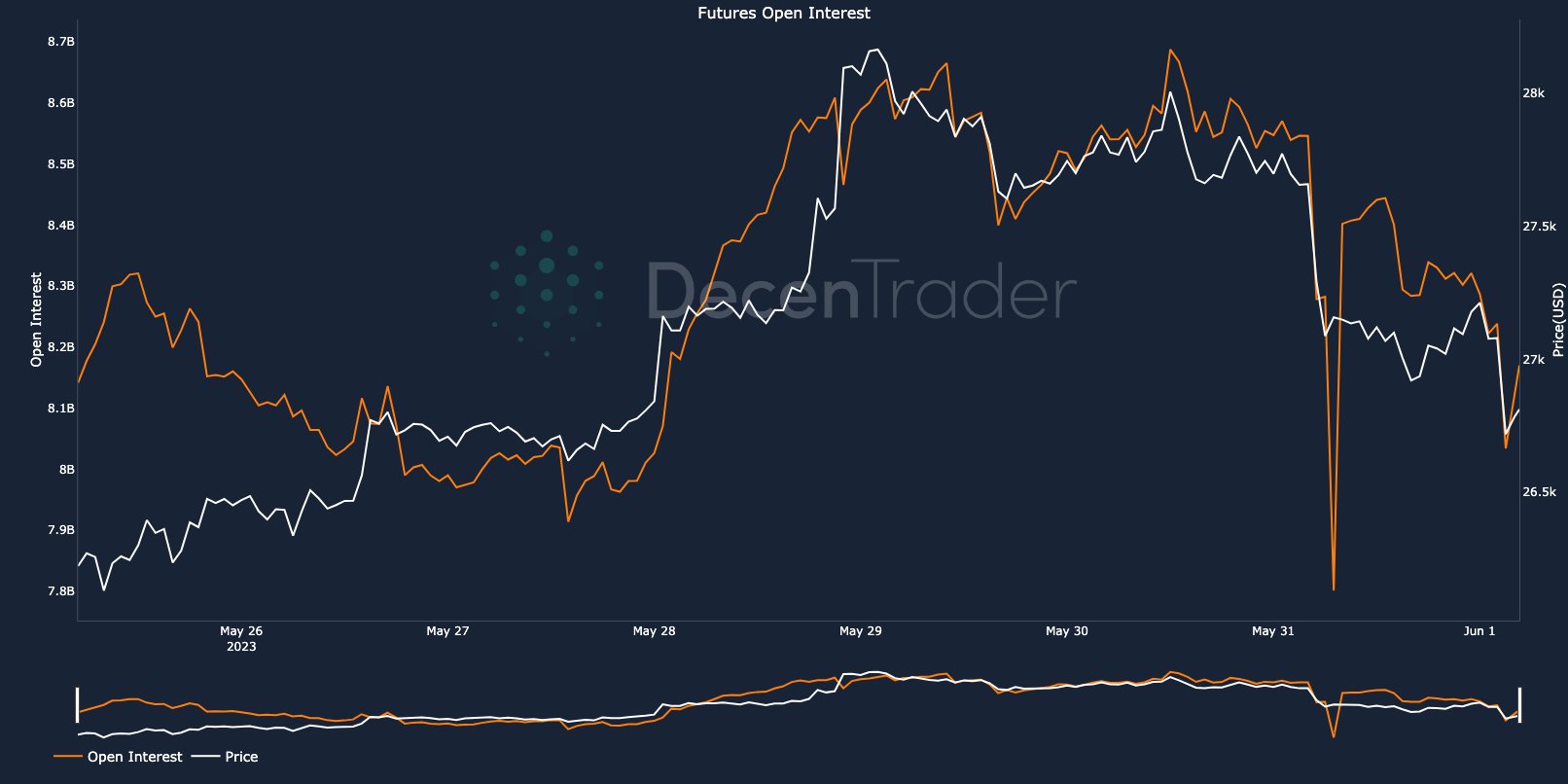

Moreover, the worsening crypto landscape and regulatory challenges caused BTCUSDT open interest to fall massively as traders got liquidated or closed their positions. BTC longs liquidation continues to rise causing prices to tumble significantly. The negative funding rates will potentially cause Bitcoin price to fall below $25k.

Also Read: Crypto Market Selloff: Here’s Why Bitcoin, Ethereum Price Falling Today

US House passed the Biden-McCarthy Debt Ceiling deal, now it heads for US Senate voting to pass before the debt fault deadline of June 5. Some Senate members such as Senator Bernie Sanders look to oppose the Debt Ceiling deal. Meanwhile, Bank of Japan Governor Kazuo Ueda proposes to raise interest rates as inflation continues to rise.

Meanwhile, US Federal Reserve official plans to pause in June and raise rates later amid U.S. economic slowdown. According to CME FedWatch Tool, the probability of a pause is 63%, rising from last week.

The global stock market rose on Thursday amid positive sentiments about the debt ceiling deal and the US Fed pause in June. The US Dollar Index (DXY) remains above 104, putting selling pressure on Bitcoin price.

BTC price tumbled 2% in the last 24 hours, with the price currently trading at $26,900. The 24-hour low and high are $26,671 and $27,346, respectively. Furthermore, the trading volume has increased in the last 24 hours, indicating an interest among traders.

Also Read: Binance CEO “CZ” On First Digital USD (FDUSD) Stablecoin Support On Exchange

- Crypto.com Joins Ripple, Circle With Conditional Bank Charter Approval Amid WLFI’s Probe

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?