Breaking: Grayscale Files Updated S-1 for its Avalanche ETF with the US SEC

Highlights

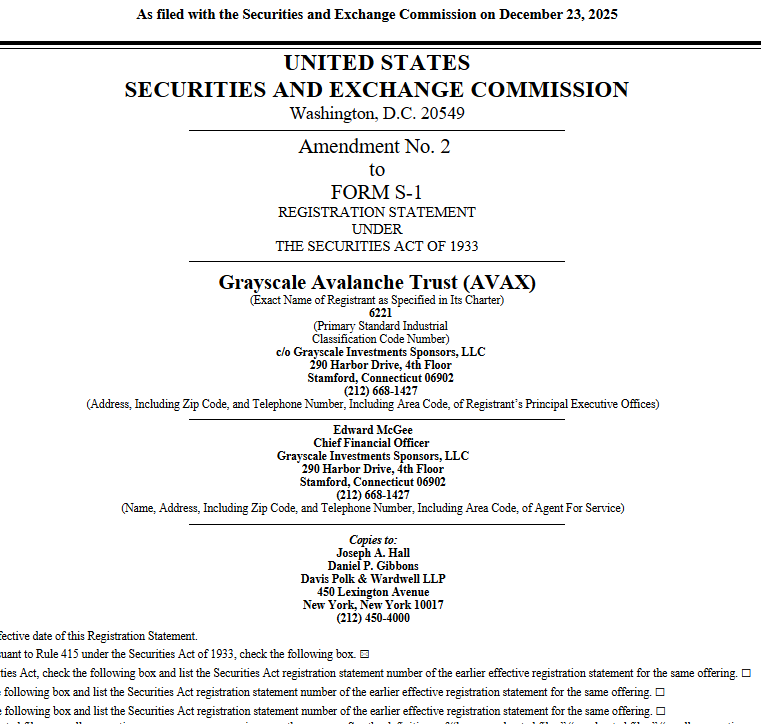

- Grayscale amends its S-1 for Avalanche ETF with the U.S. SEC.

- The issuer updates in-kind creation and redemption, risk and tax disclosures, and financial data.

- AVAX price pares its weekly gain of 10% by more than 2% today.

Crypto asset manager Grayscale has filed an updated S-1 for its Avalanche ETF with the U.S. Securities and Exchange Commission, moving closer to listing on Nasdaq. AVAX is up more than 9% over the past week amid heightened anticipation of the Avalanche ETF launch.

Grayscale Updates its Spot Chainlink ETF for Auto-Approval

According to the latest US SEC filing, Grayscale filed a second amendment to S-1 for the proposed conversion of its Avalanche Trust to a spot Avalanche ETF.

The issuer has not revealed a management fee, staking fee or any waiver in the latest filing. Instead, the amended filing shows several updates, primarily in-kind creation and redemption, risk and tax disclosures, and financial data.

In addition, the issuer updated the sponsor details to confirm Grayscale Investments Sponsors LLC as the sole sponsor of the trust. The changes mentioned likely respond to an SEC feedback amid the review process.

Grayscale Avalanche Trust ETF seeks the SEC’s approval to list the shares on Nasdaq under the ticker symbol “GAVX.” At present, the shares trade under the ticker AVAXFUN on OTC Markets.

Last week, VanEck Avalanche ETF (VAVX) disclosed its management fee of 0.30% and staking details, including Coinbase Crypto Services as the staking provider.

AVAX Price Slips Amid Low Trading Volumes

AVAX price fell 2.50% over the past 24 hours, following a more than 10% rally in a week following VanEck Avalanche ETF filing. The price is currently trading at $12.08, with a 24-hour low and high of $11.88 and $12.34, respectively.

Furthermore, trading volume has dropped further by almost 18% over the last 24 hours. This indicates a decline in interest amid the broader uncertainty in the crypto market.

As CoinGape reported earlier, the US SEC Crypto Task Force met with Ava Labs, Blockchain Association, and The Digital Chamber representatives. The S-1 updates by Avalanche ETF issuers came after the meeting.

CoinGlass data shows selling sentiment in the derivatives market. Total AVAX futures open interest has dropped 2.09 to $489.38 million. AVAX futures open interest fell 1.93% on Binance, 2.10% on OKX, and 0.68% on Bybit in the past 4 hours.

- Crypto Exchange HashKey Launches RWA Issuance for Institutions Amid Tokenization Boom

- Just-In: Ethereum Foundation Begins Staking 70,000 ETH, Futures Open Interest Bounces

- 8 Best White Label RWA Tokenization Platform Development Companies

- Hong Kong Stablecoin Firm RedotPay Targets $1B Raise in Potential US. IPO Debut

- Crypto Market Crash: Glassnode & 10x Research Warn Deeper Bitcoin Price Fall Ahead

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?