Coinbase & CoinmarketCap Go Down Amid $500B Crypto Wipe Off

Coinbase Inc. ($COIN), one of the largest crypto exchanges that went public last month has malfunctioned again as users were unable to access their accounts amid a $500 billion market wipe-off.

We’re seeing some issues on Coinbase and Coinbase Pro and we’re aware some features may not be functioning completely normal. We’re investigating what’s going on right now, and as soon as we know more we’ll let you know.

— Coinbase Support (@CoinbaseSupport) May 19, 2021

The crypto market is down by over 25% with liquidations of over $8 billion. Bitcoin market registered the biggest liquidation with $3.47 billion worth of leveraged positions both long and short getting liquidated over the past 24-hours. Etheruem with over 40% decline for the day saw the second-highest liquidation with $2.19 billion in leverage positions getting rekt over the past 24-hours.

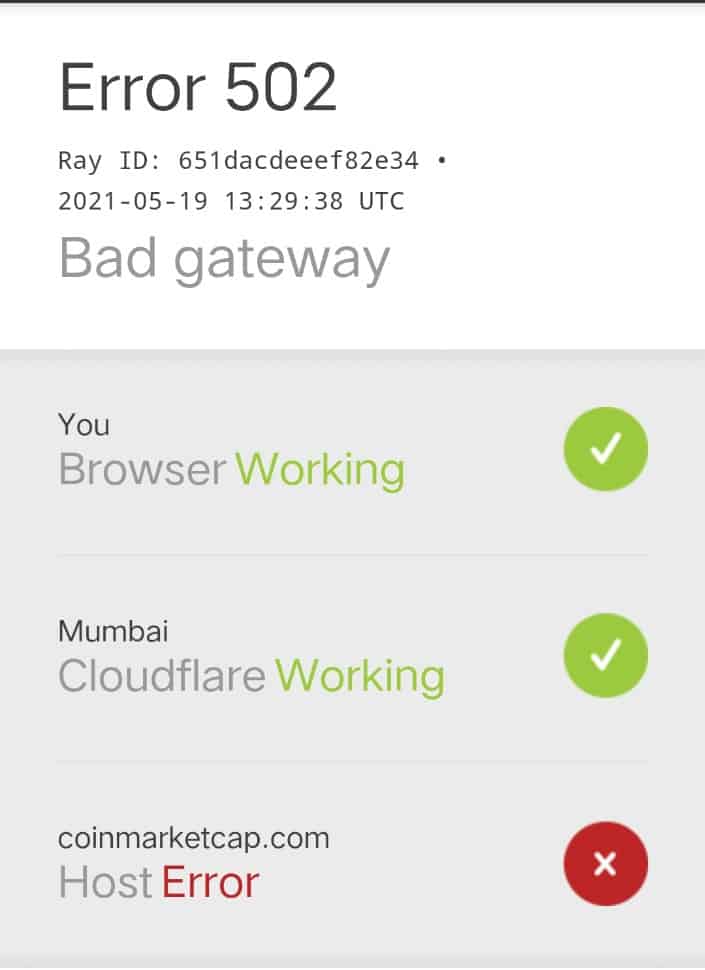

CoinmarketCap, the popular crypto price data platform is down as well. The market mayhem has not just lead to the liquidation of billions of leveraged positions, it has also disrupted major service platforms as well.

The top cryptocurrency nearly recorded a 50% correction from its ATH recorded 35 days ago while Ether’s price fell over 50% from the top within 8 days of ATH.

Binance Dismisses ETH & ERC-20 Withdrawals Temporarily

The world’s largest crypto exchange by trading volume Binance has temporarily suspended Eth and ERC-20 withdrawals on the platform.

*BINANCE: ETH AND ERC20 WITHDRAWALS ARE TEMPORARILY DISABLED

— *Walter Bloomberg (@DeItaone) May 19, 2021

The growing list of crypto platforms malfunctioning during the peak liquidation period has also run havoc on traders who were not able to access their accounts or sell during the peak trading hours. The falling markets amid malfunctioning crypto platforms bring back the memories of March last year which saw a similar liquidation spree across the whole cryptocurrency space.

The Bitcoin futures open interest reached a 3-month low as well indicating declining institutional confidence amid a market turmoil.

$BTC futures open interest across all exchanges hit a three-month low.

Chart👉 https://t.co/TnZi7sO93j pic.twitter.com/5MQfUzoowY

— CryptoQuant.com (@cryptoquant_com) May 19, 2021

Prominent Bitcoin proponent Michael Saylor reinforced his confidence in Bitcoin amid the market correction suggesting he won’t sell despite their Bitcoin profit worth $1 billion getting wiped off just after a day of purchasing $10 million in BTC.

The crypto market is currently fighting back to regain its losses and Bitcoin has jumped back above $37,000 and ETH regained its position above $2,500 at the time of writing.

- Just-In: Ethereum Foundation Begins Staking 70,000 ETH, Futures Open Interest Bounces

- 8 Best White Label RWA Tokenization Platform Development Companies

- Hong Kong Stablecoin Firm RedotPay Targets $1B Raise in Potential US. IPO Debut

- Crypto Market Crash: Glassnode & 10x Research Warn Deeper Bitcoin Price Fall Ahead

- Operation Chokepoint: Federal Reserve Advances Proposal to End Crypto Debanking

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?